Inflation in the US is less than expected. Military drills end around Taiwan. The price of Disney's streaming service has been raised. Today is what you need to know.

US inflation decelerated in July by more than expected, which may take some pressure off the Federal Reserve to continue hiking interest rates. A decline in gasoline offset increases in food and shelter costs. The People's Bank of China said consumer inflation will likely exceed 3% in the second half of the year.

The softer-than- expected US inflation data is expected to lead to a Wall Street rally. Australia and Hong Kong futures increased in value. After the S&P 500 hit a three-month high, contracts for US equity fell. The dollar has retreated the most since the beginning of the epidemic, while short-term Treasury yields have fallen. Is it a good idea to rest the strategy or just change it? What do you think about the survey?

The military said the exercises around Taiwan had come to an end and would continue. The white paper blamed Taiwan's leaders for increasing the risk of war by refusing to accept that both sides belong to one China. You can read the whole thing here. President Joe Biden will now focus on the future of Trump-era tariffs after the drama of Pelosi's visit.

Disney is raising the price of its flagship Disney+ streaming service in order to make more money from its online businesses. The company plans to introduce an ad-supported version of the flagship streaming service.

Online searches for flights out of Hong Kong went up by 290% in the 24 hours after the government announced it was shortening the stay in hotels. In order to escape some of the world's strictest Covid measures, residents chose Bangkok and Osaka. The cut was seen by Hongkongers as a move towards a return to normal life. The top Communist Party newspaper warned officials to be careful when fighting Covid-19, as more tourist destinations impose restrictions to stamp out all traces of the virus.

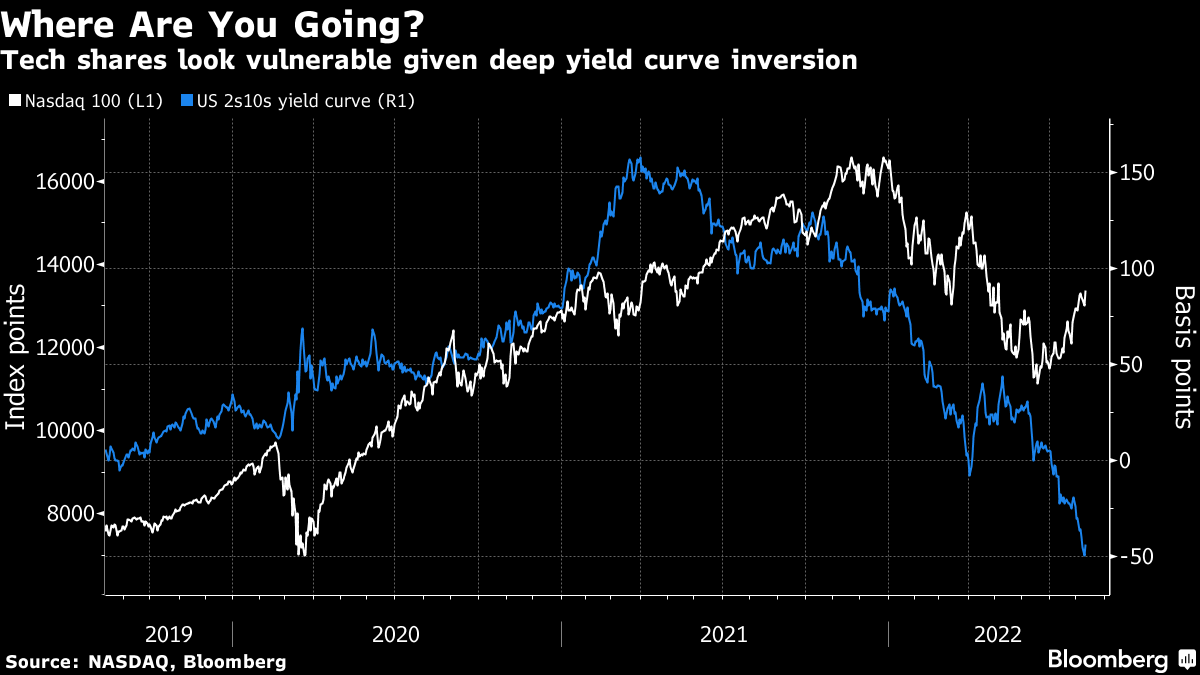

Markets were happy after July'sCPI met expectations for a slower rate of price increases. Tech shares led the cheer for those who believe that inflation has peaked and that the Federal Reserve will soon do the same. The definition of a bull market is a 20% rise from the lowest point.

The dilemma for investors is that US inflation is still very high, even if you measure it in different ways, and so the Fed came out soon after the print to reiterate that they are a long way from the top of the hiking trail. The yield curve is still deeply inverted even after a retreat overnight. Unless signs emerge that the Fed can achieve a soft landing, there is a risk that the rally will end quickly.

Garfield Reynolds is based in Australia.

The trust industry in China is worth $3 billion. We're sorry for the mistake.

Garfield Clinton Reynolds helped with the project.