While sitting in her office in Gujarat, India, she received a message from her distant relative, who said that they had received nude photos from multiple phone numbers, along with a text that read, "loan"

She said she was numb and ignorant.

It was the first time that a customer service executive was made aware of the circulation of her edited photos after taking her mugshots from the government.

She received many threatening and abusive phone calls and messages from men who claimed to be loan recovery agents.

Just a week after she applied for a small loan of around $100, all this began.

She didn't have the minimum salary needed for banks and other financial institutions in India, so she turned to a startup loan platform instead. She used an app her office colleague suggested to get the loan.

She had repaid the loan within a couple of weeks of getting her salary, but she claims that she had to pay over and above the original loan amount in order to get rid of abusive calls and messages. The threats haven't stopped yet.

Hundreds of millions of dollars have been disbursed through apps since the emergence of the corona virus.

India has been in the midst of a larger economic downturn. According to data shared by the Centre for Monitoring Indian Economy (CMIE), the country's unemployment rate in April 2020 was 22%. The rate fell to 6.80% in July this year from 6.96% in the same month last year and 7.40% in July 2020, but they are still higher than the U.S., U.K.

The government, along with other stakeholders, have taken action against some of the most egregious loan apps in order to limit their impact. The country's law enforcement agencies are trying to raiseawareness.

The image is from TechCrunch.

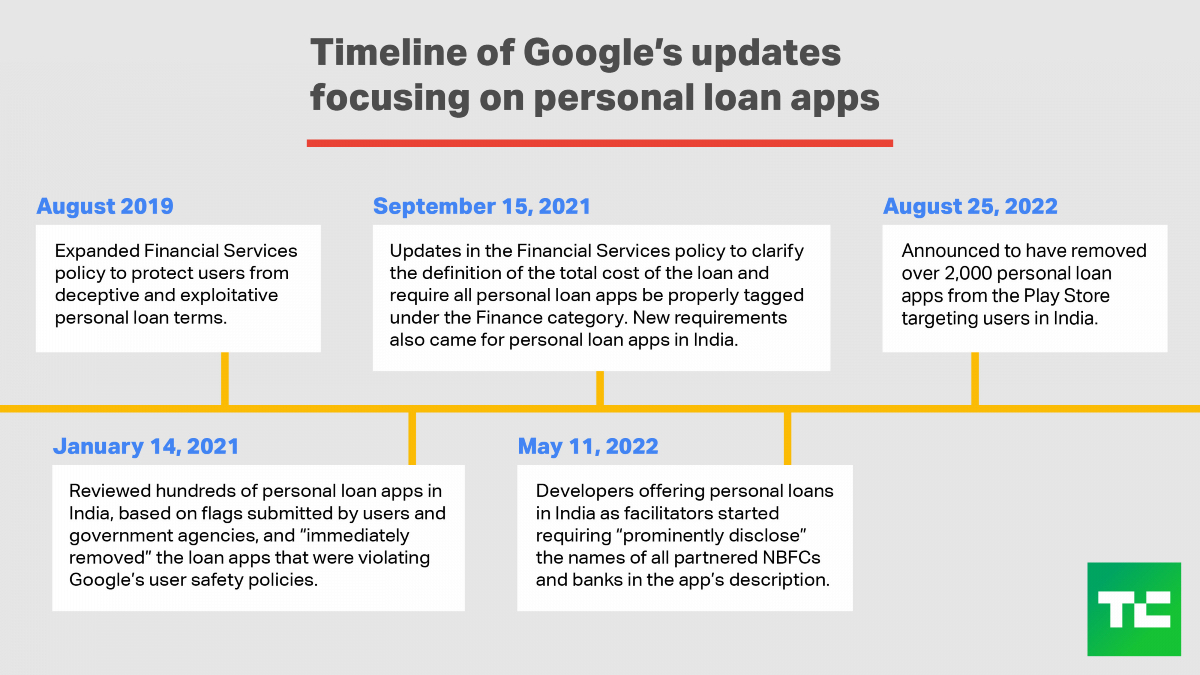

It's still an ongoing problem. More than 2,000 loan platforms apps have been removed from the Play Store in the last year. In the aftermath of their engagements, people who have had the misfortune of using them are still being abused and harassed.

Some people are taking their lives because of the pressure they get from these loan apps. Nearly two dozen suicides have been reported due to harassment from loan app operators. More than half a dozen of them were reported from the major tech center in the country, and in fact the largest campus in the country is located in the city of Hyderabad.

The state's law enforcement agency has made 10 arrests related to loan apps since the beginning of the year. The police identified 314 suspicious loan apps, according to him. He said that the agency sent its list to the internet search engine. He said that many of them are still on the Play Store.

The loan apps are emerging like nothing else this year.

He said that many of the apps were the same ones that were pulled by the government. The operators continued to operate. He said that they changed the names of their apps and then contacted the old customers and then harassed them to repay their loans. We have asked the agency to give us examples of apps that have been taken down but are operating again under a different name, and we will update this as we learn more.

There have been 250 billion transactions through these loan apps. The police officer said that each transaction was between 25 and 250 dollars.

According to a report by The Economic Times, loans of over 500 million dollars were disbursed by these apps.

The Fintech Association of Consumer Empowerment shared a list of loan apps to get them pulled from the Play Store. The Enforcement Directorate is one of the state police departments that is investigating issues with loan apps.

There was action taken against some loan apps, but no details were given.

In India, hundreds of personal loan apps have been reviewed for compliance based on flags submitted by users and government agencies. We have taken necessary enforcement action as part of our ongoing policy compliance sweeps, including removal of apps from the Play Store, for apps that remain non- compliant past the deadline.

The requirement to submit a copy of the license for review in case the developer is licensed by the Reserve Bank of India was added to the Play Store developer program policy.

Developers who are not registered with the central bank are required to reveal the names of all the NBFCs and banks that give loans through their apps. It was necessary for developers to make sure that their account name matches the registered business name in their declaration.

The law enforcement agencies will continue to get assistance from us.

There are a number of levels where predatory loan providers operate.

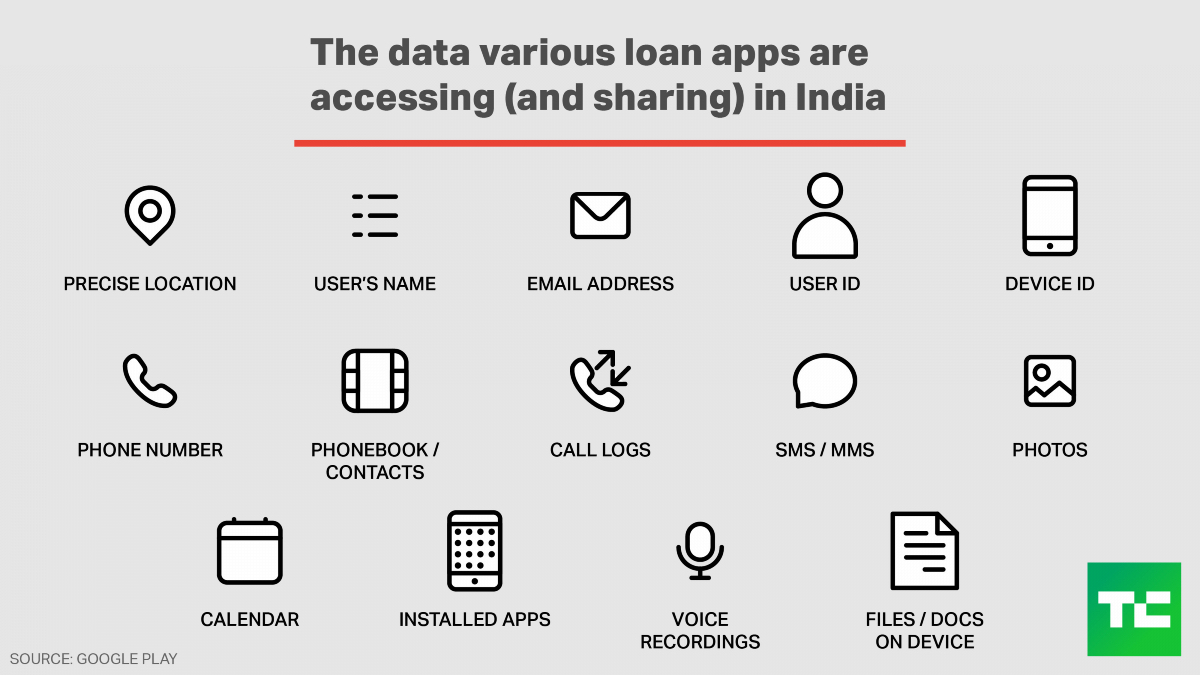

They gain user data access first and use it to recover and harass people. Operators of these apps get user consent if they pretend to use their contacts in case they are not reachable. Some apps don't get users' consent before taking all that data. Some apps say they need access to contacts and call records to fight fraud. The phone numbers obtained for recovery purposes are sometimes too harsh to bear.

The image is from TechCrunch.

They use established app stores to connect with users. Ordinary consumers assume that if they use an app available in the Play Store that it is credible because of the vetting that is done by the company.

It's difficult for a lay person to figure out if the Reserve Bank of India has authorized an app.

It's not only predatory loan apps that are on the Play Store. In the case of the latter, users are told to report non-compliance of the developer program policy to the company, which in turn will take appropriate actions against those developers.

Cashless Consumer's Srikanth Lakshmanan, who closely reviewed a list of loan apps impacting people in South India, believes that Google is not being held responsible for the situation.

He said that they don't want anyone else to say that they're failing.

The working group on digital lending was formed by the Reserve Bank of India in January last year. There were nearly 600 illegal loan apps that were found in the Play Store.

Even though they worked with the Reserve Bank of India to identify questionable loan apps, it was difficult for them to flag them. The current systems are trained to flag malicious apps, but not apps that can harm after some time of their installation, not just by way of Malware but through the malicious actions of people connected to those apps.

It's difficult to know where to draw the line in some cases and it raises big questions over what kind of data access should be allowed to have by default.

He said it was similar to Facebook. It is a bad company since it has access to all the data on your phone.

At the company's event this week, Saikat Mitra acknowledged that using only machine learning to flag such apps doesn't work.

The executive said that they could look into the amount of reverse engineering code. The problem of loan apps compared to other apps is that all the violations are not happening on the app.

Some working group recommendations have been considered by the Reserve Bank of India. There is still a lot of work that needs to be done.

Many other entities are operating in the market, which may be under the radar of the Reserve Bank of India, because of the way the regulatory structure is organized.

Several loan apps that are not registered with the Reserve Bank of India can be used to target people looking for instant credit. This doesn't mean that the ones that are registered with the Reserve Bank of India are doing fair business.

According to Lakshmanan of Cashless Consumer, some well-funded startups in the digital lending space indulge in all sorts of shady practices.

Hundreds of abuse and harassment-related complaints exist against many apps that are considered legal in the country, according to user reviews on the Play Store and App Store.

The details of these apps were shared with both Apple and Apple's parent company. Neither Apple nor Google responded to the request for comment.

The Reserve Bank of India advised regulated lending platforms to have fair methods and practices for loan recovery agents and not to resort to intimidation or harassment of borrowers.

The announcement made by the Reserve Bank of India was to make sure that everyone is aware of the guidelines. The adverse effects of loan apps had gone down.

He said that we are less than what we saw two years ago.

Some of the well-known digital lending platforms are included on the board of theDLAI.

Associations are looking for a self-regulatory organization to address consumer grievances

The Reserve Bank of India can't deal with every single complaint in the most timely manner, as per the requirement of establishing an SRO.

Market experts like Ahmed of Vidhi Centre for Legal Policy don't look for an SRO from the industry They would like the Reserve Bank of India to set up a mechanism to deal with grievances.

Adam J. Aviv, an associate processor of computer science at the George Washington University, said that even though privacy labels have been put on their app stores, they seem to have no priorities to use them to communicate risks with loan apps or to restrict their privacy-violating behavior

Some restrictions are placed on apps in other contexts, such as for children-focused apps or health apps, in order toComply with local laws and regulations. Governments could put in place similar policies. Aviv said that this could force the hand of the mobile app stores and the developers to meet minimum privacy standards.

Similar to India, people in Mexico and other countries are being harassed through loan apps. According to experts, it is due to carelessness.

According to Collins W. Munyendo, a graduate research assistant at the George Washington University, developing countries have a ready-made market for money-seeking individuals.

In contrast to the U.S. and U.K., a similar system lacks in developing markets. In the last few months new legislation was put in place to restrict the circulation of such apps.

The regulatory framework doesn't exist yet to control that space and anyone could wake up and create an app and put it out there.