Powell stressed the importance of getting inflation down before the public gets used to higher prices and expects them to be the norm.

Powell said that expectations were important to why inflation was so persistent in the 70s and 80s.

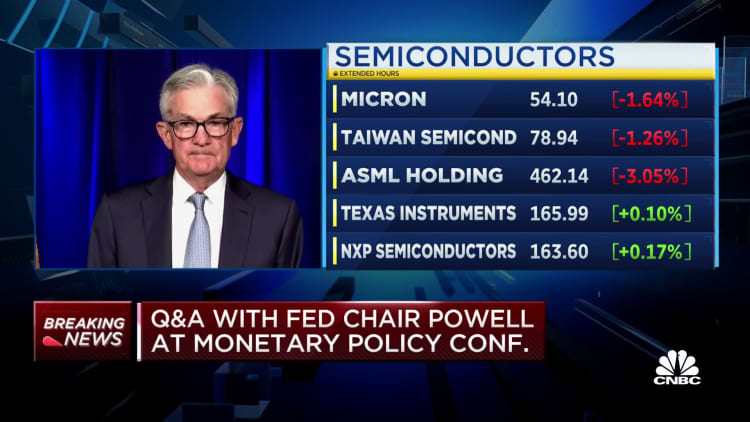

The leader of the central bank said in a Q&A presentation that history cautions against premature easing of policy. We will keep working on this project until the job is done.

It was Powell's last public appearance before the Fed's next meeting.

Major averages didn't change in the early going on Wall Street despite the comments. The two-year note, the most sensitive to Fed rate hikes, rose by almost 5 basis points. There is a basis point.

Four times this year, the Fed has raised benchmark interest rates, with the fed funds rate now set in a range between 2% and 2.5%.

The Federal Open Market Committee is expected to raise the rate for the third time this year. According to the FedWatch tracker of fed funds futures bets, the probability increased to 86% during Powell's comments.

Powell said that one reason for acting aggressively is to make sure that inflation doesn't become ingrained in the public consciousness.

He said that the Fed has the responsibility for price stability. The risk of the public seeing higher inflation as the norm increases if inflation stays well above target.

The monthly path of inflation has been abating recently. After rising above $5 a gallon earlier in the summer, gasoline prices have fallen steadily.

The Bureau of Labor Statistics will release the August consumer price index data next week. The consumer price index is expected to increase by 2% after it was unchanged in July. The year-over-year increase in July was 8.5%, and many areas outside energy saw large increases.

Pandemic-specific causes have caused the inflation pressures. When inflation began to rise in the spring of 2021, Powell and his colleagues dismissed it astransitory and did not respond with any major policy moves.

It is incumbent on the Fed to act until inflation falls and avoid the consequences of the 1970s when a failure to implement an aggressive policy response allowed public expectations for high inflation to get out of hand.

He said that they need to act now and keep at it until the job is done to avoid that.

Even though the official unemployment rate is expected to drift higher as a result of the rate increases, Powell noted the strong labor market with strong levels of hiring. He warned last month that the economy could experience some pain from tighter policy, but that slowing growth is necessary to tame inflation.

He said that they hope to achieve a period of growth below trend which will cause the labor market to get back into better balance and that will bring wages back down to levels that are more consistent with inflation over time.