You can sign up for the New Economy Daily newsletter and follow us on social media.

The Federal Reserve is on track to raise interest rates by 75 basis points for the third consecutive meeting this week and signal they are heading above 4% and will then go on hold.

It is possible to make a case for going even larger. There are persuasive arguments against delivering a shock 100 basis-point increase when they gather in Washington.

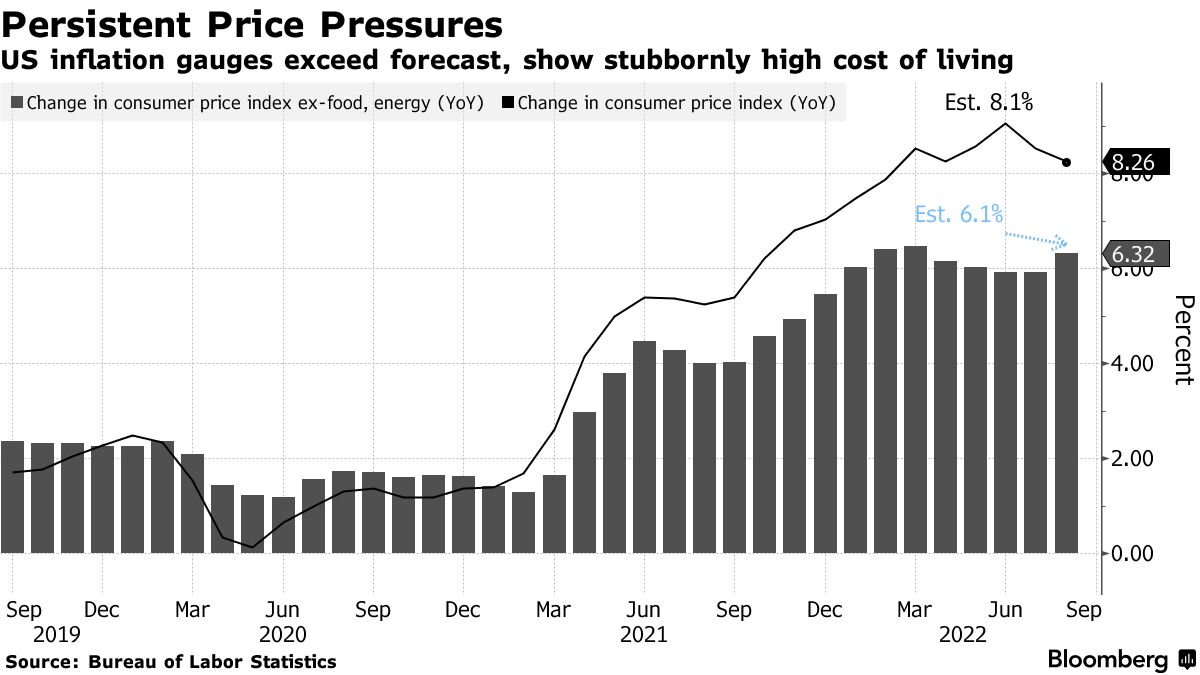

Since officials last met in July, the "totality" of data shows the economy remains resilient and inflation is high.

The half-point move that was on the table this week was hardened into a 75 basis-point increase. Policy makers probably don't want to hike by a bigger amount because of the risk of a US recession.

Increasing speculation for Fed rate cuts in 2023, lowering long-term bond yields, easing financial conditions and pushing monetary policy in the wrong direction are all consequences of such a reaction.

He acknowledges reasons why they might go for the bigger hike.

Feroli said that pushing back against expectations of easing next year is not just a matter of aligning forecasts.

The Fed is expected to raise the rate to 4% in 2022, signaling higher for longer.

The policy statement is released at 2pm. Powell will hold a press conference later in the day. The forecasts that are expected to show rates moving to 4% over the next few months, from a current target range of 2% to 2.5%, will be updated.

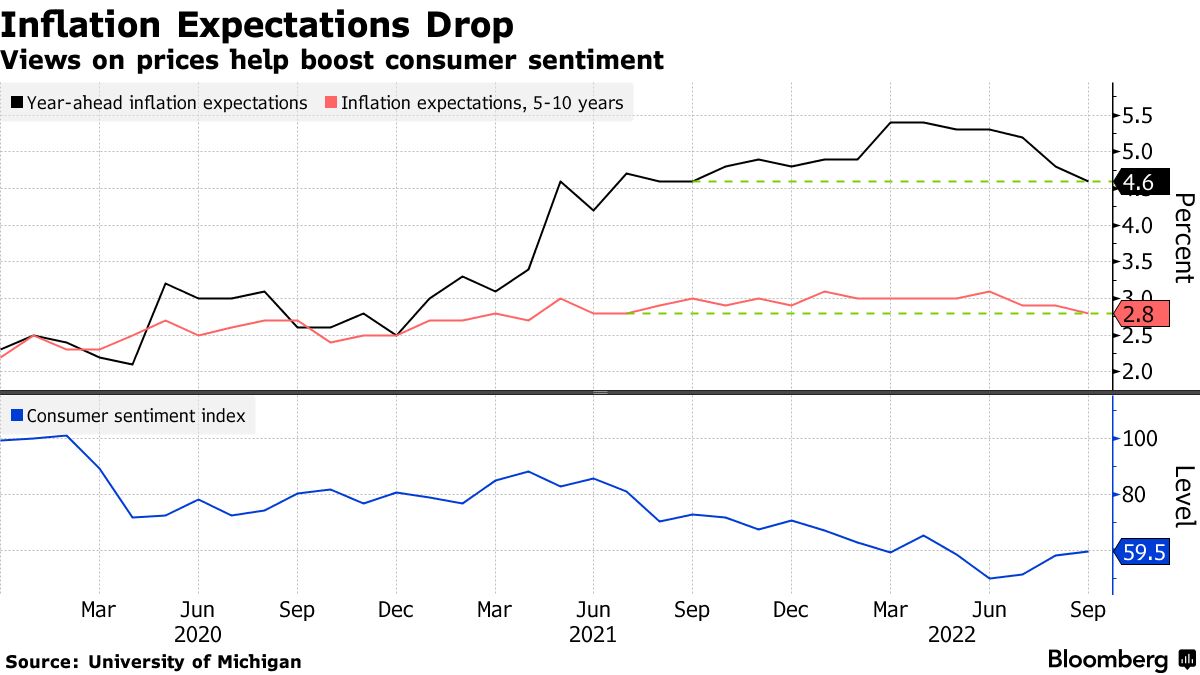

The long hold strategy is based on the idea that the committee needs to buy some insurance against inflation expectations going adrift in order to avoid the disastrous stop-go policy of the 1970s.

Fed officials don't see a rate cut next year.

It shows they are willing to overshoot on rates and impose higher economic costs because easing too soon could just stoke inflation all over again.

The governor of the Fed said that he got burned last year. We don't want to get burned again. He said that it has to be a permanent, long-term decline.

Core consumer prices rose by more than expected in August. The University of Michigan surveys inflation expectations over the next five to 10 years.

The argument for a full percentage-point move this week is that the Fed needs to get ahead of inflation while consumer spending is still strong.

Steven Blitz, chief US economist at T.S. Lombard, said that the fall in oil and gasoline prices would boost spending.

He favors the bigger move because it would allow the Fed to take a softer stance on inflation at their next meeting in November.

If the Fed raises the federal funds rate by 100 basis points, it will be the largest increase since the early 1980s, when former Fed Chair Paul Volcker hammered inflation with mega moves of as much as 400 basis points.

Fed's 75- or-100 choice keeps traders guessing.

The former Fed Vice Chair said that he could probably make a case for a 100 basis point move. He noted that it could be difficult for the committee to shift from there.

The baseline seems to be 75, which is a vigorous one. They have to be careful not to overreact to the information.

The investors seem to agree and are only pricing in a small chance of a bigger move.

"There is no reason to shock the market in a more hawkish manner with 100 basis points, since Fed officials didn't opt for that at a time when rates were even lower."

The international context is taken into account. The Fed doesn't want a global recession that would cause financial stress.

With China and Europe slowing down, it's not wise to go 100 basis points right now. A percentage point off US GDP could be caused by a severe recession in Europe.

Molly Smith helped with the project.