Both stocks and company bonds have been in high demand this summer. With the fall approaching, bonds strengthen as central bank tightening and recession fears take hold again.

Both markets were ready for a bounce back after a bad first half. The spark was lit by resilient earnings and hopes that a slight cooling in rampant inflation would get the Federal Reserve to slow the pace of its rate hikes.

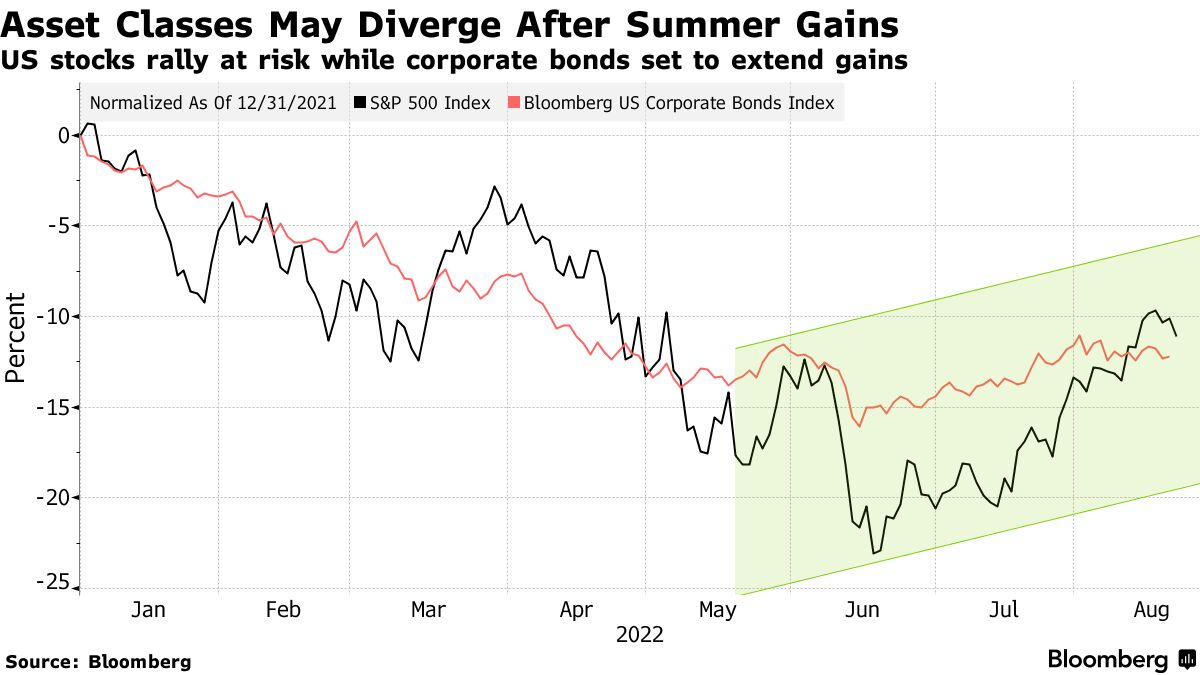

US stocks are on track for their best summer on record after a near 12% advance in July and August. Since the bottoming out in June, bonds of companies have gained 4.6% in the US. With the two moving in tandem, bonds look better placed to extend the rally as the dash to safety in an economic downturn will offset a rise in risk premiums.

One of the best summer rallies has been experienced by the stock market.

There is a source for this.

The economic outlook is cloudy as Fed officials have indicated they're not keen to stop tightening until they're sure that inflation won't flare up again, even at the cost of some economic "pain."

Debt from investment grade firms would benefit from a potential flight-to- safety. It is a risk to earnings that many investors do not want to take.

We don't want to chase the bear market rally that we've seen so far. I don't think we're out of the woods yet. Earnings don't reflect the risk of a US recession next year, and bets of a dovish Fed pivot are premature.

The second-quarter earnings season restored faith in the health of corporate America and Europe as companies were able to pass on higher costs. The US labor market has held up well.

Business activity is expected to slow from here on, while strategists say companies will struggle to keep raising prices to defend margins, threatening earnings in the second half Earnings are expected to fall 2% this year and 5% in 2023 according to Beata Manthey.

BofA and JP Morgan were cool on European equities after the summer rally.

Sentiment is still bearish despite the fact that investors in Bank of America Corp.'s latest global fund manager survey have become less pessimistic about global growth. Michael Hartnett said that inflows to stocks and bonds suggest that the Fed is not afraid. He thinks the central bank isn't done with tightening. At the Jackson Hole gathering of the Fed, investors will be looking for clues.

If the S&P 500 climbs above 4,328 points, Hartnett suggests taking profits. Current levels are 2% higher than that.

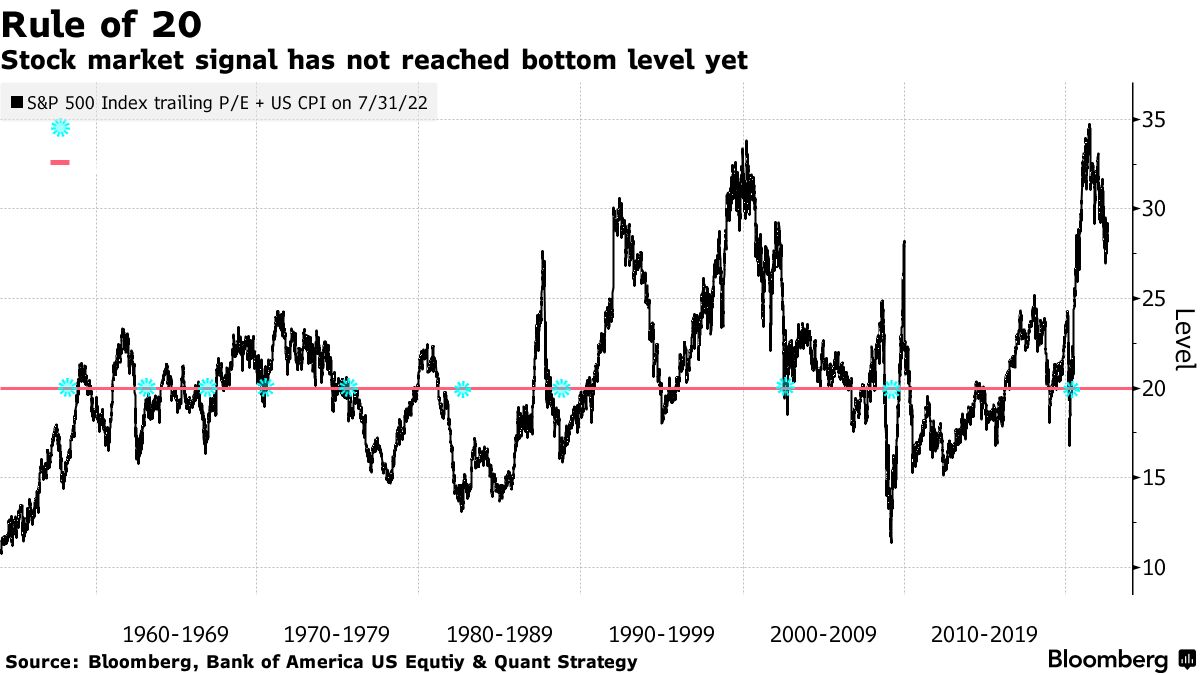

The US stocks will decline again. Since the 1950s, a measure from Bank of America that combines the S&P 500's trailing price-to- earnings ratio with inflation has fallen below 20 before each market trough. It only got as low as 27 during the selling season.

There is a trade that could give a big boost to the stock market. Tech giants Apple Inc. and Amazon.com Inc. have been seen as a relative haven. The stock rally has been led by the group, and strategists at JP Morgan expect it to continue.

The layers that make up a company's borrowing costs look set to be used by investors. A premium is paid to compensate for threats like a borrowers going bust.

Building blocks move in opposite directions when the economy weakens. In a recession, the flight-to-quality in such a scenario will help cushion the blow.

Christian Hantel is a portfolio manager at Vontobel Asset Management. Hantel said that in a risk-off scenario government bond yields will go lower.

High-grade bonds, which are longer-dated and offer thinner spreads, are particularly affected by falling government yields.

Hantel said that there is a lot of risk around and it feels like the list is getting longer and longer but that there is nothing more you can do. We should get more inflow at some point because we have been getting more questions about investment- grade.

The summer rebound has made entry points in corporate bonds less appealing. George Bory, head of fixed income strategy at $476 billion money manager Allspring Global Investments and a bond Evangelist in recent months, has somewhat lessened his enthusiasm regarding credit and rate-sensitive bonds as valuations no longer look particularly cheap.

After the bond selloff sent yields soaring to levels that could beat inflation, he held on to his bullish views.

In the second half of the year, he expects the world to become more bond-friendly.

Jan-Patrick Barnert and others assisted.