The $9 billion rescue of Tsinghua Unigroup was capped by a flurry of anti-corruption probes into top industry officials.

According to people familiar with top government officials' thinking, senior officials are angry at how tens of billions of dollars funneled into the industry over the past decade haven't produced the sort of breakthrough that emerged from previous national-level scientific endeavors. Asking not to be identified, they said that Washington has been able to contain Beijing's technological ambitions and strong-arm it.

The investigations have sent shock waves through the industry. In order to break its dependence on the West, the government allocated more than 100 billion dollars to build a domestic chip sector. Beijing became the primary vehicle for doling out capital to the country's chipmakers because of the National Integrated Circuit Industry Investment Fund.

The agency said it was sending a team to the Ministry of Industry and Information Technology to investigate the executives. The minister, Xiao Yaqing, was the most senior member of the cabinet to be investigated by the same regulators.

Jordan Schneider, a senior analyst at Rhodium Group said, "If you are going to be putting tens of billions of dollars in an industry, regardless of whether it's a high tech one or just like building trains and airports, you're going to have illegal dealings going on."

The government is looking into the head of the Big Fund, who once warned against cutting corners in developing chip technologies. The fund drew about $45 billion in capital and supported scores of companies.

As Washington slaps ever tighter restrictions on China, Beijing is growing frustrated. The US is increasingly limiting the kind of chip-making equipment that American companies can export to Chinese customers, while recruiting allied countries to join its technology blockade

The contingency plans for strategically important industries were reviewed this year by various government agencies. Senior officials looked at the report on the chip sector last month and it became clear that advances in the field may have been overstated.

There was a belief that Beijing only needed to throw money at the problem. The world is facing great changes not seen in a century. During the Trump administration's time in office, sanctions were launched against Chinese companies that proved to be effective.

The State Council Information Office didn't reply to faxed inquiries. Representatives from Unigroup didn't reply to questions.

The gap with the West hasn't been closed by China despite years of effort. Despite the efforts of state science institutions and firms like Naura Technology Group Co., ASML still dominates the chip-making machinery market. The supply of photoresists is controlled by Japanese companies. The country still relies on imports to meet most of its chip needs despite the fact that tech giants such asHuawei researched local alternatives.

The enormous inefficiency that can result from freely doling out subsidies has been pointed out by critics. Companies with little experience winning incentives or grants for research have been reported. Powerful local interests have pursued government money in order to get subsidies and prestige. According to an analysis by the South China Morning Post, there were 15,700 new chip companies in the first five months of the year.

Some success can be pointed out by China. Industry experts say that SMIC may have overstated its gains. The country has vastly increased the capacity of memory chips through two companies.

The chipmakers have been allowed to go public. A Big Fund backed memory chipmaker went public in Shenzhen last week.

The first day of trade for five mainland China IPO stocks went well.

Unigroup, the standard-bearer for state-backed chip innovation, was beginning to fail when the Biden administration showed few signs of relenting on their campaign against China.

The list of investigations into chip industry figures now reads like a Who's Who of China's Semiconductor pantheon. People said that the dragnet is expected to widen as investigations go on.

A number of investigations have begun into the figures of the chip sector.

The source is Caixin.

The investment firm that managed capital for the Big Fund is under investigation. The fund's chief was also under scrutiny last month. The former Unigroup Chairman and his co-president have been implicated.

The minister was the subject of an investigation last month. His probe was unrelated to the Big Fund investigation.

Tsinghua Unigroup was forced into a takeover to get out from under a mountain of debt. After Beijing tightened lending, it began unraveling. The proposed takeover was called a "crime" by the bidder.

It's not clear if the investigation is related to Unigroup. According to company registration information, the Big Fund was involved in several projects led by Zhao. The Big Fund was a minority shareholder of Unigroup.

The Chinese chip mogul says the rescue is a crime.

A person who asked not to be named talking about a sensitive matter said that the probes of Zhao and Diao were linked to the allegations of wrongdoing. They didn't pick up calls. The Big Fund didn't have any comment.

He was a highly regarded executive in China. Several high-profile investments using state-backed capital expanded Unigroup's reach into areas from mobile processors and memory to server. The US government blocked his bid at the last minute.

He went on to build a $30 billion memory company. The company was taken over by a group of people.

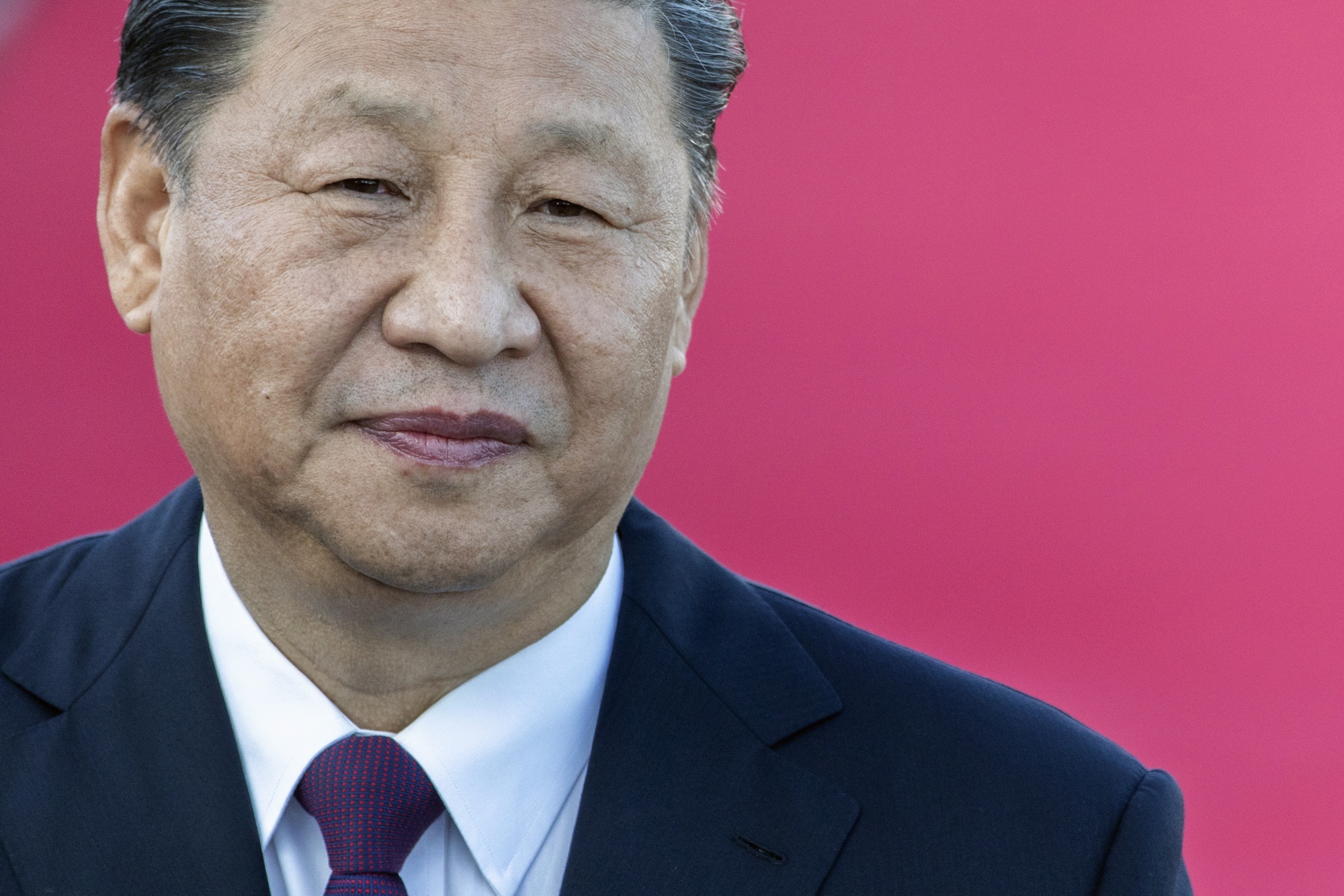

The Rhodium Group believes that the industry is so important to the strategic ambitions of the President that the series of chip probes have been aggressive. If there were signs of trouble in the past, China would cut off funding, but now they are not.

He said that the industry needs to provide the Chinese people with full self- reliance.

The assistance was given by John Liu, Colum Murphy, and others.

(Updates with announcement of the latest probes in the fourth paragraph)