You can follow us on social media and sign up for The Readout newsletter.

The British pound is going to sink to new lows as soon as possible.

The UK's economic troubles are getting worse by the day, with families likely to be pushed into energy poverty this winter due to inflation. The consensus among traders is that the Bank of England will have no choice but to cause the economy to go into a recession and cause widespread job losses.

The pound is close to historic lows. The challenges facing the British economy and the next prime minister are highlighted by the fact that the currency is less than 4 US cents away from its weakest level in 25 years. A five-quarter recession is predicted by the BoE.

Is there more bad news? The senior currency strategist at Bank of New York Mellon Corp. said yes. It is not possible for sterling to return to where it was in the past. It will be very difficult to achieve that.

The surge in power prices has led traders to believe that the BoE will have to be more aggressive. Money markets expect benchmark interest rates to go up 4% next year. The yield on the 10-year bonds climbed to 2.59%.

Higher rates should result in a stronger currency. Right now, it is the opposite for the United Kingdom. The belief among investors is that Britain will be worse off than the US and the euro region if borrowing costs are hiked further.

When the growth-inflation trade off is bad, rates aren't always going to be enough to support a currency.

UK inflation hit a 40-year high of 10.1% last month, and Citigroup says it could surge past 18% in January. According to Baringa Partners, more than half of the UK's households could be in energy poverty this winter.

The snapshot shows what is happening in other UK markets.

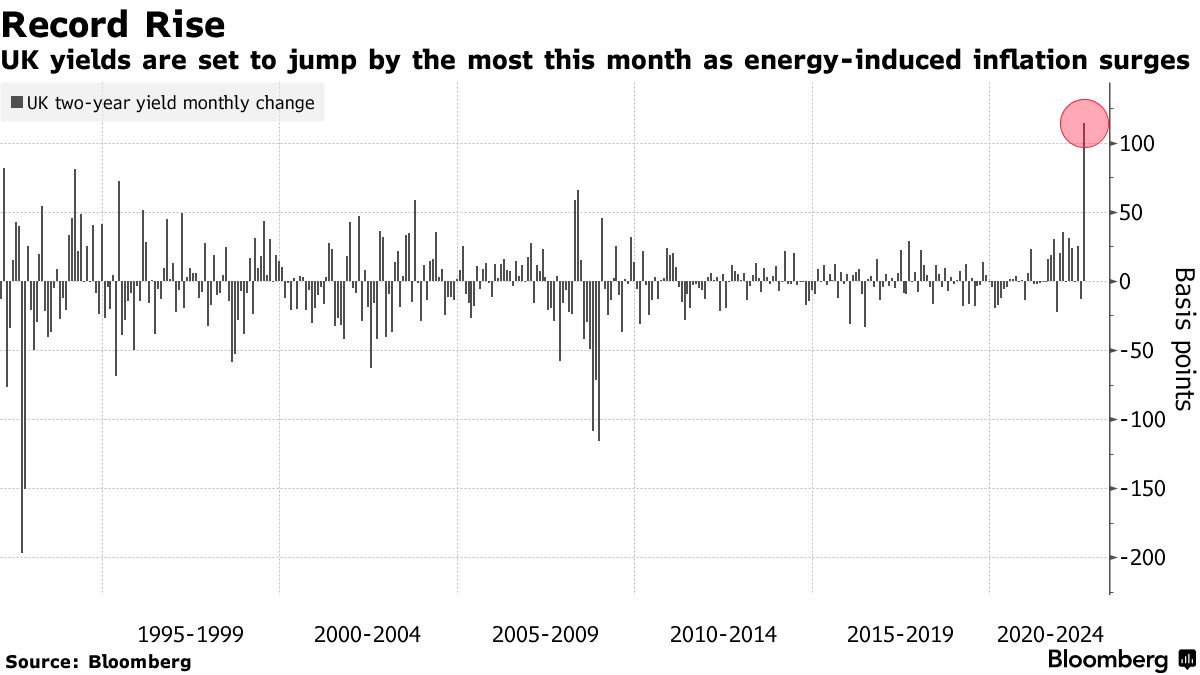

The yield on UK short-end benchmark bonds, which are the most sensitive to changes in monetary policy, is set to rise this month. Two-year yields have risen to the highest level since the financial crisis.

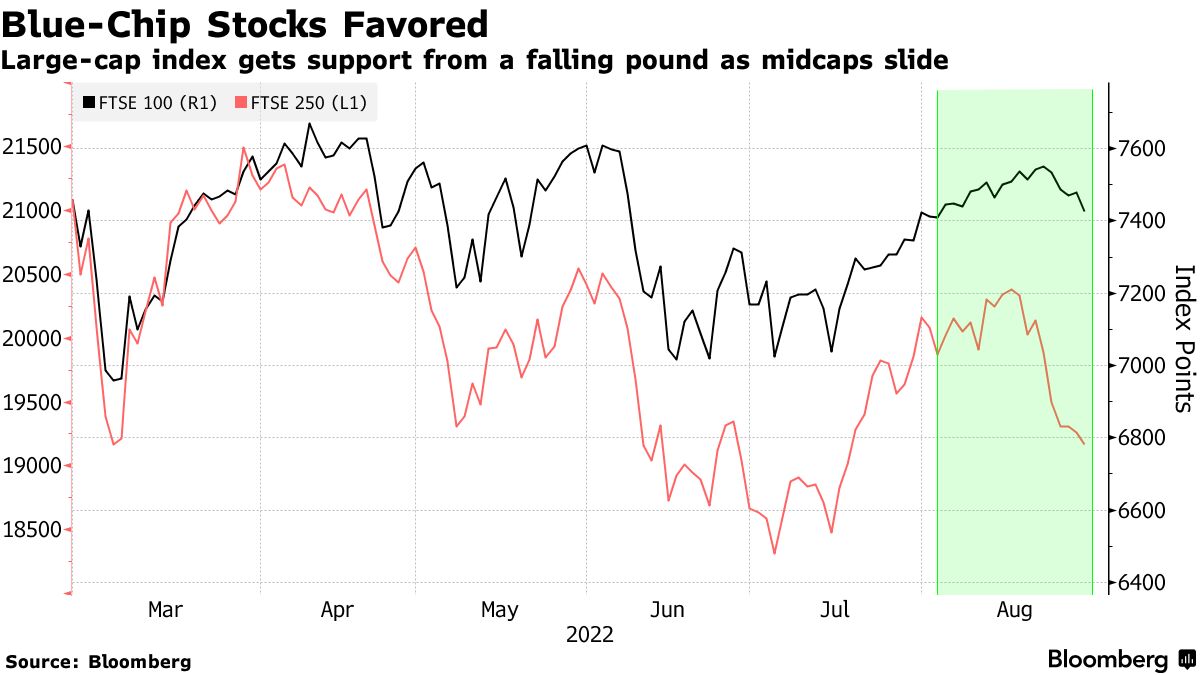

The weaker pound has been a boost to the UK's big exporters. Smaller companies are being weighed down by recession concerns.

Corporate debt that is short-dated was not performing well this month. The extra yield that investors demand to hold sterling notes is the highest it has been in years.

Policy rate-sensitive short notes have a negative effect on sterling credit.

This is the source of the index.

The help was given by Joe Easton, James Hirai, and Tasos Vossos.