Nancy Pelosi did not include Taiwan in her agenda. Chinese banks are going to have a $350 billion hit on their books. The gold secrets of JP Morgan are known. Today is what you need to know.

A statement from Pelosi's office didn't mention a possible stop in Taiwan on her trip to Asia. Reports that she would stop on the island angered China, which regards the self-governing island as part of its territory. According to the statement on Sunday, Pelosi will lead a congressional delegation that will visit Malaysia and South Korea. There are four mysteries of Pelosi's Taiwan trip.

In a worst-case scenario, China's banks could face mortgage losses of $350 billion as confidence in the nation's property market plummets. A mortgage boycott has been triggered in more than 90 cities because of a crisis of projects that are stuck. The full story can be found here. China Evergrande, the world's most indebted developer, failed to deliver a "preliminary restructuring plan" it promised by the end of the year, as the country's factory activity unexpectedly contracted in July.

Australia is on track for its steepest tightening of monetary policy in a generation as the housing market shifts into reverse and consumers pull back on spending. The Reserve Bank of Australia will lift its key interest rate by 50 basis points for a third month in a row on Tuesday. Since May, it has tightened 175 basis points, the biggest increase since 1994. Inflation is running at more than twice the upper end of the RBA's 2% to 3% target, as policy makers try to rein in it.

The economic and regulatory challenges surrounding China temper some of the optimism sparked by a recent rebound in risk appetite.

The trial of the former head of precious metals at JP Morgan Chase has given new insight into the trading desk that dominates the gold market. Michael Nowak, who ran precious metals trading at JP Morgan for over a decade, is being tried in Chicago along with two other men for conspiring to manipulate gold and silver markets. The proceedings gave a new insight into the inner workings of the business, from its profitability and market share to huge pay packets. The full story can be found here.

Considering the economy, the surge in US stocks over July was quite a feat. The latest upside surprise on the consumer price index underscored just why the Federal Reserve is being so aggressive. The non-inflation section of the data showed the economy is in decline, with slumps in activity and a contraction in GDP in the second quarter.

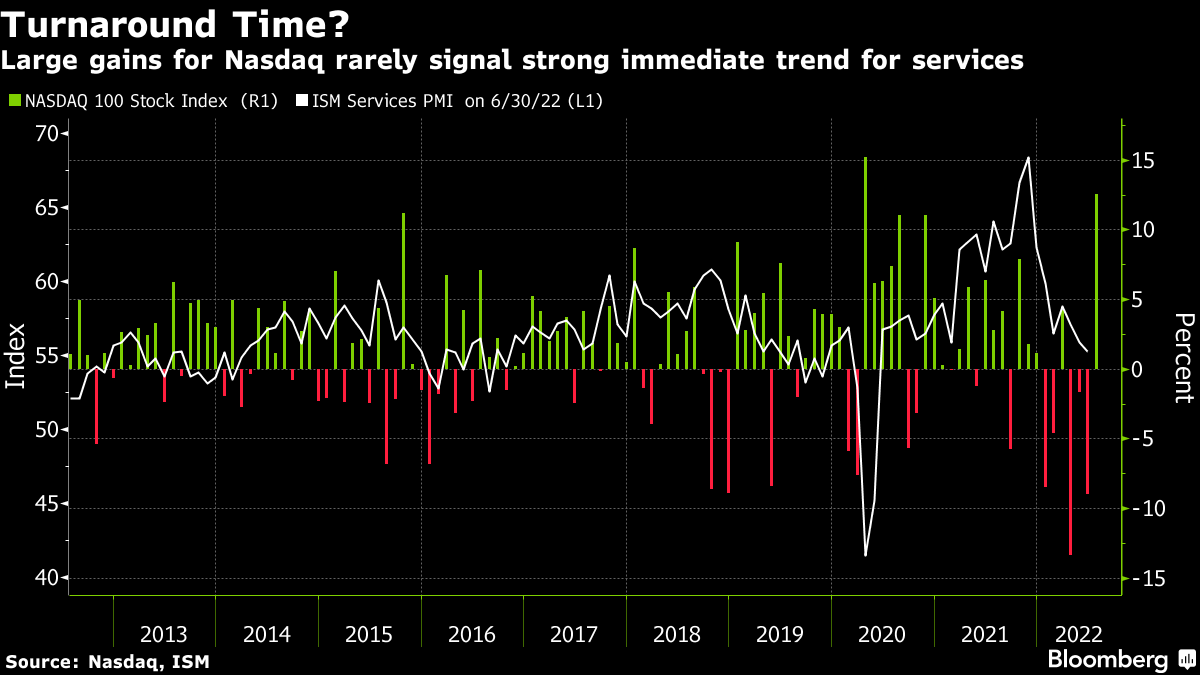

If you focus on the idea that a severe economic slowdown means fewer rate hikes going forward, then the spike in the Nasdaq 100 may make sense. The concern is that gains of this magnitude have usually failed to signal a sustained improvement in either US services activity or the Nasdaq 100 itself. The jury doesn't know if the recent rallies are a bear-market trap or a signal of a turn around.

Garfield Reynolds is based in Australia.

Garfield Clinton Reynolds helped with the project.