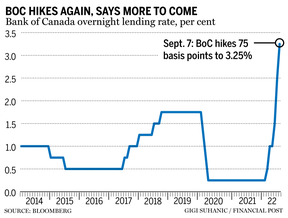

The Bank of Canada raised the policy interest rate by 75 basis points on Wednesday, the highest rate since the financial crisis.

The Bank said it was continuing its quantitative tightening policy and that more rate hikes would follow in an effort to stamp out high inflation.

The Financial Post is part of Postmedia Network Inc. There was an issue with signing you up. Try again.

The Bank warned of persistently high global inflation with pressures stemming from China's ongoing COVID-19 shutdowns and volatile commodities prices

The central bank noted that inflation pressures had fallen to 7.6 per cent from 8.1 per cent in July, but core inflation continued to rise to a range of five to 5.5 per cent. The consumer price index dropped due to falling gasoline prices and the current reading is too hot for the economy to deal with.

According to a statement from the Bank, the global and Canadian economies are in line with the July projections. The effects of the COVID-19 outbreak, supply disruptions, and the war in Ukraine are having a negative effect on growth.

Inflation is expected to remain elevated so the policy rate needs to rise further.

The Canadian economy grew at a slower than expected 3.3 per cent in the second quarter, which the Bank admitted was weaker than anticipated.

The Bank noted that the country's housing markets had grown unsustainably during the Pandemic. The Bank said it expects the economy to slow in the last half of the year.

The central bank pointed to stronger indicators of domestic demand as consumption and business investment both increased.

Most economists were expecting a 75 basis point hike. In a note last week, the managing director and head of macro strategy at Desjardins said that central bankers will need to keep an eye on inflation as it begins to decline.

The effects of restrictive policy will show up more clearly this fall and winter, which will allow the central bank to pause rate hikes.

The Bank will have to abandon any pretense of a soft economic landing with more rate hikes expected.

The Bank of Canada has a neutral range of two to three per cent for the policy rate. The policy rate has been raised a total of 300 basis points in the last few months.

The last time the policy rate was this high was in April 2008, when the Bank of Canada lowered the rate to three per cent. The Bank of Canada will make its next policy rate decision in October.

The email address is shughes@postmedia.