The Pandemic changed the way companies do business, but remote and hybrid work are here to stay. There are obstacles from an HR perspective. Businesses with employees in multiple states face difficulties opening accounts for disbursements. Some are afraid of the consequences from noncompliance and are letting vague regulations dictate operations. According to a recent report, over half of companies won't allow employees to work in locations that aren't already established for tax reasons.

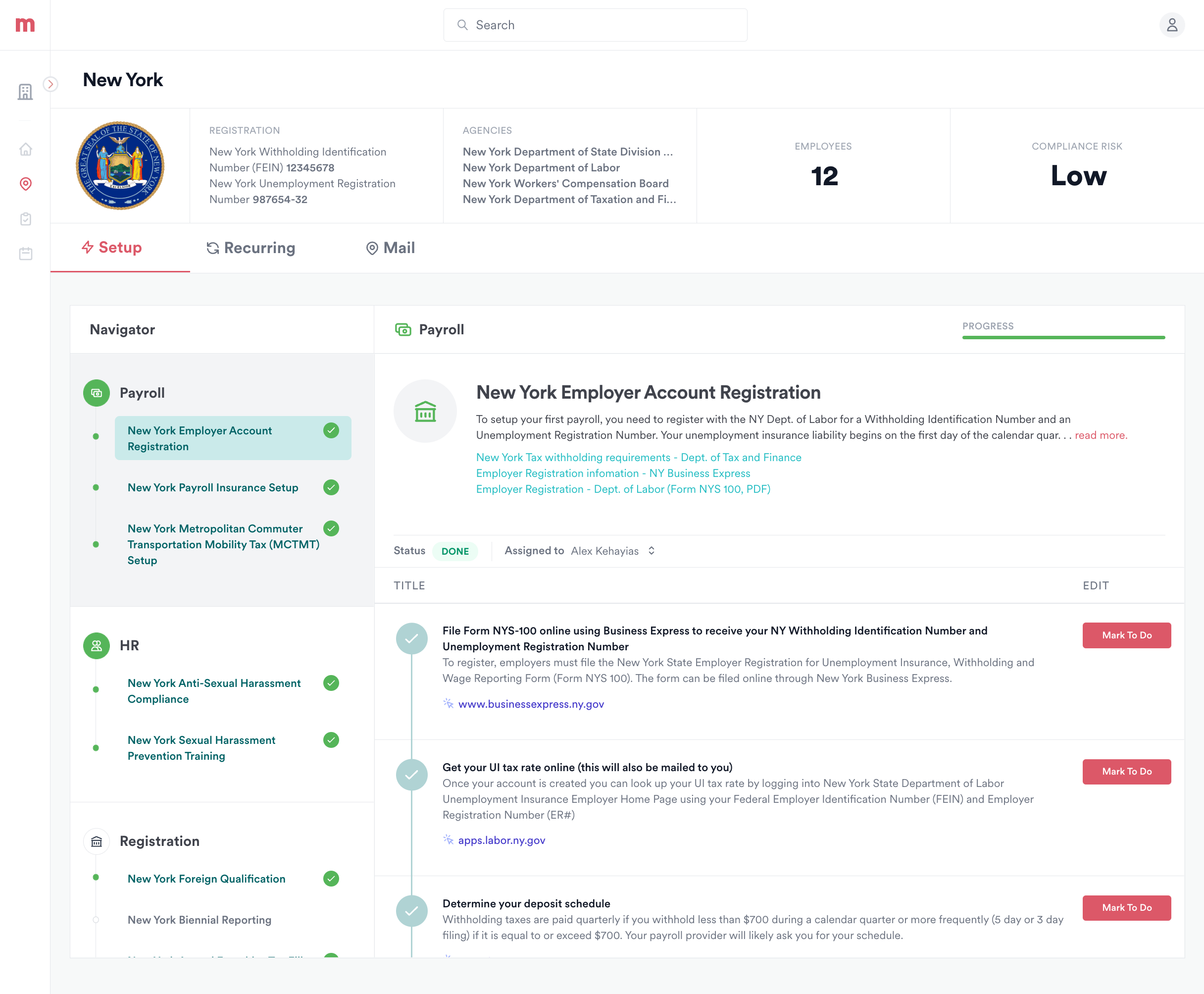

Ensuring a company complies with multiple tax and employment laws is a challenge every year. Alex Kehayias believes that Mosey is close to being close. Mosey's automation tools help U.S. based companies hire workers remotely and stay compliant by using a database of reporting requirements for all 50 states.

One of the most important problems to solve for the future of work is the separation of work and home. Many businesses struggle because multi-state compliance is too difficult, but it has enormous potential to improve access to opportunity. Watershed, Mystery, Common Room are just a few of the fast-growing businesses that our customers are. Customers are retooling the back office and nearly every industry is being changed by remote work.

Mosey today closed an $18 million Series A round led by Canaan with participation from Gusto, SemperVirens and Charge, bringing the startup's total raised to $21 million. Funding will be used to expand Mosey's team, scale the platform, and establish new partnerships.

Before founding Mosey, Kehayias was a product manager at Morgan Stanley and an engineering manager at Stripe. While at Stripe, Kehayias built and headed Stripe Atlas, a platform for early-stage startups that tackles accounting and tax issues.

Most companies use a mix of legal, financial and HR consultants to figure out their compliance requirements. It becomes expensive when multiple states are involved. States that don't have an income tax have their own rules for income tax withholding. If the business is located in a state that implemented a reprieve during the Pandemic, things get more complicated.

The cost of complying with U.S. income taxes is estimated to be $2 billion.

The move to remote work was accelerated by the Pandemic. Kehayias said that out-of-state hiring increased from 34% before the Pandemic to 62% in the next five years. Rules and regulations for hiring and managing remote employees are complex and changing quickly. There will be a lot of change in payroll and tax.

The image was created by Mosey.

Mosey has a solution that integrates with payroll providers and government agencies to calculate tax obligations. HR workers can use the platform to open employer and tax accounts. Reminders and alerts are sent when new requirements are added.

The case for Mosey is simple: lower the risk that comes from operating in multiple jurisdictions and decrease the cost of compliance by using technology. The flexibility to hire wherever the talent is is provided by the use of many kinds of automation.

The tax code is difficult to understand in the best of circumstances. The startup faces stiff competition from companies like Deel, which raised $150 million at a $1.25 billion valuation. The last of which was worth over $3 billion was Symmetrical.ai.

According to Kehayias, the platform is gaining traction with customers like Calm and Tatari.

Despite the economic downturn, funding for HR tech startups is still robust, with VCs funneling more than a billion dollars into them during the month of January.

We are a small team but growing quickly. The product and systems needed to scale to the demand are being built. We work very closely with our legal and tax partners to make sure we are always up-to-date and that businesses can trust us.