You can sign up for the New Economy Daily newsletter and follow us on social media.

The consequences of China's slowdown for the world, as well as prospects for the US, Chinese and European economies, were discussed by Michael Spence in an interview on August 17th.

He is a senior adviser to General Atlantic and chairman of the Global Growth Institute.

There is a partial transcript of the interview.

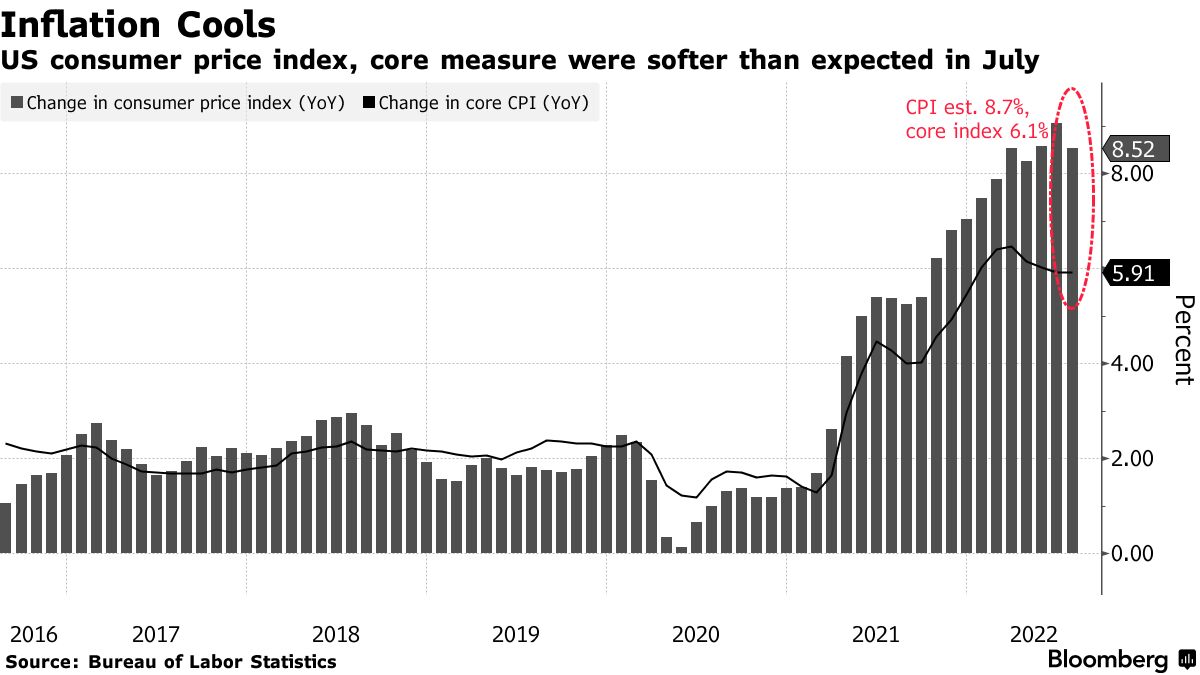

Is inflation over?

I think inflation has peaked but it may not settle down at an acceptable level in the near future. There are different levels of transitoriness. As the system adjusts, a spike in a lot of commodities will likelybate.

Changes in labor markets and the configuration of the global economy are significant. We brought more productive capacity online for more than two decades. When demand increases, the supply side responds. Shifting from a demand-constrained world to a supply-constrained world is almost a regime change in the global economy.

Are recession fear over?

I think recession fear is waning, but I don't think it's over People are still worried that inflation will force the Fed to take action. There is still a chance that we will have a downturn.

The Fed has a responsibility to control inflation. It will keep the pressure on, but there may be different magnitudes of interest-rates increases.

They are serious about their mandate. They don't want to do that again because of the damage done to their credibility by their lack of concern about inflation. They have a dual mandate and don't want to crash the economy

Fed officials offered mixed signals on the size of the rate hike.

The sentiment among investors has changed. What are some of the biggest risks you see?

Financial markets are more sensitive to interest rates and forecasts. Assets were elevated over a long period of low interest rates.

Fear of a rapid and dramatic change in interest rates has led to a rebound in financial markets. You get a big financial-market reaction when there is some evidence that the extreme scenario isn't going to happen.

We are in a world where asset prices are going to be reset, not just in public markets, but in private markets as well. There is a lot of former unicorns that aren't now.

I don't think these things will collapse, but an asset-price reset in the downward direction is likely.

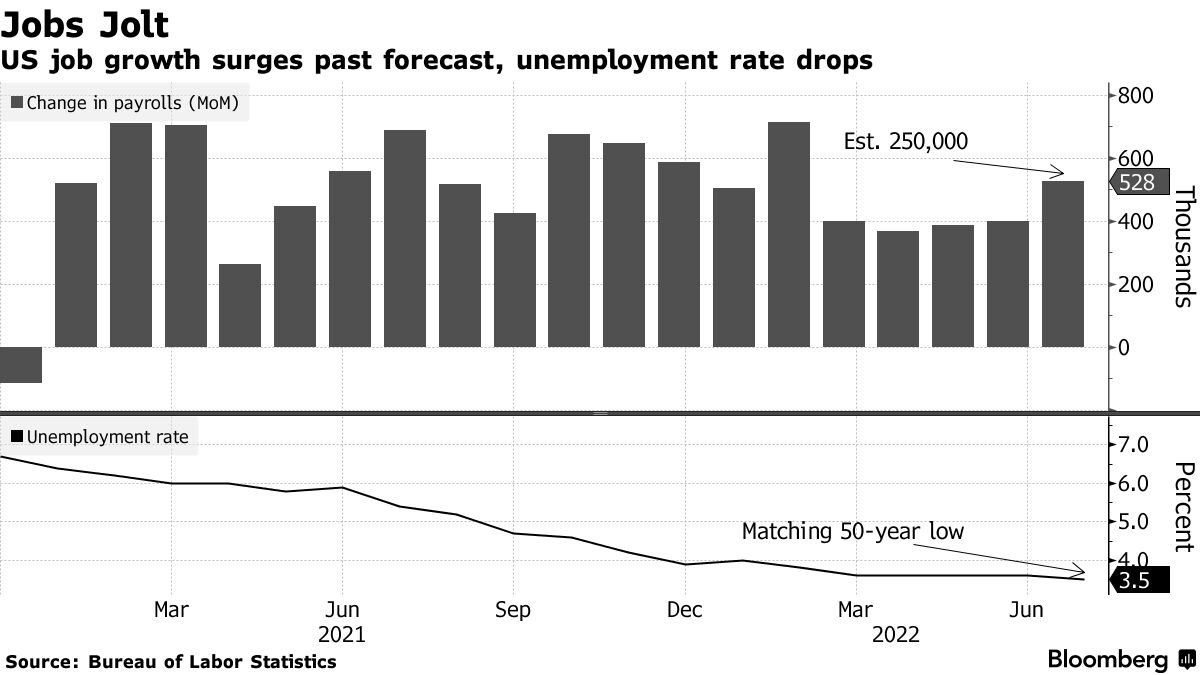

The US labor market is doing well. What are you expecting to see in the future?

There have been changes in the labor market. People who were willing to work in low paying jobs are not going back to those jobs. A lot of people retire because they have enough money to do so. There are a lot of younger people who think lifestyle is important and they don't want to do certain types of jobs.

Labor is gaining power and pressure from employers is decreasing. There is a lot of congestion in global supply chains. There is a genuine shift on the supply side in terms of who is willing to do what and how much.

There isn't an infinite supply of low cost labor anymore as labor is getting more powerful. The way the global economy is put together is changing. The labor markets would be affected.

What are the biggest threats to the US economy?

Expansion of conflict is the biggest risk. It would be a disaster if something happened in Taiwan. Climate-related risks are on the rise. It could be a complete loss of government function if I had to pick another. We had a good run recently, thanks to some leadership and politics, and we are encouraged that they will all involve investments that are critical for longer-term economic performance.

How can it be managed when China is slowing down?

The Chinese are slowing down. Domestic demand is affected by that. There is enough risk in the real estate area to make it worth keeping an eye on. I don't think they can manage that, but that will slow the economy down.

There were tensions on the US side with the Trump administration.

China continues to invest heavily in things that have the potential to create a modern economy. The medium- to longer-term prospects in China are pretty good, but there are some powerful challenges.

The third term of the president will start in March with problems mounting everywhere.

Some of the most important implications for the rest of the world were asked.

The growth of the world is directly affected by China's slowing down.

It affects a lot of people. We might get a separation of the Chinese and Western financial systems as a result of delisting of Chinese companies.

In the long run, that is not good. That is a bad outcome in the long run.

When will the Chinese economy begin to recover?

Unless there is bad luck, I think it will rebound in the next couple of years. Tech and digital are going to be subject to regulation. China stepped into regulation in a very aggressive manner. It has diminished some of the animal spirits in the economy in a way that might have been avoided with a more thoughtful approach to regulating the tech sectors.

When the president is put in place with a third term, there is a chance that the policy agenda will be changed to focus on economic and social progress. It was lost in the shuffle due to the tensions and the epidemic.

What are your biggest concerns for Europe?

It is energy and Ukraine at the moment. There are going to be big shocks this winter. If we run out of gas, we could cause a crisis or drag the economy down. Depreciation of the euro can cause inflationary pressures.

The UK seems to be in a difficult situation. Lots of people are getting hurt because of high inflation.

There is still a high chance of a recession in Europe. The energy transition is going to be difficult.

Some of the biggest shifts in the global economy worry you.

A lot of the world is notaligned. They have not endorsed the sanctions and they don't want to choose between Russia and China. A lot of the world doesn't want to play the game that's being played.

The age of scarcity began with a hit to the world economy.

It's a different question whether or not that has a big effect on the economy. We are not starting to build a new architecture because we have lost a lot of the global economy. That is important to a large number of people in a wide range of developing economies.