The interchange is welcome. Thank you for signing up and voting for confidence after you received this. If you read this as a post on our site, you should sign up here so you can receive it in the future. I take a look at the hottest news from the last week. This will include everything from funding rounds to trends to an analysis of a particular space. My job is to stay on top of the news and make sense of it so I can keep you up to date.

I have to say that this past week was one of the busiest of the past few years. That's right, whoa. It's going to be a long day. I tried to fit as much of it as possible into the newsletter.

Let's talk about bank charters before we discuss the news items from the past week.

The primary roles of a chartered bank are to accept and safeguard monetary deposits from individuals and organizations as well as to lend money out. There are different details from country to country. The government gives permission for a bank to do business in the financial services industry. A commercial bank is associated with a charter bank.

In 2020, Varo became the first-ever all-digital nationally chartered U.S. consumer bank, as opposed to partnering with one as most digital banks do.

It was a big risk. I talked to Colin Walsh to see if it was worth it. His answer was absolutely unanimous.

My full interview with Walsh can be found here.

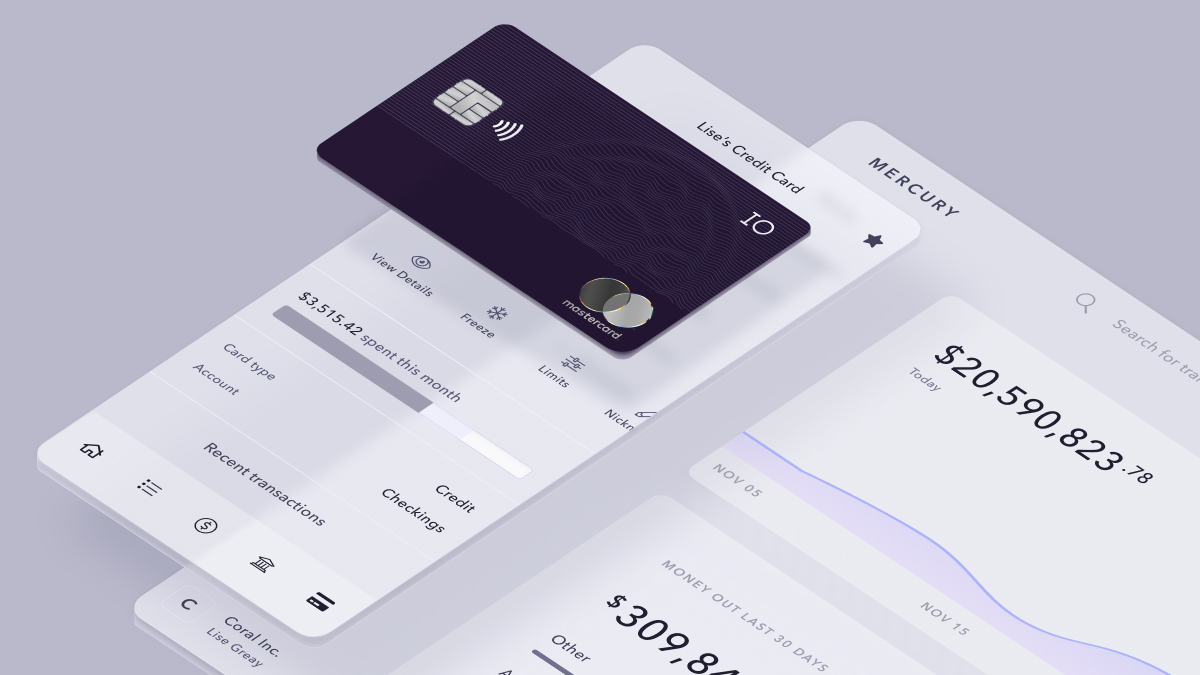

The credit card was launched last week. The IO Mastercard is designed to help startups scale their business. The first thing you need to do to qualify for the card is have $50,000 in a Mercury account.

A corporate credit card has been one of the most requested features by customers. Mercury considered launching with a credit card as its first product but chose to start with a bank account since it's the ideal foundation from which to build additional financial features. It's an effort to carve out its own space against other companies.

Payhawk plans to launch in the US with a focus on enterprise customers. It is launching its first credit card product in the U.S. as part of that move. The company's Series B round was extended to $215 million, making it a unicorns.

We are not finished yet. In the last year, Center tripled its customer base while retaining 98% of existing customers, according to a recent announcement. Many corporate card players point to Concur as an incumbent that they want to replace.

Corporate cards are already offered by a number of companies in the U.S.

The image is called Mercury.

Cash App Pay, a mobile payment method, will be offered by Adyen to its US customers. Customers will be able to pay with their Cash App balance or linkedDebit card. As the first financial technology platform outside of the Squareecosystem to launch Cash App Pay, we look forward to seeing the value this partnership brings to our customers and Adyen. The partnership will give Adyen business customers access to over 80 million active customers that make up a third of Gen Z consumers in the U.S.

Square announced last week that all of its products and services are now available in Spanish to sellers in the US. Millions of Hispanic-owned businesses in the U.S. will have the ability to use Square in English or Spanish, including key products like Square Banking to unlocks access to financial services and Square for Restaurants to enable seamless, bilingual communication between front and back-of-house.

Goldman Sachs and Modern Treasury are working together to accelerate the shift to embedded payments. Goldman is pushing to better serve mid-market companies that have long wanted to bank with Goldman according to an email I received. "Embedding payments into software products is increasingly the trajectory of commerce, and by partnering with Modern Treasury, we are creating new opportunities for clients to seamless leverage our payments capabilities within their own."

The investment banking and financial services giant is embarking on its biggest round of jobs cuts since the beginning of the Pandemic, according to a report. Several hundred roles will be eliminated by Goldman this month, according to people with knowledge of the situation.

Pay made headlines last week. The "pay later" part is becoming increasingly difficult for some borrowers according to the Associated Press. According to Kyle Wiggers, the U.S. Consumer Financial Protection Bureau issued a report suggesting that companies that allow customers to pay for products and services in installments must be subjected to stricter oversight. Affirm CEO Max Levchin said in an interview that there was a fair amount of what the report called for. This is a lending activity that is subject to all the lending rules.

The proptechs are taking a hit. Sundae, a residential real estate marketplace, has had two layoffs this year. The majority of the team were laid off. More than 100 employees were let go. Sundae is focusing on creating a more streamlined customer experience so that we can get offers to sellers even faster, according to an email I received from a company spokesman. We saw layoffs as a chance to use data and technology to streamline our approach and improve our customer experience. The company had a raise in 2021.

Forage, a payments processor that aims to make it easier for grocery stores to accept Supplemental Nutrition Assistance Program payments online, has hired a new chief business officer. She comes to Forage from Amazon, where she was the founder and general manager of the underserved populations team. I wrote about how Ofek Lavian left his job at Instacart to join Forage. He is the startup's CEO today.

Worldpay for platforms is an embedded finance solution for small and medium businesses. The offering eliminates the need for businesses to pay separate partners to help with card issuance, cash advances or faster access to cash flow. This has implications for companies that target small businesses.

Consumers can pay at an online checkout with just one click with the new online checkout feature from Revolut.

It was seen on a website.

Market heterogeneity is a blessing in disguise.

The OpenWallet Foundation is being announced by the Foundation.

The founders are optimistic about the future.

The chief business officer is Forage.

It was seen on a website.

Credit for flexible subscription payment models helped Ratio bag $411 million in equity.

Turaco has a goal of 1 billion users and has raised $10 million in funding.

Denim raised $126 million in equity and debt.

Allocations have been valued at $150 million to help private equity funds.

Payall secured $10 million in a seed round to help banks facilitate more cross-border payments.

The lease-to-own startup raises money to fight.

Fazz raises $100 million to serve businesses of all sizes.

An app for Nigerian merchants has received $8.4 million in new funding.

Power got $316 million in equity and debt.

Indian company Cred is investing in a partner.

Elsewhere.

Ethic bags $50 million.

The composer raised $6 million for an automated investing platform.

The CEO and co-founder of DoorDash invested in a startup that is building a portal for Mexico.

Candis raises $16 million to increase automation.

There is a $10.5 million funding for Splitit.

PortX has secured $10 million in new funding.

Renovite was acquired by JP Morgan Chase to battle Stripe.

It wasWhew. If this week is any indication, the fourth quarter is going to be insane. I am going to try to refresh this weekend. I hope you are doing the same. Next week, see you!

If you haven't heard, it's coming to San Francisco on October 18 and 19. I want to see you there. Simply click here to use the code InterCHANGE to get 15% off passes.