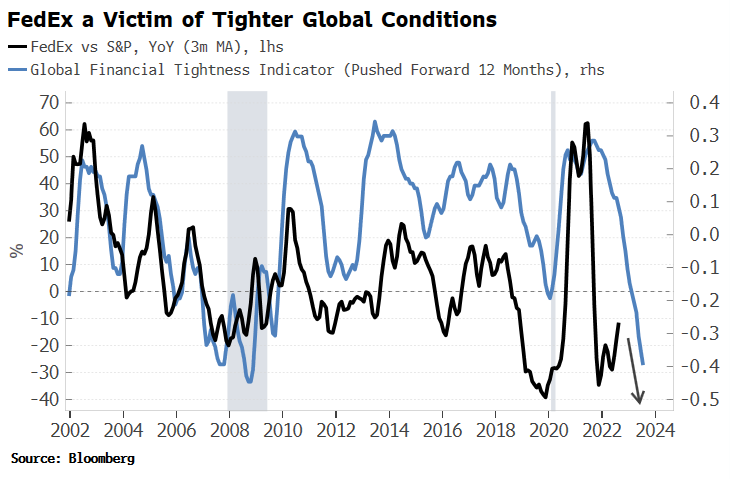

The US and global economies are slowing according to FedEx.

The delivery company is a bellwether for the economy and is sensitive to global monetary conditions. These conditions have yet to improve, while central banks around the world are focused on eradication of elevated inflation.

Credit spreads are widening as banks tighten their lending standards and higher interest rates feed through to higher borrowing rates. Mortgage rates are rising fast, too, which is putting the squeeze on consumption, with some measures in Thursday's retail sales report for August coming in less than expected. There is more coming.

The only fundamental support currently contributing to S&P returns will be stressed in such an environment, leaving the stock market prone to higher volatility.