If you sign up for our newsletter, you'll get the latest news on the region.

The world's two richest oil economies are reentering the bond market for the first time in months.

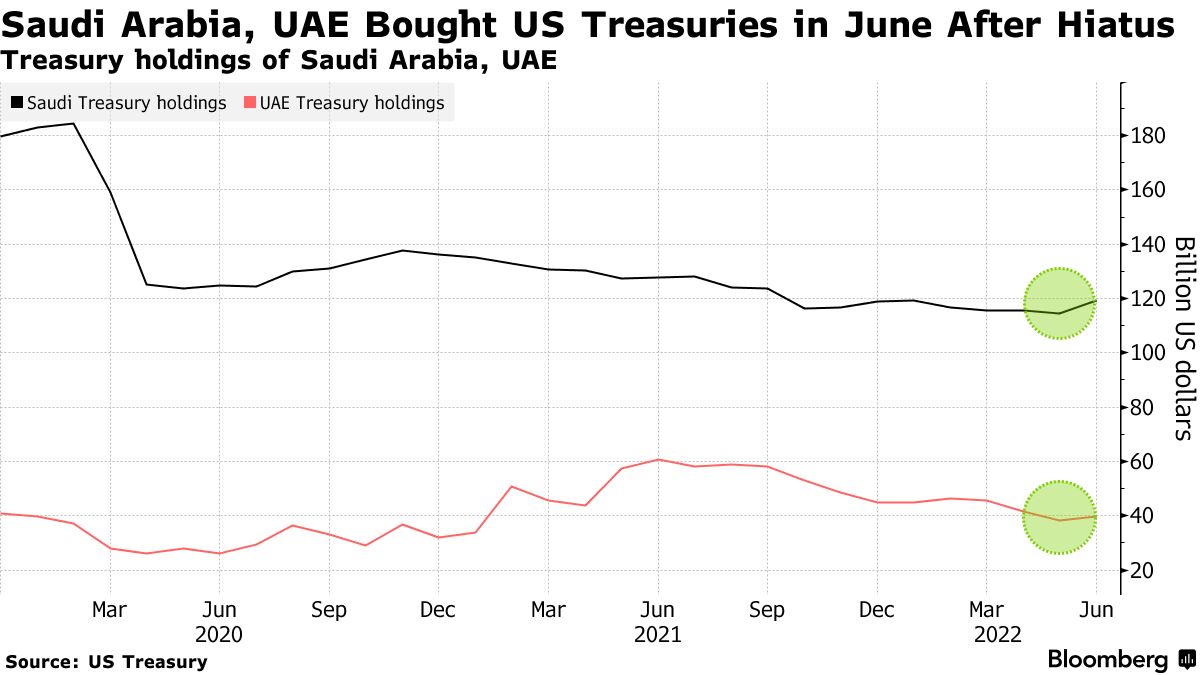

The oil-exporting nations of the Middle East, including Saudi Arabia and the United Arab Emirates, largely held out from buying US Treasuries through the rally in crude prices.

The longest period of restraint ended in June. The most recent data from the Treasury Department shows that Saudi Arabia increased its inventory by $4.7 billion. It is still close to the lowest level in a year.

The country's holdings have fallen by more than a third since June. Foreign investors bought the most data in the first half of the year.

Karen Young is a research scholar at Columbia University.

The choice to abstain from what has traditionally been the world's safest and most liquid asset was a reflection of a new approach on the part of the Gulf's oil exporter. Even with state coffers bulging with cash, governments in the region are looking to get higher returns from their stock of savings and pay down debt

Saudi Arabia's holdings of Treasuries are down more than a third since the beginning of the year.

Saudi officials said earlier this year that the kingdom would hold billions of dollars in its government current account until the end of 2022.

The Federal Reserve's interest-rate hikes will lead to a recession if there is a change in attitude towards Treasuries. Against a backdrop of growing concern over an economic downturn in the US, Treasuries fell on Tuesday.

There is a ratio of net government debt to GDP.

S&P is a division of Goldman Sachs Group Inc.

The Gulf's oil wealth still stands out despite years of increased debt.

Soussa said in a report that local governments are a significant net creditor.

(Updates with drop in UAE holdings since last year in fourth paragraph. A previous version of this story corrected university name in fifth paragraph.)