Do you want to know about European markets? It's in your inbox before the opening. If you sign up, you'll get notifications.

The bleak economic outlook of the UK makes it impossible for the pound to get a break from rising interest rates.

Money-market traders think the Bank of England will raise its key rate by a full percentage point by March.

Instead of buying sterling, investors sold it, while options traders remained bearish. They bet that the worst is yet to come.

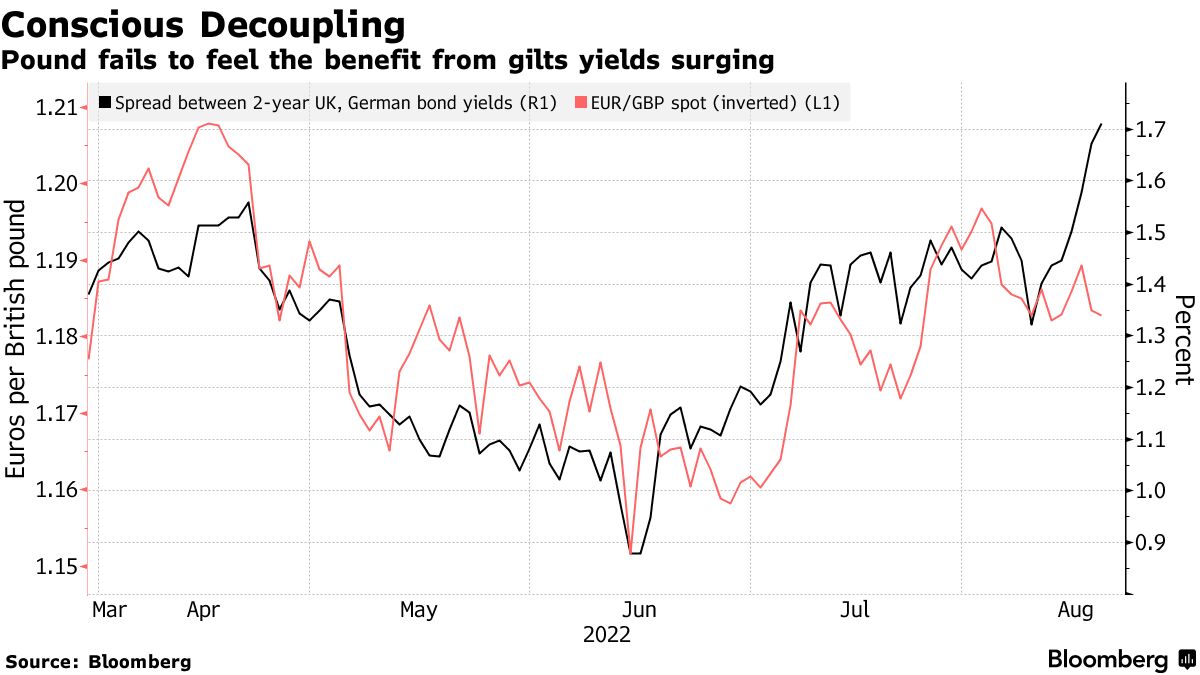

Raising rates should act as a positive for the currency and the bonds. The UK's poor growth outlook, price pressures and uncertainty over the path of policy under a new leader are hurting demand for the pound and bonds. Even as the rise in UK bond yields outstrips other markets, sterling has fallen against both the euro and the dollar.

It could be truly alarming if this trend continues. He said that global investors don't like the UK's double-digit inflation and the likelihood of the next prime minister throwing fiscal stimuli.

Adam Cole has also seen it. He said investors are questioning the credibility of UK policy because of the breakdown in the correlation between currency and yield shifts.

The cable was on track for its worst weekly performance in over a year. The fear-greed indicator shows that sellers are controlling prices again. The pound has fallen to its lowest level against the euro in a month.

The sterling bearish boxes will not get any better soon.

The cost of living crisis in the UK may limit the extent to which the BoE can hike. Workers are pushing for higher wages and are protesting.

The one-year inflation swaps surged past 11.5% after jumping 295 basis points since Tuesday's close, prior to July's inflation print. One and two year gross notional volumes were nine and six times higher than usual.

Consumer confidence in the UK fell to the lowest level since records began in the early 1990s. In the first four months of the fiscal year, government borrowing came in higher than expected, raising questions about tax cuts being promised by the two prime minister candidates.

Conservative leadership in the UK was attacked over tax cuts.

Bank of America strategists think that the UK's real policy rates may stay negative.

The UK will have the most negative real terminal rate of all the G 10 countries. The euro area is in the exact same situation.

The BofA strategists wrote that it is not a given that the European Central Bank and the Bank of England will do more. The euro would be negative for the BOE if they didn't do enough. Buying euro-sterling volatility is recommended by them.

Analysts are starting to re-think the currency's valuation due to the UK's large deficits. The UK's current-account deficit is likely to be around 6 to 7 percent of GDP, according to the analysts at Royal Bank of Canada.

As a falling currency increases the performance of UK equities and reduces the relative price of UK assets, it will help keep the UK deficits fundable.

Some light can be seen.

There are signs that the economy may be starting to exert less upward pressure on prices. A good lead indicator for inflation is the Confederation of British Industry's measure of expected selling prices.

The balance of risks is still to the downside for sterling. The bank has a forecast for the first quarter of the following year.

The flight to haven assets such as the dollar has been one of the biggest influences on moves in cable. The outlook remains grim, even though the impact of rates has jumped, because of the stronger economic picture in the US.

The dollar will do better if rates dominate. If the risk appetite story dominates, sterling won't perform as well.