A business reporter.

Image source, Getty Images

Image source, Getty ImagesAccording to the World Bank, interest rate hikes by central banks could cause a global recession in three years.

It said that central banks have raised rates with a degree of synchronicity not seen in the past 50 years.

Raising rates make it more expensive to borrow.

It can slow the growth of the economy.

Ahead of monetary policy meetings by the US Federal Reserve and Bank of England, the World Bank has warned.

The World Bank said on Thursday that the global economy was in its worst downturn in 40 years.

The world's three largest economies - the US, China and the euro area - have been slowing.

Even a moderate hit to the global economy over the next year could tip it into recession.

The World Bank called on central banks to coordinate their actions to reduce the degree of tightening needed.

In the last few months, inflation has hit a 40-year-high in the US and UK.

As the war in Ukraine boosted energy, fuel and food prices, this was the reason for this.

The central bank has raised interest rates in order to cool demand.

The risk of a recession is increased by large rate increases.

Image source, James Leynse

Image source, James LeynsePolicy decisions are usually made by the central banks.

They have worked together to support the global economy.

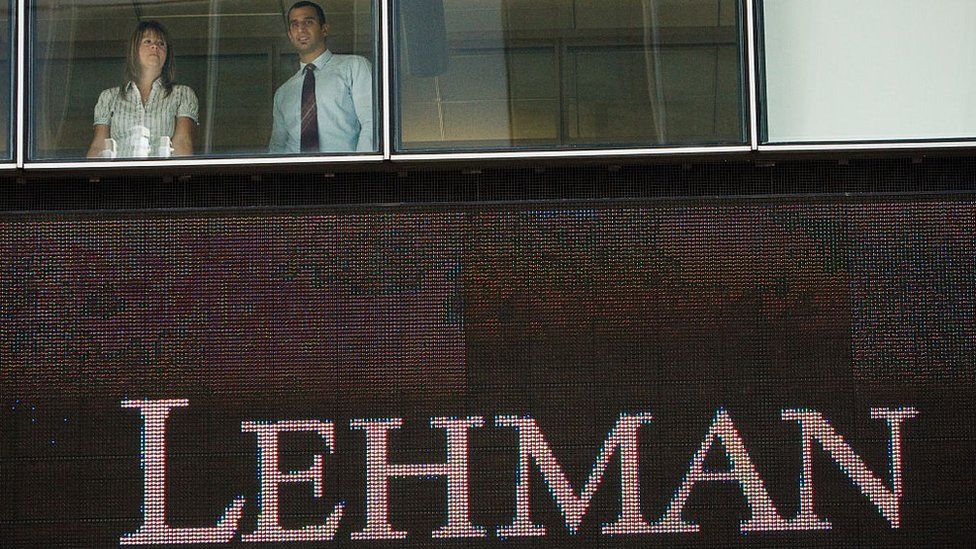

The global financial crisis was caused by the US's mortgage crisis.

The crash happened after the collapse of Lehman Brothers.

The European Central Bank and central banks in Canada, Sweden and Switzerland joined the Fed in lowering their interest rates.

They said in a statement that the financial crisis has increased the downside risks to growth and has diminished the upside risks to price stability.

They said that some easing of global monetary conditions is needed.