There is a need for a review of the mortgage stress test.

The person who said that wasStephanie Hughes.

2 days ago and 27 comments.

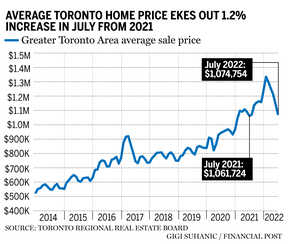

According to the Toronto Regional Real Estate Board, the average price of a home in Toronto in July was over a million dollars.

The photo was taken by Tyler Anderson.

Home prices and sales in Canada's most populous city continued to slide as economic uncertainty and rising rates put more would-be buyers on the sideline.

According to data from the Toronto Regional Real Estate Board, the average price of a home in Toronto fell six per cent in July. Home prices in the city increased by one per cent from July to July.

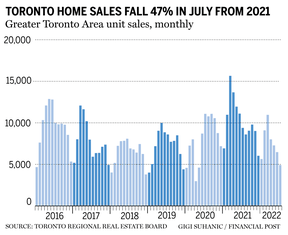

The number of homes that changed hands fell by 47 per cent in July and 24 per cent in August.

More households in the Greater Toronto Area will be planning to purchase a home in the future but are unsure of where the market is headed despite the slump in sales. The guidelines were set by the office of the financial institutions.

The data shows that policymakers could help allay some of the uncertainty. TRREB believes that the OSFI mortgage stress test should be reexamined in the current environment. Consumers should not be subject to an additional stress test burden when renewing their existing mortgage with a different lender.

The stress test rules need to be explained in a more sound way.

Policymakers would have to take a growing population into account and drive more housing supply construction according to TRREB chief market analyst.

The tight labour market will drive the growth of the Greater Toronto Area population. Despite more balanced market conditions, policymakers must continue to increase housing supply to account for long-term population growth. Home buyers will eventually have to pay higher borrowing costs because of savings and unemployment rates. We want to have an adequate supply in place or the market will tighten up again when they do.

The market in Toronto lost steam in July due to the Bank of Canada's aggressive rate hiking path and fears of a recession.

David Larock, mortgage broker and president of Toronto-based Integrated Mortgage Planners Inc., said markets like Toronto have a tendency to be hit harder than areas likeCalgary, which saw sales slip three percent year-over-year in July.

In an interview before Toronto's July data release on Thursday, Larock said that Toronto andVancouver seem to be more impacted than places likeCalgary. The most speculative markets have been most affected by the one per cent increase by the Bank of Canada.

The email address is shughes@postmedia.

The Financial Post is part of Postmedia Network Inc. There was an issue with signing you up. Try again.