Now is the time to apply for the Citi Double Cash Card.

I wanted to take a look at the Citi Double Cash Card because I think it's the most valuable no annual fee credit card out there. I have a card that I spend the most money on.

This is a good time to pick up the card if you don't already have it. The Citi Double Cash is one of the most flexible and rewarding no annual fee cards on the market.

You can earn cash back or travel rewards with theCiti Double Cash. It can be an industry leading travel rewards card with a bit of effort.

What you need to know about the card is covered below.

The Citi Double Cash doesn't offer a welcome bonus. We don't know when the offer will end, but fortunately that's not the case right now.

A bonus of 20,000 ThankYou points is being offered by the Citi Double Cash. It's possible to redeem 20,000 points for travel rewards or cash back.

Thanks to the travel opportunities, I value ThankYou points at 1.7 cents per point. It's worth $340 to me. Excellent for a no annual fee card.

You can get up to 2x ThankYou points when you pay for a purchase with the Double Cash. I will discuss in more detail how each ThankYou point can be redeemed for cash back, as well as other ways, below.

You can't beat the Citi Double Cash's no annual fee. A lot of people sacrifice credit card rewards because they don't want a card with an annual fee, so here you're getting a valuable card that won't cost you anything

The Citi Double Cash is offering a low introductory rate on balance transfers. The variable interest rate will be based on your creditworthiness after that. There is an introductory balance transfer fee of 3% of each transfer completed within the first four months of opening account. Your fee will be 5% after that.

I know that this isn't for everyone, but I am aware that some people take advantage of it. 18 months is a long time for a card.

I only recommend getting a credit card if you can pay off your balance in full every month, or else the rewards won't outweigh the costs.

It's worth mentioning that the Citi Double Cash is a Mastercard. This is an area where American Express is still improving. Getting a Mastercard that will be accepted virtually everywhere is something to think about.

The Citi Double Cash isn't a card you'll want to use for international purchases The rewards on the card wouldn't compensate for the foreign transaction fees. There are many cards with no foreign transaction fees.

Credit card issuers have different policies for approving new card members. You will only be approved for one Citi card per eight days and two per 65 days.

It makes sense to apply for the card directly, but there are other ways to get this card. Citigroup is one of the most generous issuers in this area.

The benefit of product changing is that you can maintain your credit line and it won't count on your credit report. You have the option of applying for the card or changing it to something else. If you change your product, you won't be eligible for a welcome bonus.

The Citi Double Cash gives 1x ThankYou points when you pay for a purchase and 1x ThankYou points when you make a purchase.

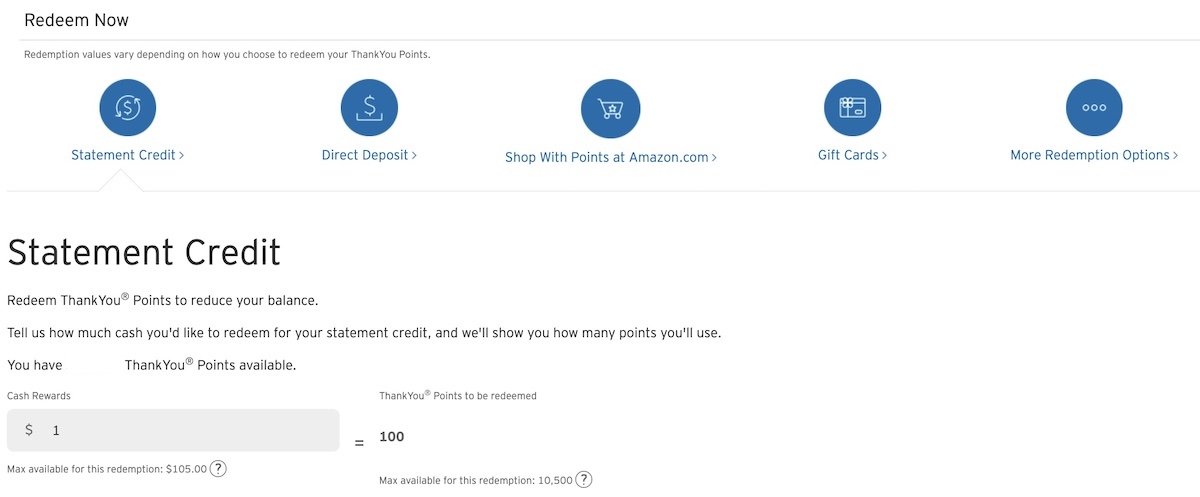

You can redeem your ThankYou points for cash back either in the form of a statement credit or a direct deposit. A lot of people earn a small amount of cash back on their credit cards.

It is the gold standard for credit card rewards to earn at least two cents back on each dollar. There are other ways to redeem your rewards and get more value.

How do you redeem the 2x ThankYou points that you earn for every dollar you spend with the Citi Double Cash? You will see the ThankYou points post when you pay your bill. The 1x points you earn from spending and the 1x points you earn from paying will be displayed in two columns.

There is no minimum to redeem your rewards for cash and you can choose whether you want a statement credit or direct deposit.

Points can be used for Amazon purchases or gift cards. You might as well take the cash because the redemption options don't offer much more than a penny of value per point.

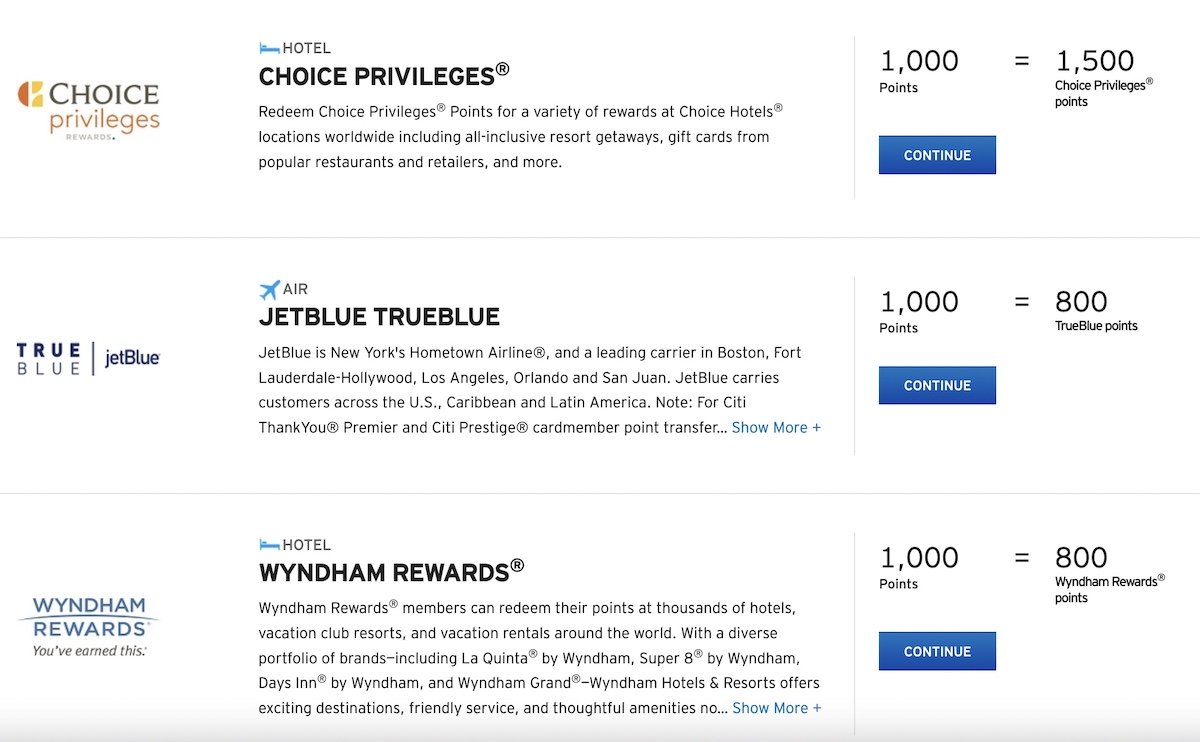

Transferring ThankYou earned on the Citi Double Cash directly to three travel partners is possible.

Since there is a way to get more value for travel redemptions than that, I wouldn't recommend that.

If you want to maximize the value you get from the Citi Double Cash, I recommend having it in conjunction with the incredible Citi premier card. This is a great card duo. What's the reason?

If you have the Citi Double Cash card, you can transfer your points to the full list of airlines and hotels at a better ratio. Air France-Klm Flying Blue is one of the partners.

This is a great way to redeem for an international experience. The cards are very close together.

The combination of these two cards is unbeatable. You can get an industry-leading rate of return on your spending if you use the two cards together.

Points could be transferred to the following programs.

The only annual fee credit card that offers an uncapped return is this one. I value ThankYou points at 1.7 cents per point, which is a return of 3.4% on spending.

You can do better than that in some instances. You can earn 2x points on this card if you take advantage of the transfer bonuses.

There are only a few cards that can compete with the Citi Double Cash.

Whether you want to earn cash back or travel rewards, the Citi Double Cash is an industry leader. You don't have to decide which you want, you can earn rewards and redeem them when you please.

You can redeem those rewards after you spend a dollar on the card.

With no caps, you can earn 2x points per dollar. You can earn cash back or transfer points to ThankYou partners if you want to redeem for larger travel rewards, which makes this card even more valuable.

The Citi Double Cash is one of the best cards out there.

There are a lot of options.

You can earn cash back or travel rewards points with the Citi Double Cash card. 2x ThankYou points are earned by the card. You can redeem your points for cash back or transfer them to other airlines and hotels.

I have had this card for a few years, and it has been the card I have spent the most money on every day. This is the best time to get the card because it has a welcome bonus.

You can learn more about the Citi Double Cash Card by following this link.