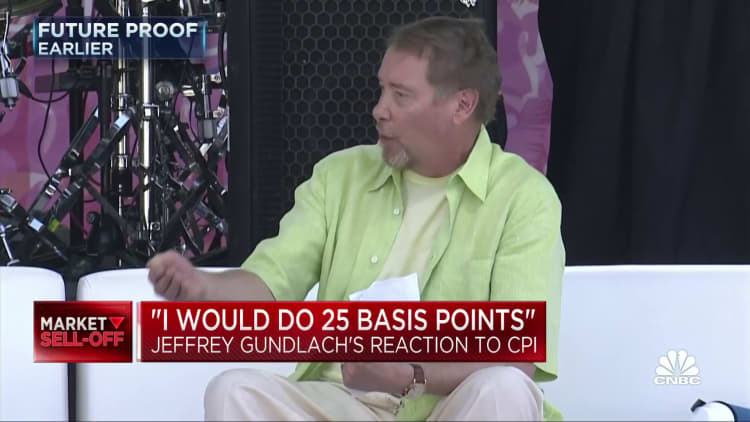

His comments came hours after the U.S. consumer price index report showed inflation was higher than expected. The stock market had its worst day since June 2020 as investors braced for more rate hikes from the US Federal Reserve.

48 hours ago, it was thought that the Fed's terminal rate would be 4%. The end rate is the level at which the US central bank is expected to stop hiking rates.

That level of uncertainty in terms of terminal rates, where the Fed will stop raising, is now officially an unknown. And so that’s extremely problematic for the markets.

You can see that there is a bet going on. He predicted that the Fed would raise at least 75 basis points, most likely a full percentage point. The central bank is expected to hike rates next week.

The Fed's decision to stop raising terminal rates is now officially unknown. That is problematic for the markets.

The Bureau of Labor Statistics reported Tuesday that inflation rose more than expected in August due to rising food and shelter costs.

The consumer price index, which tracks a broad basket of goods and services, increased for the month and the year. Excluding volatile energy and food costs, the inflation rate rose in August.

The majority of the economy is still strong, and the Fed will continue to raise rates until they see some kind of slowdown.

The consumer economy is one of the strongest parts of the economy. He said that the employment rates still remain strong. There is something we need to see.

Shelter costs, which make up about one-third of the weight in the consumer price index, went up in August. The decreases in energy prices were counterbalanced by increases.

The market rallied for the last three sessions because of the idea that inflation would slow, but that didn't happen.

The only thing that slowed down was gasoline prices. We are in a very difficult situation.

We lost all of our gains in about 11 minutes of trading this morning.

The risk of the Fed overshooting remains despite the fact that the drop in housing prices was not reflected in the latest inflation data.

It takes 16 to 18 months to accurately reflect housing data in the consumer price index.

He said that the change in housing prices which has started to drop is not reflected in the consumer price index.

There are some risks that the Fed may overshoot.