Adding lines of business is always risky in a startup. A company that spreads itself too thin can end up not doing a good job. It can find an offering that is both a hit and a hit at the same time.

In Ramp's case, the latter seems to be true.

Bill pay was launched by the corporate spend startup in October of 2021.

According to Eric Glyman, Ramp went from launch to more than $1 billion in bill pay volume within half a year.

The pace of growth has outpaced the business of corporate cards. It took us a long time to go from a small company to a billion dollar business. Businesses are using the bill pay product more quickly than before.

Existing customers could find bill pay in self-service. Vendors who were paid with the feature grew in popularity as more people used it.

People are coming in just to get the bill pay product.

He believes that the appeal can be attributed to the ability to integrate with other offerings.

When using a stand-alone solution like Bill.com, a user has to connect their product to accounting software and then connect their credit card to the reimbursement software so they can continue to operate their accounting software on it It's possible to manage it all in one platform with automated accounting and expense management.

The success of the bill pay feature has led to the addition of financing and a new product called Flex.

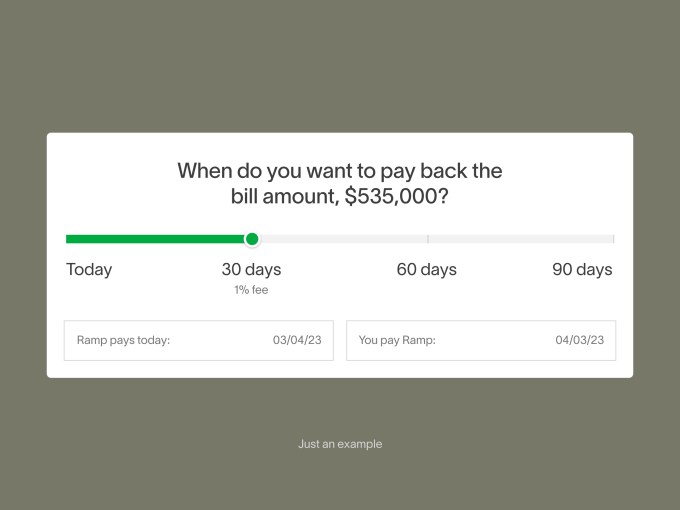

If a customer used Ramp to pay a vendor, they had 30 days to repay the money.

Customers will be able to add financing to pay the money back up to 60 or 90 days later for a fee with the new Flex feature. Bill pay gives businesses the flexibility to pay in a variety of ways, including via check or card.

The image is titled " Ramp."

Many of the businesses we support have a lot of working capital that is tied up when paying bills. Financing through other forms of payment is now possible.

The fee paid by the business is bigger when the financing is longer. When bills are paid, Ramp makes money by charging fees and interchange fees. Ramp won't make any money off of bill pay if the business pays back the money within 30 days. The hope is that the software will make people stickier.

Flex is available to select customers. Although not in all U.S. states, the company is working towards a general access.

The Flex feature seems to be an attempt by Ramp to stand out. Brex allows its customers to forward their bills and invoices to the startup to pay them, or have their vendors send them directly. Customers can make payments through a variety of methods. It does not charge any transaction fees and does not state on its website that it offers flexible financing for those payments. There is no indication on the websites of Air Base and Rho that they offer financing through their bill pay features.

Glyman expects non-tech businesses that have long cash conversion cycles and rely on working capital offerings beyond corporate cards to find the flexibility to pay bills.

Glyman said that they can now help their customers determine how and when to pay their bills.

The bill pay feature is becoming very significant in terms of overall payments volume, he said.

Billions of volume on the card is powered by us.

There are currently $120 trillion in global B2B payments processed annually, of which only 1.5 trillion are on cards.

He said that they are looking at other ways of expansion to make the product more valuable and to drive adoption of core products.

Shouldn't Ramp be concerned about the risk of default?

The company is not taking new risk with the new Flex feature, according to Glyman. If a business has a $100,000 limit, they could put $20,000 or $30,000 on their card and use that limit to make bill payments.

He said that Ramp invested in its early days in credit risk.

We do better on our existing product than our peers. The core product is the same as today'sFlex.

He said the company has been very pleased with its default rate.

He said that they believed they had industry-leading performance in terms of their credit.

In order to be more competitive and one-stop shops for its customers, Ramp is not the only fintech startup that has expanded its offerings. In the past few months, Brex declared it was making a big push into financial software with a focus on enterprise clients, Airbase said it was adding corporate card offerings, and Rho said it was adding expense management to its offerings.

The travel business was announced by Ramp earlier this year. The company raised $200 million in equity in March.

Fintech Roundup: The gloves are off in the spend management space