Israel's central bank is poised to extend its cycle of interest rate hikes to the longest since 2008, responding to the fastest inflation in over a decade and an economic upswing that has propelled employment, output and consumption to levels last seen before the epidemic.

Policy makers will raise the benchmark by the same amount on Monday, just over a month after the third straight rate hike and the largest since 2011.

A hike of 75 basis points, which would rank among the biggest in Israel over the past two decades, is predicted by only one analyst.

With inflation set to benefit from the shekel's surge and a letup in global energy prices, Governor Yaron is faced with a dilemma. The central bank tries to get ahead of inflation by increasing the pace of monetary tightening whenever it raises rates.

Leumi economists Gil Bufman andYaniv Bar said in a note to clients that there was an upward surprise in inflation and a continued process of rate hikes.

The central bank was able to hold down the shekel because of its strength. Inflation was caused by the shekel falling through much of the first half of the year.

Since the beginning of July, the shekel has appreciated against the dollar, making it the second-biggest appreciation in the world.

In the last six months, the Bank of Israel hasn't waded into the foreign-exchange market, the longest stretch since 2013).

The Bank of Israel wouldn't say if it was considering restarting its purchases of foreign currency.

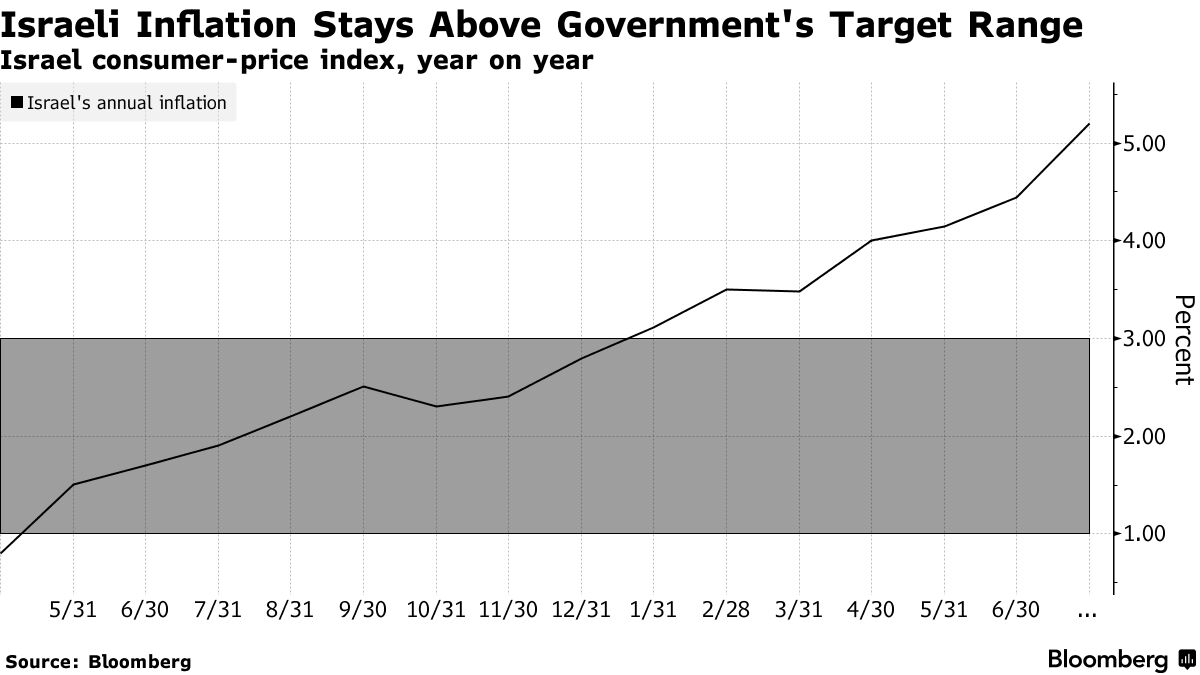

The central bank is concerned about how to get a grip on inflation. The research department raised this year's estimate to 4.5%, an increase of a full percentage point from April's projections.

Since January, price growth has been above government targets. It accelerated to 5.2% on an annual basis last month after topping all forecasts.

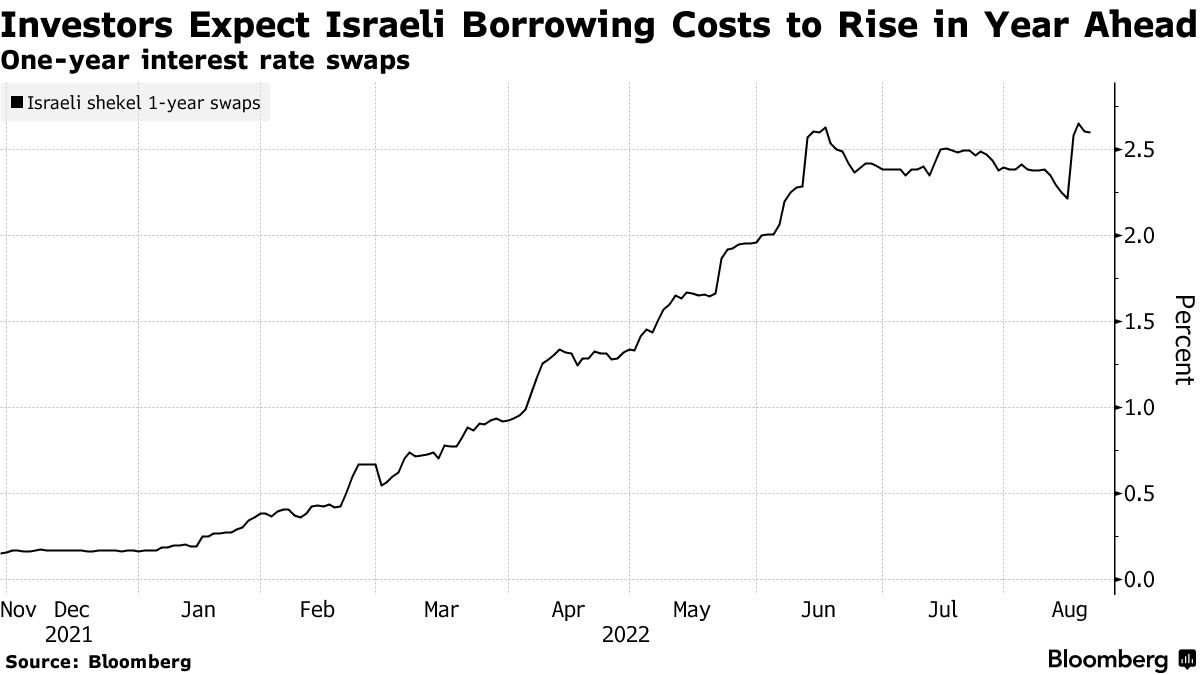

There is scope for borrowing costs to go up. A one-year interest rate swap is pricing in an increase to over 2.5% a year from now.

The central bank believes the key rate will be 2.5% by the end of the year, while Goldman thinks it will be 2%.

Even with the surprise acceleration in inflation, the outlook for prices is still below what the central bank sees.

They said that recent shekel strength should help place a lid on imported inflation.

Harumi Ichikura, Gwen Ackerman, and Daniel Avis worked together.