You can sign up for our newsletter and follow us on social media.

There is a wave of rescue-package pledges from global financial institutions and China. The appeal of the region is due to the high price of materials.

Money managers have made choice bets on eurobonds on the African continent, with general sentiment favoring the two countries.

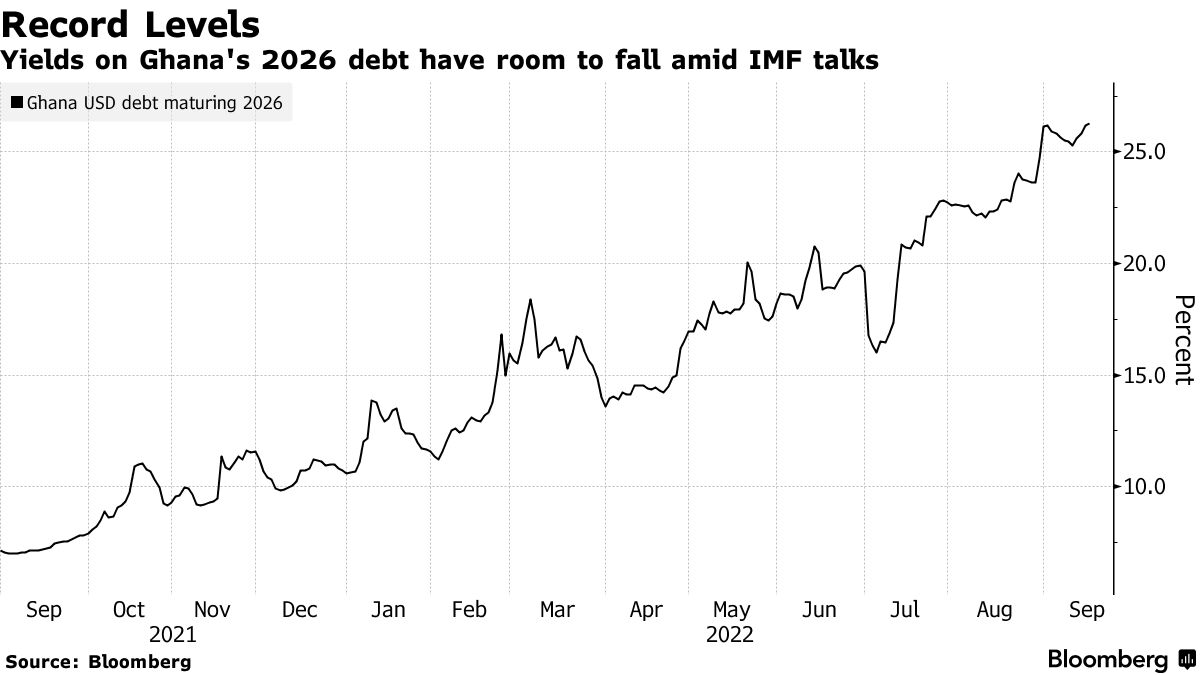

There was a time when traders couldn't exit Africa fast enough. As investors fretted that poorer nations would default on their debts due to soaring food and energy costs, yields soared to record highs.

The past year has been difficult for frontier markets, according to a note to clients. We see scope for optimism.

There has been a change. The International Monetary Fund is working on deals with vulnerable countries. Waivers on loans of 17 African countries were announced by China. Theyields have dropped but are still way above average.

There are reasons to be positive on the asset class.

The sanctions against Russia have led to a rise in raw-material prices. Logistical supply issues and robust demand in Europe and Asia caused thermal coal prices to reach a new high.

Commodities have repriced to the downside in the last few weeks but we expect them to stay elevated by historical standards.

Between the second quarter and the current one, BlackRock almost doubled its holdings of eurobonds from Luanda. Switzerland's largest bank added to its ownership.

A senior portfolio manager at Emso Asset Management in New York said he favors debt from several African countries. Oxford Economics changed its view on the country.

It has been two years since oil prices went down, but that hasn't stopped the country from halving its debt ratio. The kwanza has been one of the best performers against the dollar this year. At a time when most nations are struggling to keep price growth under control, that slows inflation.

The country-specific risk is out of the way because of a successful election.

Rob Drijkoningen, a Netherlands-based portfolio and managing director at Neuberger Berman Europe, stated that the country has confirmed the reformist agenda can continue politically and has oil supply as its main asset that will continue to support it. Subject to valuations, we like it.

Maciej Woznica is a portfolio manager at Coeli Frontier Markets.

He said that the pricing is below the expected recovery rates. You don't get a chance to buy below recovery values on a daily basis.

In September the country's dollar debt returned 8.4%. The 74 member gauge has an average loss of 0.9%.