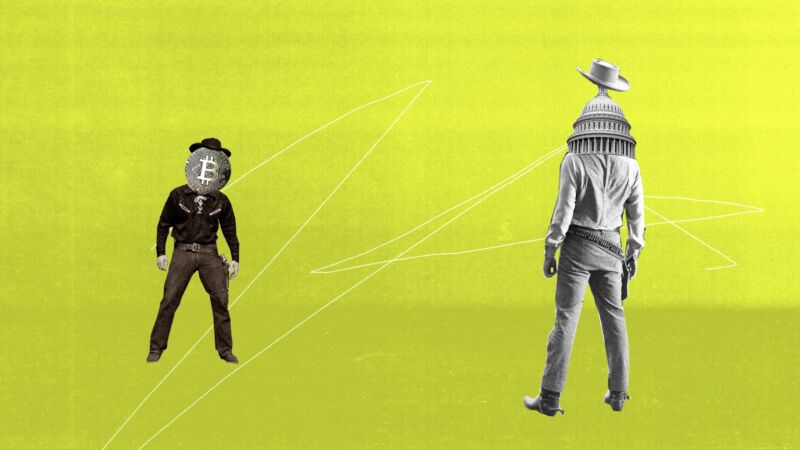

If you've been paying attention to the news over the past few years, you'll know that the market for cryptocurrencies is not regulated.

You wouldn't have that sense if you were Ishan.

A view into which token the platform planned to list for trading causes assets to increase in value. According to the US Department of Justice, Wahi used that knowledge to buy assets before they were listed on the market. In July, the DOJ announced that it had indicted Wahi, along with two associates, in what it said was the first ever cryptocurrencies insider trading tip scheme. The defendants could face decades in prison if found guilty.

The SEC made its own announcement on the same day. The three men were being sued. Civil cases can only be brought by the SEC. The SEC's civil lawsuit was the cause of panic in the industry. The SEC claimed that nine of the assets he traded were securities.

This may be a technical difference. Whether a coin should be classified as a security is a big issue for the industry. Anyone who issues a security is required to register with the SEC. Legal liability can be devastating if they don't.

AdvertisementOver the next few years, we will find out how many people have taken that legal risk. Gary Gensler, who was appointed to chair the SEC by Joe Biden, has made it clear that he believes most of thecryptocurrencies are securities. That belief is being put into practice. The SEC is going to go to trial against the company that created the popular XRP token. It is looking into whether or not the company listed securities that weren't registered. There is a class action lawsuit against the company. The days of the free-for-all may be over if these cases succeed.

It's helpful to start with the orange business.

The Howey Company was sued by the SEC in the 1940s because it was accused of selling unlicensed securities. The Supreme Court upheld the SEC's position. The court ruled that the Howey Company didn't mean it wasn't raising investment capital. The economic reality of a business deal will be looked at by the court. When someone puts money into a project expecting the people running the project to turn that money into more money, there is an investment contract. Investing is when companies convince investors that they will get paid back more than they put in.

The Howey Company was found to have offered investment contracts. The people who bought the land didn't actually own it. Most people wouldn't go on it. The company owned it for all practical reasons. The Howey Company was raising investment in order to sell property. The elements of a profit-seeking business venture are here. The capital and share in the earnings and profits are provided by the investors.

The Howey test is what the courts follow today. There are four parts to this thing. If it is an investment of money, in a common enterprise, with the expectation of profit, and derived from the efforts of others, it's an investment contract. You can't get around securities law if you don't use the words "share" and "stock"

Which leads us to the other side of the world.