You can sign up for the New Economy Daily newsletter and follow us on social media.

Federal Reserve officials look on track for another jumbo increase in interest rates this month and assure Americans they will bring inflation back down to 2%.

The governor of the Fed said he supported another significant increase. The president of the St. Louis Fed said that he was leaning towards a jumbo move. Both have been good indicators of where Fed policy is going.

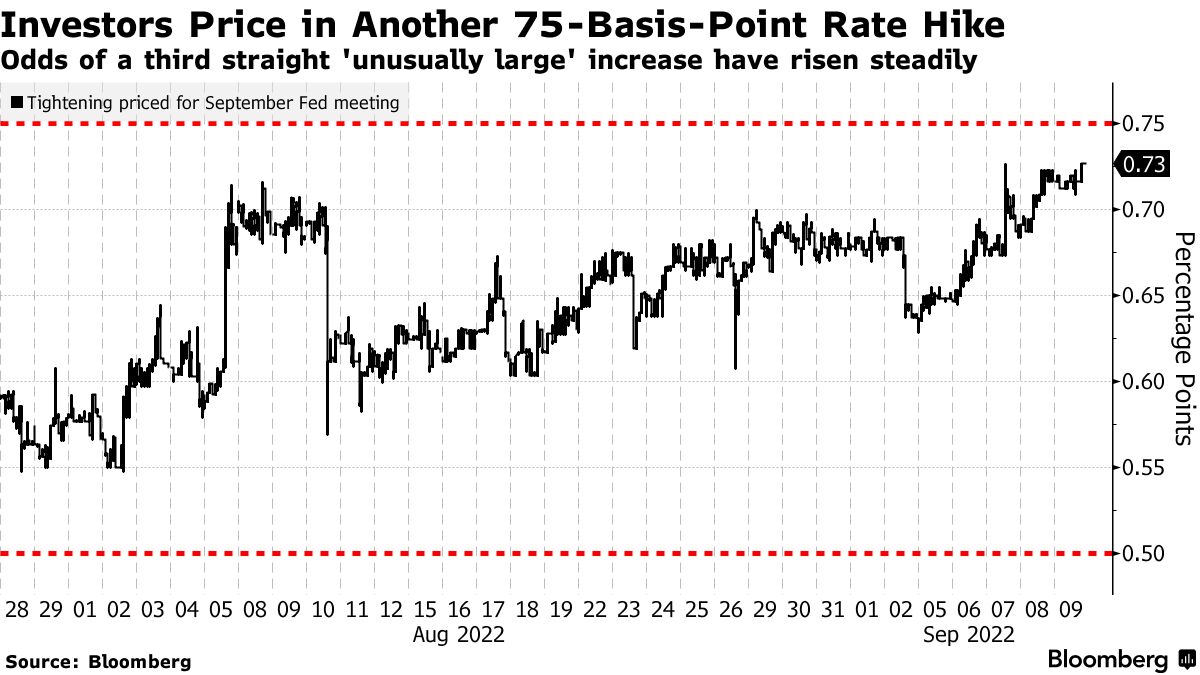

Their comments followed comments from other policy makers this week that endorsed a third consecutive 75 basis point increase. Powell had previously stated that the decision was between a half-point and a full point. The public comment period is about to start.

A growing number of big banks have changed their calls to a 75 basis-point move this month from 50 basis points.

It will be the most aggressive series of rate increases since the 1980's if the Fed goes big again.

The committee's sense of asymmetric risks from inflation being too high for too long is the reason for the rush to get rates to restrictive territory.

Officials worry that a long period of high inflation will erode public confidence in the central bank's ability to deliver 2% inflation, making it more costly for the Fed to return to the target.

Powell said that the clock is close to running.

He said that the public will start to incorporate higher inflation into its decisions if inflation stays above target. Our job is to prevent that from happening.

To avoid pledges of pausing or slowing the rate-hike campaign, officials have set a high bar for the economic data to convince them to do so.

I will support taking further steps to tighten monetary policy until I see a moderation of the rise in core prices.

Financial conditions are already being impacted by policy.

Freddie Mac says 30-year mortgage rates have doubled from the beginning of the year. There has been a decrease in housing activity. The price of global commodities and used cars in the U.S. have come off their peaks, while the dollar is higher against a basket of ten major currencies.

It adds up to the beginning of disinflationary trends for the U.S.

It will take a long run of data to convince the Fed that inflation is on a downward path and that policy can move off its tightening bias.

While cautious not to say that they are pausing on their run to 4% on the benchmark lending rate, some officials are saying they will be more nuanced in their assessment of the data going forward.

Esther George, president of the Kansas City Fed, said that the policy will have to be determined through observation. This argument is based on the likely lags in the pass through of tighter monetary policy.