Beijing set up a group of bad banks in order to contain the effects of the Asian financial crisis. Bad banks are having a hard time helping with the distress in China's property sector.

China's "Big Four" asset management companies have become so bloated that their capacity is limited.

Chen Long is a partner at Beijing-based consulting firm Plenum. He said that he wouldn't count on them to help address the property crisis.

China Evergrande, the world's most indebted developer, has taken the spotlight in the country's property crisis, but stress at the bad banks shows Beijing's challenge to mobilize rescue options.

The risks asset management companies face from a property crisis that they are needed to help ease are underscored by this.

The bad banks were established in the 1990s and grew far beyond their mandate. The biggest bad-debt manager was bailing out in 2021.

A debt restructuring is now expected for Great Wall after the company held off releasing its 2021 annual report in June, another signal of weakness across the sector even as its services become more important to the health of the world's second- largest economy.

Ratings downgrades and warnings from global agencies spooked investors in China's dollar bond market.

The health of China AMCs is a sensitive topic for investors. After Great Wall missed its reporting deadline, they sold bonds again. After falling from 81 to 75 cents on the dollar in July, the bonds rebounded to about 80 cents in August.

One-fifth of the bad debts in the property market have been resolved by the bad banks.

The People's Bank of China is trying to tame rising discontent over unfinished apartments by soliciting state bank loans from a Rmb200 billion funding pool.

Bank and AMC executives say that the AMCs have been included in the rescue discussions with central bankers.

According to the bond prospectuses, Orient and Great Wall raised Rmb10 billion to solve the risk of quality property projects and rescue the soured debt of the sector.

After missing its self-imposed deadline of July 31, Evergrande has put one executive on its board and another on its risk resolution committee. AMCs are talking to distressed developers about potential rescues. The AMCs have helped set up the city-level rescue funds.

The scale of funding support from AMCs is expected to be cautious as they already hold large exposure to property developers, said David Yin, vice-president and senior credit officer at Moody's.

The property crisis is linked to the groups, according to a Beijing-based research group.

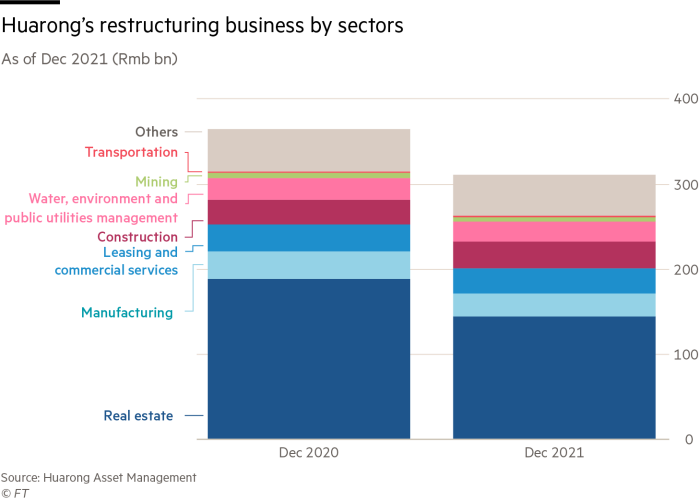

The AMCs make up between 25% and 42% of the total debt assets.

According to a recent report, the effects of the property downturn on financial institutions are still being felt. She said that the AMCs have been pushed to reduce their exposure to property.

The most exposed to the property sector are the ones with the heavy reliance on debt assets to generate income.

Cinda warned on July 26 that its six-month profit will fall 30 to 35 per cent as certain financial assets are under greater pressure. Moody's lowered Cinda's Hong Kong unit due to "increasing risks arising from the company's sizeable real estate exposure"

Smaller AMCs that only operate in Chinese provinces will be expected to take more responsibility for property sector rescues due to their close ties with local governments.

One manager of a smaller AMC in Jiangxi, a province in south-eastern China, said some local asset managers could contribute to the recovery by investing in bonds related to unfinished housing projects.

The aim is for homes to be delivered in six months.

The second option is for AMCs to form consortiums with new developers or third-party construction groups to take over and restructure the projects and oust the current developers. Two to three years is how long it would take for such deals to be completed.

The bad banks are facing challenges of their own according to Yin from Moody's. With capital base capped and pressure on asset qualities, it's not realistic for them to invest a lot of money into the property sector.