The market gained more than half a percent and closed at a new four-month high. The market was supported by positive global cues, as well as auto, banking and financial services, oil and gas, and select metal and pharma stocks.

There was a gap up on Tuesday. The Nifty50 gained 127 points to 17,825 and formed a Doji kind of candlestick pattern on the daily charts.

The Nifty is placed at the edge of a significant overhead resistance of down sloping trend line, which connects from the important lower tops. The hurdle could be taken out on the upside if this is a positive sign.

The next upside target is around 18,500-18,600 levels in the near term. He said that immediate support was placed at 17,750 levels.

The market was higher than the benchmark. The Nifty Midcap 100 index and Smallcap 100 index both increased in value.

You can spot profitable trades with 15 data points.

The open interest and volume data of stocks given in this story are not only the current month's data, but the three month data as well.

Support and resistance levels on the Nifty.

The key support level for the Nifty is 17,700. The resistance levels to watch out for are 17,855 and 17,884.

The bank is called Nifty.

The Nifty Bank formed a Doji type pattern on the daily charts on Tuesday. The pivot level will act as a crucial support for the index. Key resistance levels are placed at 39,408 and 39,593 levels.

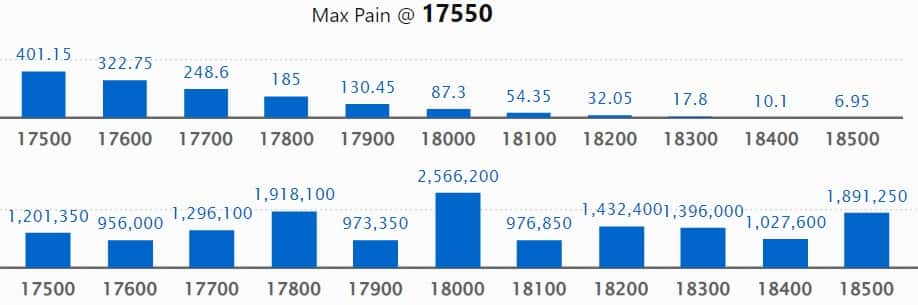

The option data is called call option data.

The 18,000 strike is a crucial resistance level in the August series.

The 17,800 strike holds 19.18 lakh contracts and the 18,500 strike has 18.9 lakh contracts.

Call writing was seen at 18,500 strike, which added 7.29 lakh contracts, followed by 17,800 strike, which added 5.19 lakh contracts, and 18,300 strike, which added 2.27 lakh contracts.

The 17,700 strike shed over 3 million contracts, followed by the 17,500 strike which shed over 2 million contracts and the 17,600 strike which shed over 1.7 million contracts.

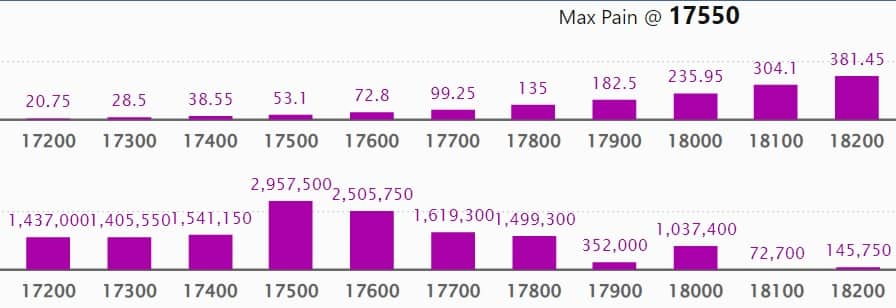

The option data should be put there.

The 17,500 strike is a crucial support level for the August series.

The 17,600 strike has 25.05 lakh contracts and the 17,000 strike has 23.83 lakh contracts.

Put writing was seen at 17,800 strike, which added 10.97 million contracts, followed by 16,900 strike, which added 3.43 million contracts, and 17,600 strike, which added 3.25 million contracts.

The 16,700 strike shed 4.12 million contracts, followed by the 16,800 strike which shed 1.26 million contracts, and the 16,500 strike which shed 1.18 million contracts.

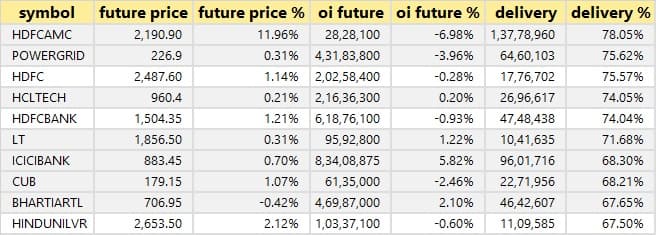

There are stocks with high delivery percentages.

A high delivery percentage indicates that investors are interested in the stock. The highest delivery was in HDFC Asset Management Company.

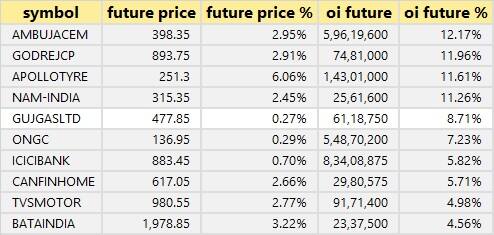

66 stocks had long builds-up.

A build-up of long positions is usually indicated by an increase in open interest. Here are the top 10 stocks based on the open interest future percentage, which had a long build up.

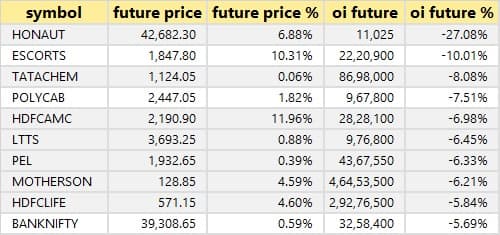

14 stocks saw a change of ownership.

A decrease in open interest and a decrease in price is a sign of a long unwinding. The top 10 stocks based on open interest future percentage are as follows:

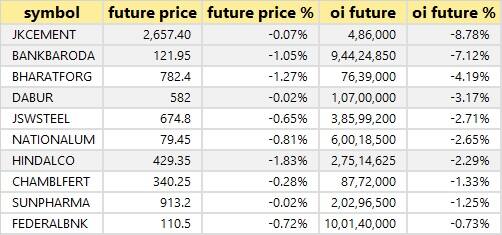

There were 24 stocks that saw short build up.

A build-up of short positions is usually caused by an increase in open interest and a decrease in price. A short build-up was seen in the top 10 stocks, which were based on the open interestfuture percentage.

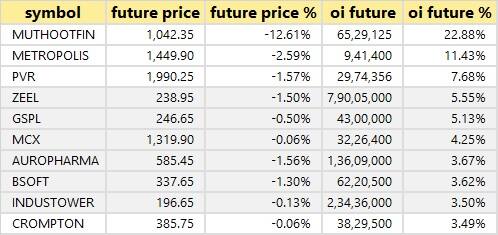

There were 93 stocks that saw short-cover.

A decrease in open interest is usually a sign of a short-covering. The top 10 stocks based on open interest future percentage are:

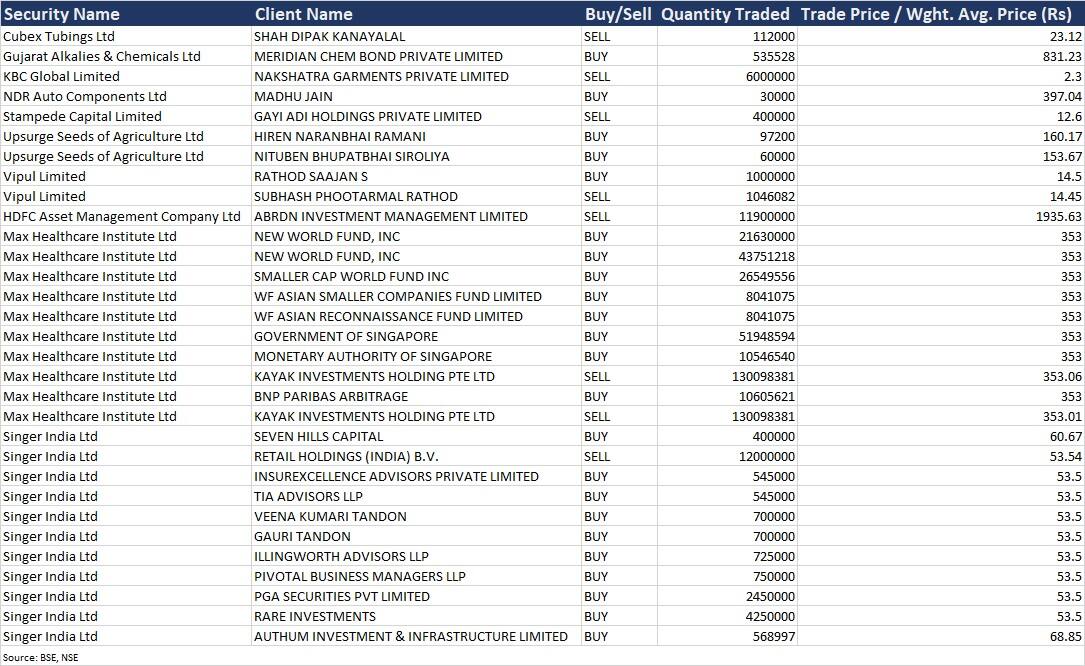

There are bulk deals.

In a block deal, the investment arm of the late investor bought 4.25 million shares at an average price of Rs 53.50 a share. The BSE block deal data shows that other investors bought shares in the firm. Around 12 million shares were sold.

American private equity giant KKR sold its entire stake in Max healthcare institute via block deals on Tuesday as GIC of Singapore and Capital Group picked up a 26.8% stake. The company's promoter will own a 24 percent stake.

Click here for more deals.

The meetings on August 17 are for investors.

The company's officials will meet with Morgan Stanley.

The company's officials will attend an investors' meet in Singapore.

The company's officials will meet with analysts.

The company's officials will meet analysts.

The officials of the company will be at the investor conference.

The company will have a meeting with the mutual fund.

The officials of the company will meet a number of mutual fund companies.

Polycab India officials will meet with two companies.

There are stocks in news.

State Bank of India has filed an insolvency petition against the company. The petition was filed at the National Company Law Tribunal's bench in the city. Bajaj Hindusthan Sugar owes a lot of money to a lot of banks.

The stock will be in the spotlight after the company named a CFO. The company's interim chief financial officer was relieved of his additional responsibilities. Jain will remain as head of corporate finance. The company said that the US food and drug administration is inspecting the plant. A warning letter was sent to the facility.

Informist reported that the Reserve Bank of India is against unregulated credit card companies. The company can offer credit cards after getting a licence from the Reserve Bank of India.

According to a report, five investment bankers were chosen to manage the sale of the government's residual stake in the company. The Department of Investment and Public Asset Management had in July invited bids from merchant bankers for managing the residual stake in Hindustan Zinc.

A bonus share issue will be considered by the company.

New orders for flue gas desulphurisation have been received by the firm. It got orders worth over a thousand dollars from Kota and Jhalawar.

There is fund flow.

DII and fii data are included.

Foreign institutional investors have net bought shares worth Rs 1,373.84 crore, whereas domestic institutional investors have net sold shares worth Rs 136.24 crore.

There are stocks under F&O ban on the stock exchange.

There are three stocks on the F&O ban list. Companies that have crossed 95 percent of the market-wide position limit are included in the ban period.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.