Consumer spending is supported by a robust job and wage picture in the US This would be a Goldilocks environment if inflation wasn't a problem.

Even though Wall Street seems to have underestimated the resilience of the US economy, shares are still below their August highs. The real test for markets is still to come. Goldilocks is a period of slow growth and a mild recession. An over-tightening will hurt the economy and asset prices.

We have a serious inflation problem. It means that interest rates will go up and that resilience won't last. There are two outcomes from a market perspective. The Treasury curve must continue to steepen in order for the fixed-income market to function. The equity market would be impacted by higher discount rates. The stock market would be under pressure and high-beta stocks would lag. The yield curve will flatten when the economy starts to decline. Eventually Goldilocks could come back, but only in the form of a recession.

You could argue that the collective wisdom of a forward-looking market made a difference. The first inkling that the third quarter was off to a good start wasn't until the Atlanta Fed's GDPNow tracker started to grow on July 29th.

A lot of people were saying that the US was already in a recession. There was a rally in shares.

The Atlanta Fed predicts a 2.5% rise in GDP for this quarter based on available data. Wall Street wasn't too bullish.

The stock market peaked in August and is now headed down. I don't think that's just a reflection of higher interest rates It is a warning that the labor market is in the Feds favor. As long as inflation remains high, there will be more rate hikes. Higher discount rates and lower earnings will hurt shares. It will be hard to maintain a Goldilocks outcome if the Fed does not relent.

This can be seen in the margins. The four-quarter operating margins for the S&P 500 have decreased steadily under the weight of inflation this year. It depends on interest rates, inflation and the ability to mitigate its effects.

We should expect the S&P 500 to retest its lows as uncertainty plays out. The path of inflation and interest rates will determine if shares break down meaningfully or exceed the lows.

There is a shift in the equity markets. Many retail investors kept their faith despite the collapse of the high-beta stuff. We saw some outflows from exchange-traded funds last year, but they were not the only ones.

It was the biggest monthly outflow since September.

Instead of buying the dip they are re-locating funds to less volatile shares and asset classes.

If the discount rate of future cash flows continues to increase, shares should fall.

It is tempting to place all of the recent equity market weakness on discount rates. The bond index dropped 20% from its peak. Global bonds are having their first bear market in a long time. The selloff in equity began before Jackson Hole.

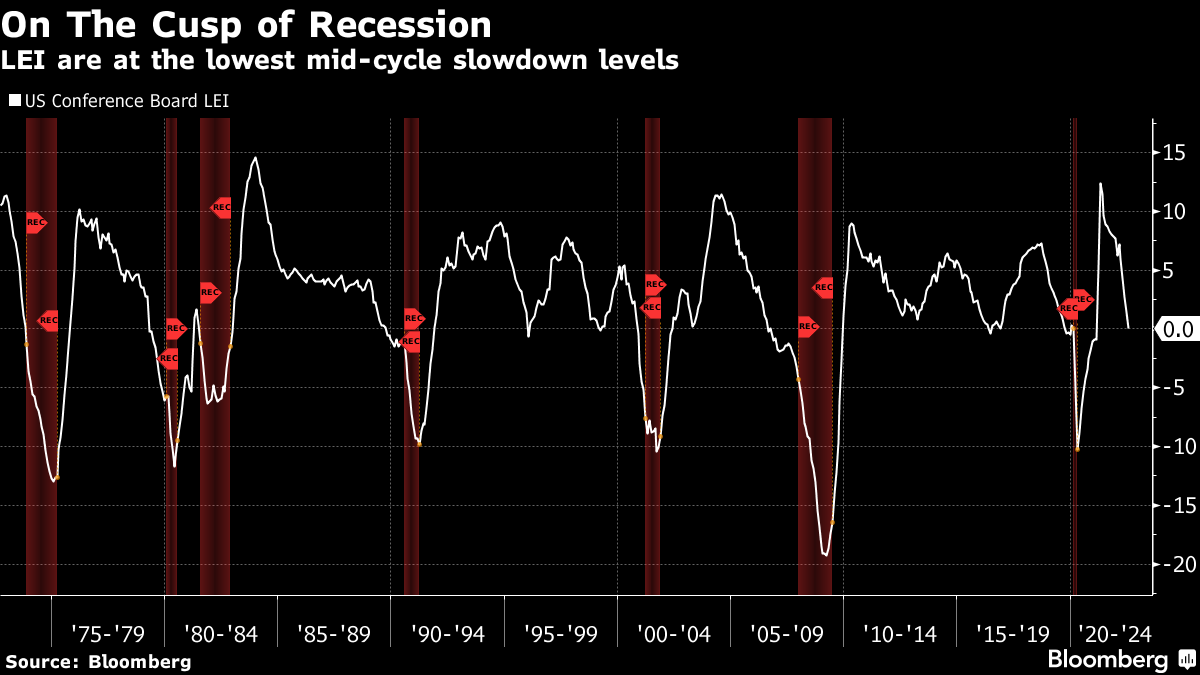

The recent weakness is a continuation of a fundamental trend after a brief resurgence in the economy. The Conference Board has leading economic indicators.

A situation in which the US economy goes into recession is the base case. We are at the level of separation between recessions and mid-cycle slowdowns. It would take a remarkable turn around to stop here. The decline in shares is more than just a rate decline. Growth has been lessened this quarter but only temporarily.

It is difficult to know what will happen next because leading economic indicators are still falling. One of the perverse things about this is that it is bad news for the stock market. We are more likely to reach new 10-year Treasury yield highs if the data is robust. That is a problem for the economy and the stock market.

As the market figured out that the third quarter would be good, long-term Treasuries sold off the most and the curve steepened.

The curve is still inverted The market is reacting to positive data, but still expecting a recession. The 10-year Treasury yield has gone up by seven-tenths of a percentage point. We are close to cycle highs on the 10-year yield.

The best way to reconcile an inverted yield curve's recession signal with the rise in rates is to look at inflation and the policy response. I wrote about it on the terminal.

whether we have hit peak rates ultimately depends on how well markets have gauged the Fed’s eventual policy path and the terminal rate. Persistent inflation and a more aggressive Fed will mean 10-year yields can go higher than 3.50%, leading to a deeper recession and another selloff in equities.

The speculative stuff would fall more than the rest.

I expect this steepening to come to an end relatively soon as the economy starts to show signs of weakness. A mild recession followed by a period of modest growth would be a soft landing.

The Goldilocks outcome is that bonds don't get crushed. Savers do a good job. It's still pretty decent, even though it isn't the Goldilocks investors want to see.