This week's startup news and trends are brought to you in a new weekly column. You need to subscribe to get this.

YouTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkiaTrademarkia Day one did not go well. The rise of edtech was the focus of most of my coverage. I wrote thousands of words about the company's savvy owl and wild founding story, and I still know more about it than anyone else.

I wanted to know if edtech is still a big deal or if it is facing a reset. In order to better understand how education technology is faring during the downturn, I interviewed seven leading venture capitalists.

What is the bigTakeaway? Discipline is being faced by Edtech. edtech is no different than the rest of the startup community, according to investors. The boom in the category in the last couple years means most of our education focused portfolio is funded quite well.

It is time to focus and ed tech has the capital to do it. It makes me think about the advice my friend often gives to our friends, that we are not that special, and that is a good thing. Feelings of change, stress or anxiety are not as deep as we think when we first feel them. Other people in their mid-20s are experiencing the same thing we are. If you invested in yourself long enough before the spotlight turned on that you are still there. Maybe focused a bit more on backstage.

For the full survey, read my piece, "7 investors discuss why edtech startup must go back to basics to survive." My analysis, "Edtech isn't special anymore, and that's a good thing," can be found on my website.

Haus' closed doors, SoftBank execution fund and a pitch deck teardown are just some of the things we'll be covering in the rest of this newsletter. You can support me by forwarding this newsletter to a friend or following me on social networking sites.

I wrote about Haus, a buzzy VC-backed aperitif company going up for sale in the wake of a collapsed Series A.

I have never seen anentrepreneur so transparent about the challenges and unfortunate outcomes of their startup. I had an interview with her.

“It’s always dangerous to be low on cash. We got there, and it’s unfortunate, but I know there are many companies in this position right now,” Hambrecht says. “I have been sharing my work online for over 20 years now. It’s definitely something in my DNA. If me sharing this process is helpful for another founder in a tough spot and considering their options, then it makes all of this a little more worth it.”

As for what’s next for the entrepreneur, a Silicon Valley branding veteran, there’s no immediate plans to jump into a new startup.

“My goal, right now, is to be as helpful as I can to make this ABC process have the best outcome possible. After that, I’m going to take some time to process the last four years; it’s been so extraordinary, as well as brutal and traumatic; I’m going to rest and process that.”

Your favorite trio looked at the numbers behind the headlines. SoftBank and deals from ByteDance were included.

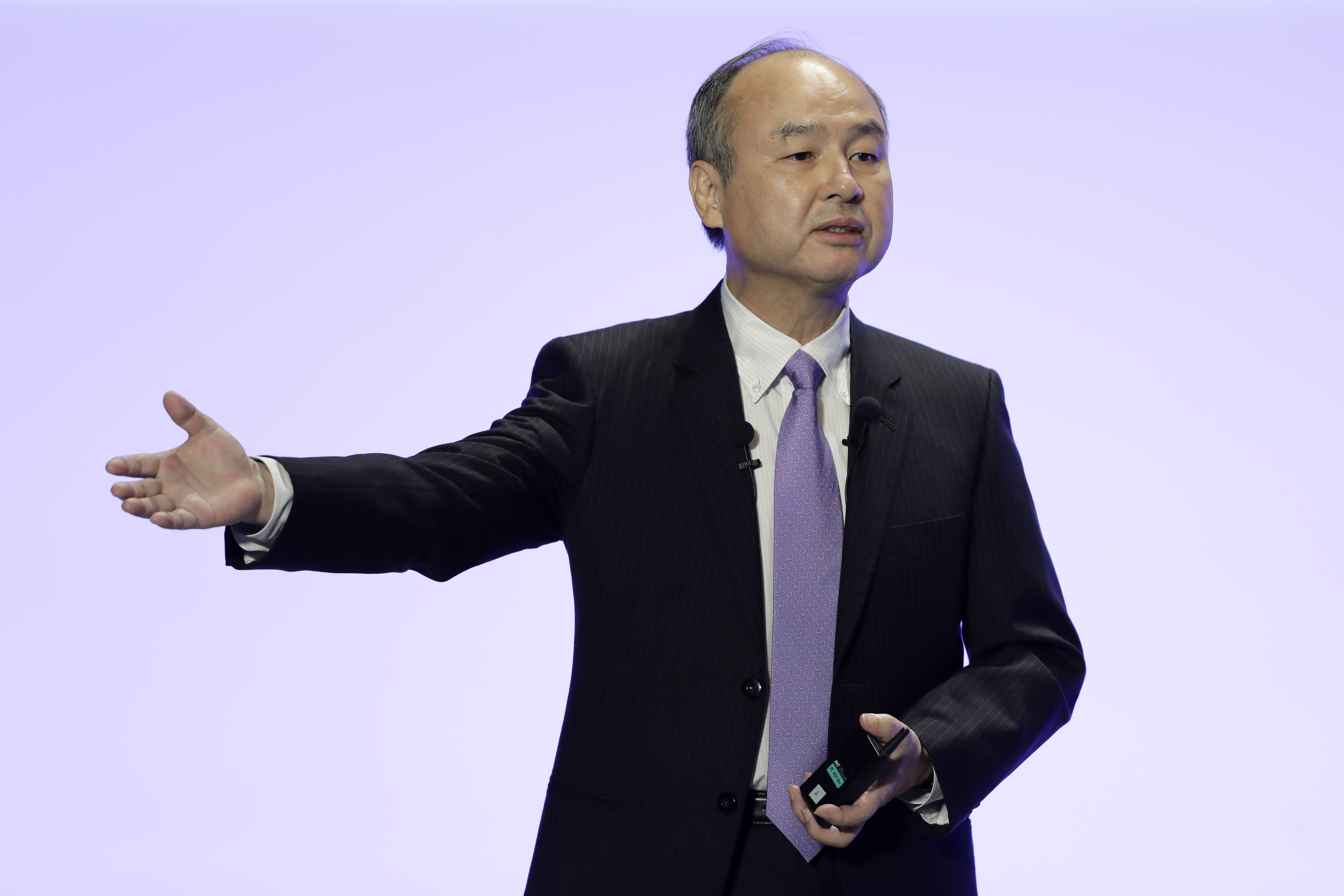

The highlight of the show was the part about SoftBank's losses on losses. Is it possible that one of the biggest, buzziest investors of the past few years is about to go bankrupt? What is Tiger Global's opinion? It is fun to get Mary Ann and Alex's take.

The image was created by Kiyoshi Ota.

The pitch deck that helped Five Flute raise a million dollars in a pre-seed round is the subject of a new pitch deck deconstruction.

You are missing out if you haven't been following along with the series. In this case, Haje taught me a lot about why more can be more in terms of length of deck. If you want to, you can read the story and make a pitch for the series.

It was titled, "Venture investors to founders: turn down for what?" You can listen to the companion show, which is called "Founders, whales and the sea change in the entrepreneurial energy."

It was seen on a website.

The earnings of the company fell short of expectations.

As the spotlight picks its side, finix raised $30 million.

Mavericks and Mark Cuban are in the middle of a controversy.

In just 18 months, the cloud security startup has reached $100 million ARR.

It was seen on a website.

You might think that the best clouds are overvalued.

There are some frank advice for open source startup.

The legal landscape of digital health companies has changed.

Same place next week. It's time to talk.

It's N.