Business and race reporters.

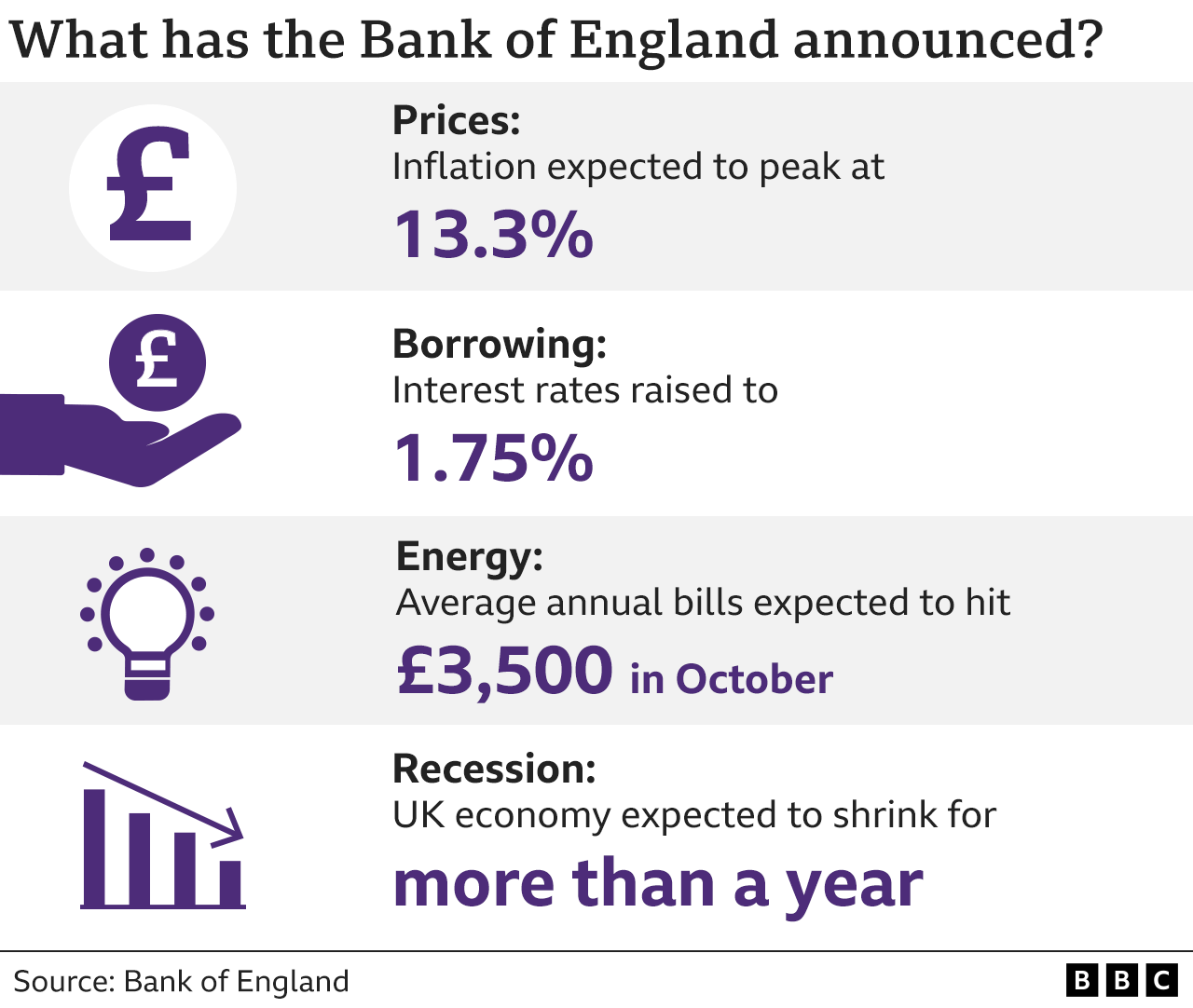

The governor of the Bank of England warned that interest rates may have to rise even higher.

The Bank of England said the UK will fall into recession as it raised interest rates.

The economy is expected to shrink in the last three months of the year and continue to shrink until the end of the decade.

Inflation is set to hit over 12% as the Bank tries to stem soaring prices.

If interest rates weren't raised, the cost of living would get even worse.

High inflation and low growth can be traced back to soaring energy bills caused by Russia's invasion of Ukraine.

The average household will be paying over $300 a month for energy by October.

The UK banking system was brought to a halt when the recession began.

Fourteen years ago, the slump was as deep as it is today.

Andrew Bailey, the governor of the Bank, sympathizes with those who are struggling most with the cost of living.

I'm afraid my answer to that is, it doesn't because I'm afraid the alternatives are even worse.

Increasing interest rates should encourage people to borrow and spend less in order to control inflation. People will save more if they are encouraged to.

Many households will be affected by the interest rate rise.

Homeowners on a typical tracker mortgage will have to pay more in the future. There will be a £59 increase in the cost of a standard variable rate mortgage.

Variable mortgage holders could be paying up to $1300-135 more a month compared to tracker mortgage holders. The interest rates have gone up six times in a row.

Credit cards, bank loans, and car loans all have higher charges due to higher interest rates.

Image source, Patrick Reid

Image source, Patrick Reid He said that he would need to pay an additional £250 a month to keep up with his debts.

All of the non-essential items will be cut from my budget because I will have to tighten my belt.

Rebecca McDonald said that high inflation was going to hit low income families hard.

Many people have taken on credit to pay their bills and are falling behind. With higher interest rates, it will be hard to pay off this debt.

The cost of living support announced so far is not enough according to Jonathan Ashworth.

"There will be families and pensioners across the country waking up this morning, reading the news, who are absolutely terrified because a juggernaut is heading their way which will smash through family finances," he stated.

VAT will be reduced on energy bills, tax relief will be abolished for oil and gas companies who invest, and support will be provided to retrofit homes to make them more energy efficient.

The Chancellor was confident that the government could overcome the economic challenges.

The Bank's gloomy outlook was criticized by Labour for being on holiday by Boris Johnson and Mr. Zaha wih.

He had a call with the Governor after the rate announcement.

There is no such thing as a holiday and not work for me. He said that he didn't have that in the private sector.

He said that the privilege and responsibility of public service meant that you never get to switch off.

The Bank of England has sirens.

The largest rate rise in more than a quarter of a century was announced by the Bank of England in an attempt to temper inflation, which is currently at a record high. The prediction of a recession as long as the financial crisis and as deep as it was in the early 1990s is the biggest shock here.

At the same time as the inflation rate is predicted to hit a 42 year high, this is a full fat recession. The combination of a stagnant economy and high inflation is called "stagflation"

It will raise questions as to why rates are being hiked at a time when consumers are cutting back on spending.

This year has seen energy bills rise sharply, squeezing household incomes and leading to slower growth for the UK economy.

Russia has reduced supplies to Europe as it wages war in Ukraine and it is feared that it will switch off the taps altogether.

The potential of gas supply problems has led to the wholesale price soaring, which has led to energy firms passing those costs onto customers, pushing up household energy bills by an unprecedented amount.

Households have been affected by higher petrol and diesel costs.

The latest rise in gas prices has led to another significant decline in the outlook for the UK and the rest of Europe according to the Bank.

According to the Bank, the rate of inflation is expected to stay very elevated. The following year, it will return to the 2% target.

The rise in interest rates will affect you. Are there any questions you would like answered? You can email have yoursay@bbc.co.uk.

If you are willing to speak to a journalist, please provide a contact number. You can reach out to us in a number of ways.