Russia will revive local bond sales as soon as next month, and it wants to use the renminbi as part of its strategy to retool its markets with a view to its ally, China.

A person familiar with the matter said that OFZs could be sold again in the second half of September. Less than a fifth of the government's first-quarter borrowing plan was fulfilled when weekly auctions were frozen in February.

At the same time, a long-mulled plan to debut Chinese currency notes locally is being dusted off with fresh urgency as trading volumes surge after sanctions shut Russia out of its traditional markets in the US and Europe. A person who is not authorized to speak publicly said that it won't be a quick process and won't start this year.

Since the beginning of the year, the Moscow Exchange has seen a 40-fold increase in trading of the Chinese currency, the renminbi. Polyus PJSC and United Co. Rusal International PJSC are both Russian companies.

The use of Yuan's 'Meteoric Rise' in Russia trading is widening.

There may be opportunities for talks in the next few months, but formal Chinese government backing is Moscow's preferred option. The more likely outcome is that the Finance Ministry will focus on smaller sales for local players who are looking for a place to park their money.

With hundreds of millions of dollars coming into government coffers from energy revenue each day, the government has no need to borrow now, and the sale of yuan debt would serve as a benchmark for companies looking to tap the market.

The borrowing plan for upcoming auctions will be announced after the initial ruble-bond sale. The ministry said it could restart with initial sales of 10 billion to 30 billion.

“Issuing debt in yuan would solve two problems at once for the Finance Ministry: it would slow the drawdown of the wealth fund and if the yuan are raised on the domestic market, it would absorb some of the excess FX supply and weaken the ruble. The recent Rusal issue shows demand for yuan instruments inside Russia is strong.” - Alexander Isakov, Russia economist

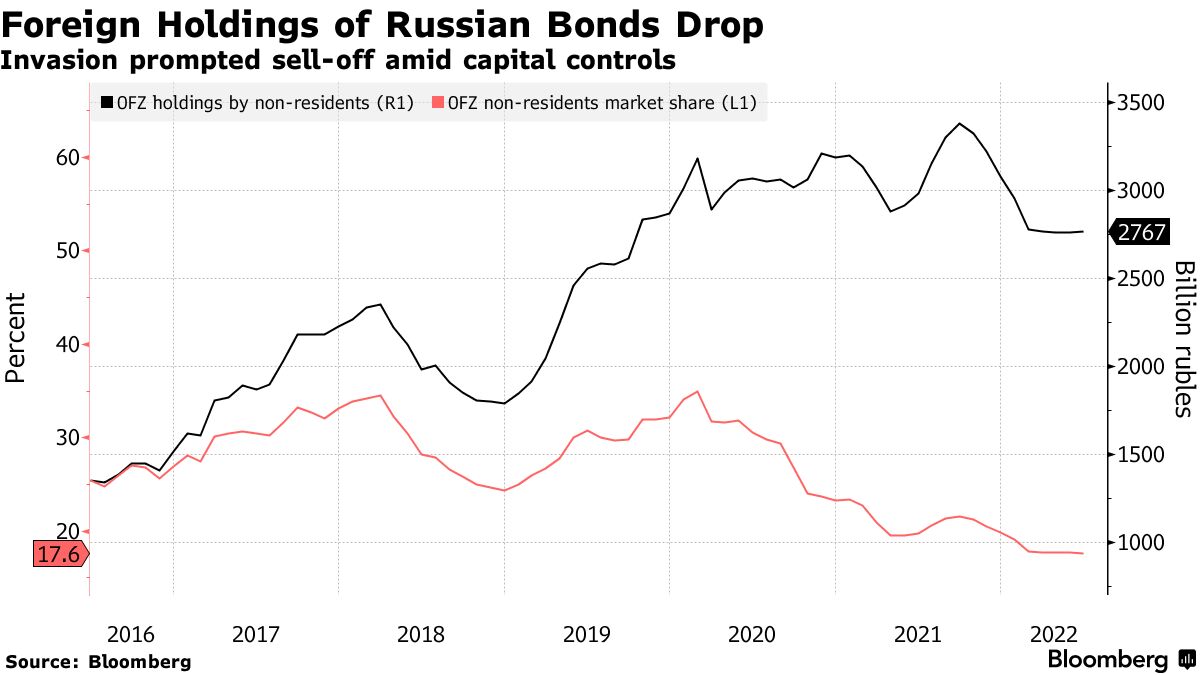

After the invasion foreigners' share of the OFZ market dropped, but it has not changed. The data from the Russian central bank shows that it was 17.6% of the total. Foreign investors who have been unable to sell their holdings due to local restrictions have written them down to zero.

The move away from the dollar and euro by Russia is a sign of how the world's biggest energy exporter is adjusting to sanctions.

There is a tale of Russia's sanctions-driven default.

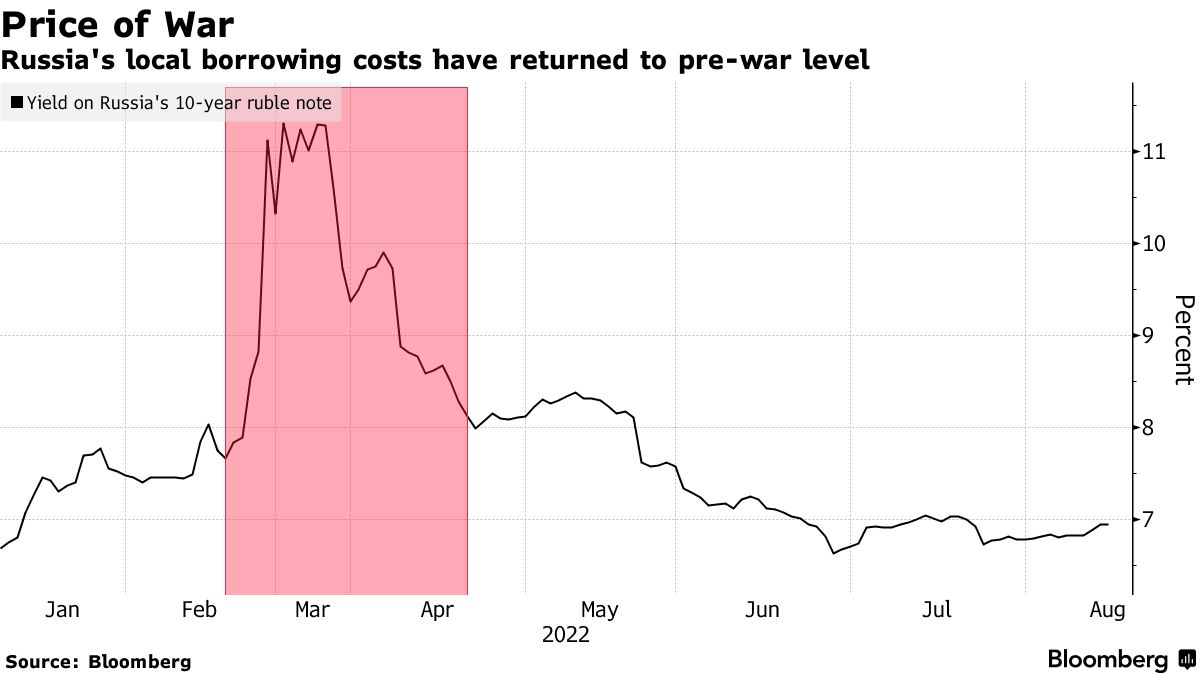

The ruble came back to a level against the dollar that was stronger than before the war, as oil revenue continued to flow in. The yield on ruble debt is back to pre-invasion levels. Sberbank said in a note that there are good opportunities for local companies to issue bonds because there is a surplus of currency.

Some of the country's biggest companies were banned from international debt markets in the year after Putin's annexation of the peninsula.

The aim was to get approval from Beijing for Chinese investors to participate in the project. The project was put on the back burner because it was difficult to complete.

Quick take on why increasing Russia-China ties worry democracies.

Vedomosti reported on Tuesday that Russia was considering issuing debt again. The Finance Ministry didn't reply to the request.

Polyus lowered final coupon guidance on its five-year bonds to 3.8% from 4.2%, according to people familiar with the matter who asked not to be identified.

Benjamin Harvey assisted.