The prices in Toronto are down 2% while the prices in Montreal are down 2%.

The person who said that wasStephanie Hughes.

3 minutes read and 5 comments

Home sales in the city fell for the second month in a row with a three per cent decline in July.

The photo was taken by Postmedia.

The aggressive path of interest rate hikes is taking a toll on Canada's housing markets.

More buyers are moving to the sidelines and waiting for a better chance to jump back into the market, which resulted in declines in home sales in both Toronto and Montreal. The Bank of Canada is hiking interest rates to combat inflation.

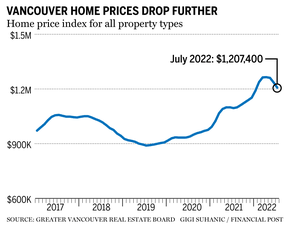

In the month of July, the number of homes that changed hands in the Greater Vancouver Area fell by 22% from the previous month. When the market was in a buying frenzy last summer, sales were down 43 percent.

The board's benchmark price index, which compiles typical property prices in each market, decreased from June to July.

Daniel John said in a press release that home buyers are exercising more caution due to rising interest rates and inflationary concerns. Over the last three months, the selection of homes for sale in the region has increased.

Home sales in the city fell for the second month in a row in July with a three per cent decline compared to a year ago. The market saw better performance earlier in the year as people moved from Toronto to look for more affordable options.

In July, the average price of a home in the city was almost half a million dollars.

While many in the real estate industry have blamed rising interest rates for the drop in demand, LowestRates.ca expert and licensed mortgage broker said the pause in home buying has more to do with the risk of a recession and overall uncertainty

Zlatkin doesn't think that people's hesitation is caused by the Bank of Canada overnight rate increase. There is a lot of uncertainty about whether a recession is coming and that is causing people to be hesitant. A job loss is more important than the rate increase.

More home buyers are sitting on the sidelines as they wait for more certainty in the market according to the chief executive officer of Zoocasa.

"Everyone is waiting for you to tell them it's the bottom and then they rush and it becomes a spike back up." Will we hit a bottom and it's good time to buy, which will create the next run up? Is it going to be a balanced market or is it going to take a few years to recover?

I don't have a crystal ball, that's for sure. We are going to see that it will stay quiet for a long time.

The email address is shughes@postmedia.