It's difficult to decide what really matters in the cryptocurrencies world. The digital sector will be undergoing its biggest shake-up in years this month.

It is expected that a technology change will cause its carbon emissions to plummet by 99 percent.

In the last few years, the growth of cryptocurrencies has been incredible.

Climate change has been their contribution due to the huge amount of electricity used by computers to buy and sell coins.

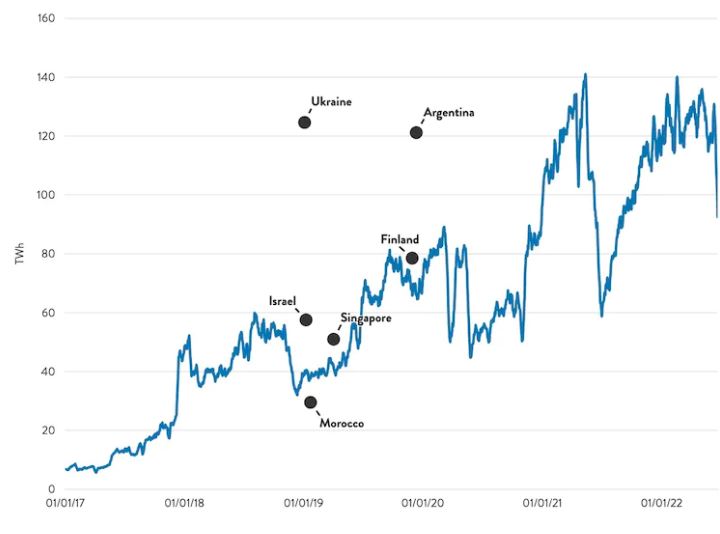

For example, the world's biggest digital currency, Bitcoin. At a time when the world is trying to reduce energy consumption,bitcoin uses more energy than Argentina.

If the switch succeeds, the pressure will be on to deal with it.

Direct online payments are made using Cryptocurrencies.

Cryptocurrencies aren't managed from a central bank. They are managed by a network of high-powered computers. The computers are called miners.

This simple explanation of how it all works is provided by the Reserve Bank of Australia.

Alice might want to transfer one unit of currency to another person. The transaction begins when Alice sends an electronic message to the network with her instructions.

A group of other transactions waiting to be compiled into a block of the most recent transactions are sitting with the transaction.

The information from the block is turned into a code that can be solved by miners.

Once a miner has solved the code, other users of the network check the solution to make sure it's legit. Alice's transaction is confirmed after a new block of transactions is added to the ledger.

Proof-of-work mining is a process used by most Cryptocurrencies. The use of calculations requires a lot of computer time and a lot of electricity.

Each year, the digital currency consumes around 150 tera watt-hours of power. Producing that energy emits about the same amount of carbon dioxide as Greece does every year.

Around 19,000 deaths may have been caused by last year's emissions of the digital currency, according to research.

The proof-of-work approach is harmful to the environment. There isn't an inherent meaning to the data in a Blockchain. Its sole purpose is to record pointless calculations which can be used to allocate new coins.

There are a lot of excuses for the huge energy consumption of cryptocurrencies.

Some claim that some miners use renewable energy to justify their carbon footprint. They can displace other potential energy users by using coal or gas-fired power.

The most successful of the competitors is changing. It is going to switch its computing technology this month.

The switch is related to something.

The 'proof of work' model is being replaced by the 'proof of stake' model.

Under this model, users stake large amounts of token in order to guarantee the validity of transactions. Users lose their stake if they act dishonest.

The network of supercomputers used to check transactions will no longer be needed because users are doing the checking. The computer'miners' will lead to a decrease in electricity use.

Proof of stake is used by some smaller cryptocurrencies, such as the ADA coin traded on the Cardano platform.

The new model has been in use for a year. The model will be subsumed into the main platform this month.

There is no hiding for the currency.

All this means what?

The experiment could fail if some people are able to manipulate the system.

The proof-of-work model will be under pressure if the switch succeeds.

The pressure has started. Last year, Musk announced that his company would no longer accept payment for its electric cars in the form of Bitcoins.

In June, the New York state legislature passed a bill prohibiting the use of carbon-based power in virtual currencies. The decision needs the approval of New York's governor.

The proof-of-work model was proposed to be banned by the European parliament. The proposal was rejected.

As Europe grapples with an energy crisis caused by sanctions on Russian gas supplies, energy-guzzling Cryptocurrencies will remain in the firing line.

As the need to slash global emissions becomes more pressing, cryptocurrencies will run out of excuses.

JohnQuiggin is a professor at the school of economics.

The article was written by The Conversation. The original article is worth a read.