After a difficult year for chip stocks, Texas Instruments boosted its quarterly dividend by 8% and authorized billions of dollars in share purchases.

At the end of June, Texas Instruments had $8.2 billion of previously authorized repurchases. The higher dividend will be paid in November.

The leadership of the chipmaker is committed to steering its free cash flow towards investor returns in order to attract long-term shareholders who might otherwise shy away from the volatile Semiconductor industry. Other companies have begun to increase their dividends and buy back their stock.

The chipmaker has increased its dividends for 19 straight years. Since 2004, Texas Instruments has reduced its outstanding shares through stock purchases.

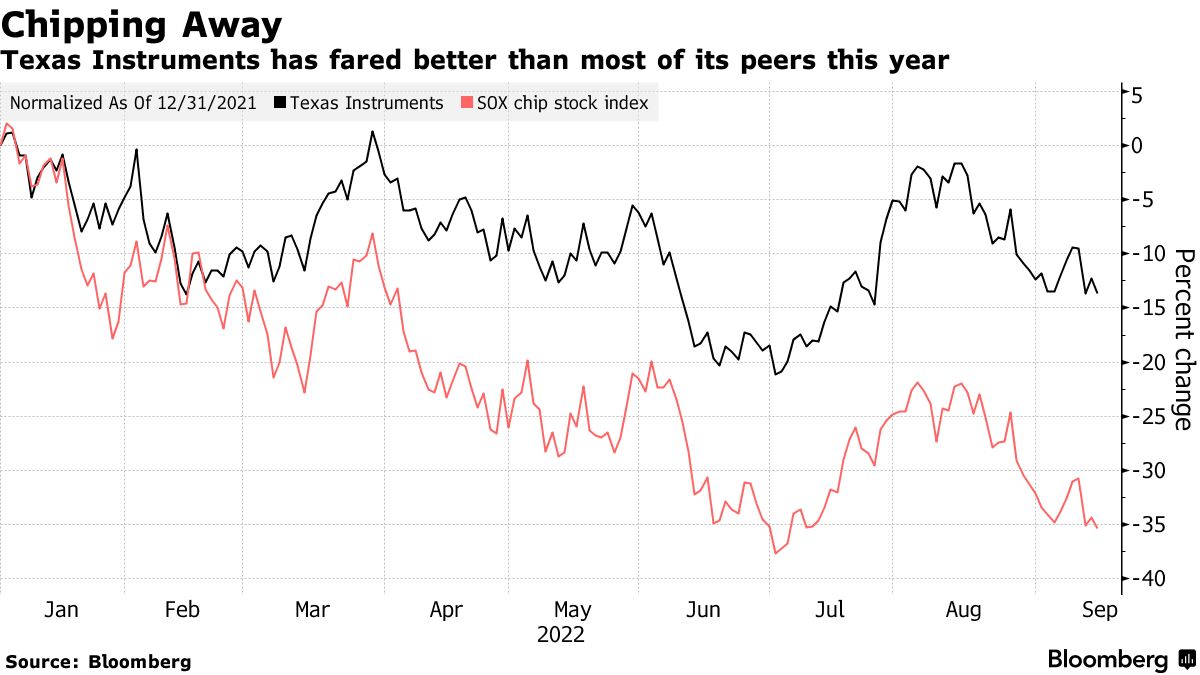

The stock of Texas Instruments has suffered a lot this year, but it hasn't been as bad as in the chip industry. The Philadelphia Stock Exchange Semiconductor index has declined 26% in the past year.

Demand for related chips has slowed because of sluggish sales. Texas Instruments is able to weather the downturn because of the components it uses. The company gave an upbeat forecast for the current quarter, with sales and profit projections coming in ahead of expectations.

(Updates with historical data in third paragraph.)