He was out of patience with the questions about the financial health of his firm.

He said that Unifin was doing well and would grow its business. One investor was cut off during the firm's earnings call last month. They are not reacting to the company's core values.

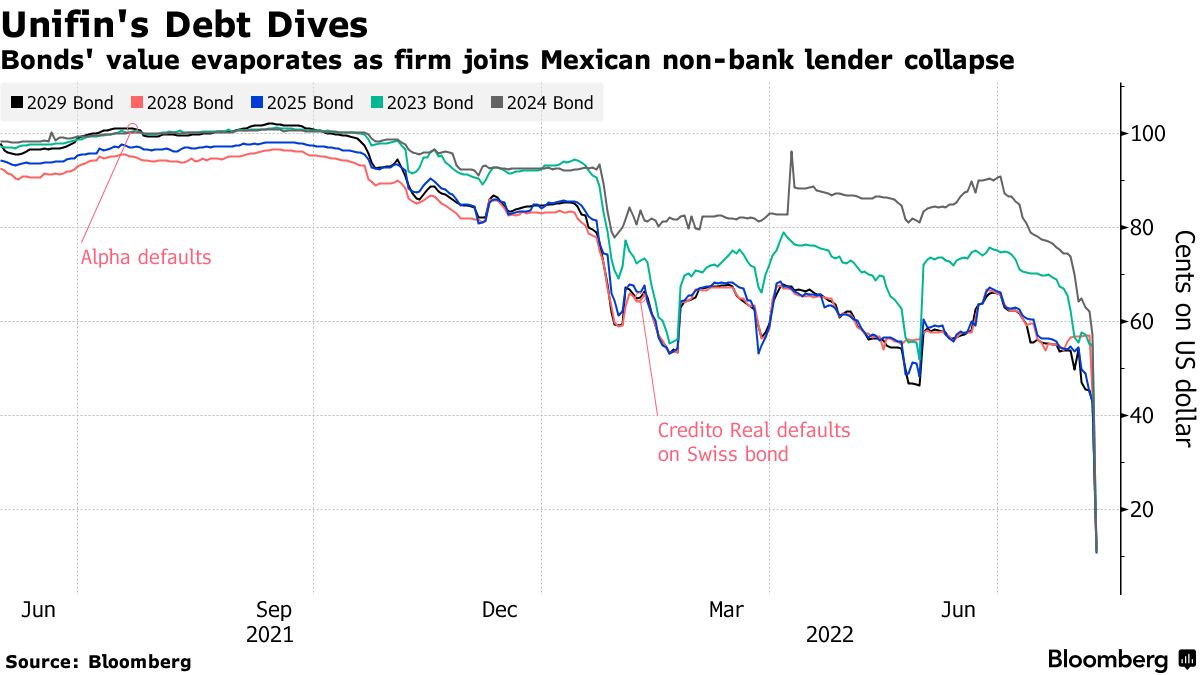

After 17 days, the equipment-leasing firm stopped making payments on its foreign bonds and said it would start talks to restructure them. The troubles that arose a year ago at one firm, and then shortly thereafter at another, were contained and did not spell doom for the other, were the greatest of all the miscalculations and false hopes in the Mexican shadow lending business.

The decision shocked investors and analysts who had been reassured by reassurances from Unifin's management.

The managing director of Latin American corporate-credit strategy at Banctrust & Co. in New York said that they were surprised by Unifen. We wanted to know why the company thought bond prices were dropping. The management told us that the bonds dropped because of the market conditions.

S&P Global Ratings declared Uni fin in default on Tuesday.

The financial collapse wiped out a combined $5 billion of bonds. Alpha and Credito Real were in trouble because of accounting problems. The collapse was caused by a surge in interest rates in Mexico and the US, which cut off firms from the easy money they depended on.

The analyst said that this could turn investors off the industry. We thought that Alpha and Credito Real were unique. This is more of an industry issue as a result of Uni fin's announcement.

Less than a year after Alpha Holding disclosed a $200 million accounting error, Credito Real failed to pay its bond in February. Credito Real revealed that its non-performing loans were more than previously reported. Unifin, which rents equipment to small and medium-sized businesses, has not reported a revision.

Dollar notes due in 2023 plummeted by 44 cents to just 11 cents, and the company's Mexican shares plummeted by 89 percent, as Unifin's unexpected default caused an epic nosedive in its bonds and shares Tuesday. Credito Real and Alpha's notes are now worth pennies on the dollar after being damaged.

Natalia Corfield, head of Latin America corporate credit research at JP Morgan Chase, said in a Tuesday note that Unifin's move may be tied to a potential inability to roll over debt. She wrote that company management may have realized that their business was not sustainable under the current capital structure.

After last-minute financing plans were canceled, the company stopped paying its debts.

You can listen to the call here.

There were a number of reasons to have faith in Unifin. In addition to its insistence that it shouldn't be blamed for the sins of its peers, it also made strategic moves, such as agreeing to a $500 million credit line with Credit Suisse Group AG. The company only used $300 million from Credit Suisse, and didn't take the other $200 million, according to a representative.

The risks were there as well. As Credito Real neared a default, the company's dollar bonds began to slide in earnest.

Credito Real and Alpha are still going strong. Credito Real announced on Tuesday that it had successfully negotiated the liquidation of its debts with some of its creditor's. It was the company's first appearance in a US bankruptcy court.

The former CEO of Credito Real pushed the company into insolvency last month, setting the stage for a legal fight over how to repay the debt.

Alpha is trying to get a remedy in Mexico.

The three companies had been market darlings, offering bond buyers lucrative yields while cutting small loans and charging double-digit interest rates to the millions of unbanked Mexicans. It is the largest of the group. The investors have to sort through the rubble for clues about the future of the industry.

Oren Barack is the managing director of fixed income at New York-based AGP Alliance Global Partners. A Mexican non-bank bank won't be able to return to debt markets until at least 2020. That is the only area of certainty in these uncertain times.

Michael O'Boyle and Jeremy Hill helped with the project.