As interest rates go up, mortgage demand goes down.

The Mortgage Bankers Association reported that application volume dropped last week. An adjustment was made for Labor Day. Demand for mortgage loans has fallen by a third.

After Federal Reserve Chairman Powell made it clear to investors that the central bank would stay tough on inflation, mortgage rates pushed higher.

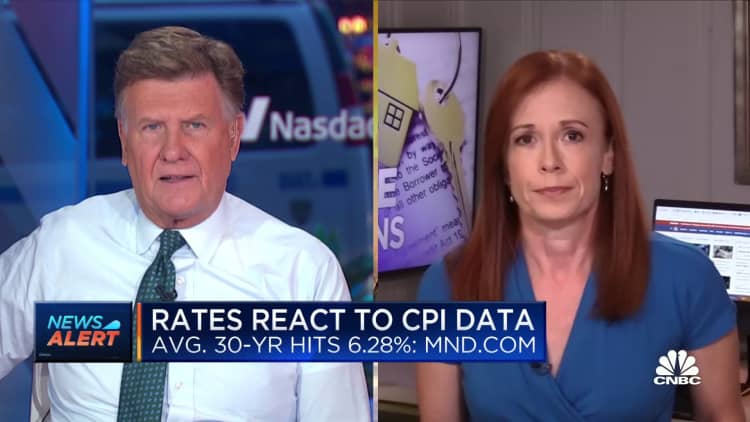

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances increased to 61% from 5.94% and points decreased to 0.76 from 0.79 for loans with a 20% down payment.

The 30-year fixed mortgage rate went up to 6 percent for the first time since 2008 and is double what it was a year ago.

Demand for home loans fell 4% for the week and was 80% lower than a year ago. Black Knight said that only 452,000 borrowers could benefit from a refinance. It's the lowest number on record. Only a few candidates could save so much money.

The number of mortgage applications to purchase a home increased by 2% from the previous week, but were 29% lower than a year ago. First-time buyers prefer VA and USDA loans because they can offer low or no down payments.

The spread between the conforming 30-year fixed mortgage rate and both jumbo loans remained wide last week. The wide spread is indicative of the uncertainty in capital markets.

The monthly inflation number came in higher than expected and caused mortgage rates to jump. The Federal Reserve was expected to hike rates more than expected.

Matthew Graham wrote that "it was one of the last shoes to drop before the Fed announcement on September 21st, and it arrived at a time where the market had fully priced in a 75bps hike, but was willing to consider something even higher if the data was convincing." This was convincing enough for the Fed to start the discussion.