There was a chance for a soft landing in Canada.

Chris Wattie has a file photo.

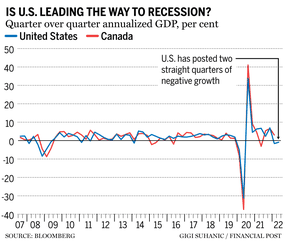

The U.S. economy has contracted for two quarters in a row suggesting it is in a recession.

The US economy contracted in the second quarter after a decline in the first. The rule of thumb for determining a recession is two straight quarters of decline.

According to the senior economist at the Bank of Montreal, there is a good chance that Canada will not escape the fate of the US.

It would be hard for Canada to avoid a recession if the U.S. contracts. We aren't calling for a recession in either country, but it's a coin flip at this point and both economies are very vulnerable.

It's basically a coin flip at this stage and both economies are very vulnerable

Sal Guatieri

High inflation is eating away at consumer spending power at the same time higher interest rates are weighing on borrowing demand, which could grind the economy to a halt. Both economies have yet to see the full impact of the aggressive rate-hiking path as monetary policy changes take some time to work their way through the system.

The Fed and Bank of Canada are expected to raise rates further in the second half of the year. There will be more economic pain in the future.

The latest GDP figures have the U.S. economy meeting the definition of a technical recession, but Guatieri and other economists argue that it's too early to declare an official recession. Negative data on employment and consumer spending needs to be dropped.

There's still more economic pain to come

Sal Guatieri

It is too early to say that the U.S. is in a recession, according to economists at the Desjardins Group.

The American economy contracted for a second quarter in a row, but don't call it a recession according to a note to clients written by the managing director and head of macro strategy. It is difficult to call this a recession without weakness in employment or consumer spending. Businesses are setting up for a harder second half, which could affect hiring plans and consumer spending.

The Federal Reserve will remain focused on inflation with higher interest rates and the GDP figures won't push them off course.

Canada has followed its biggest trading partner into almost every recession.

Guatieri acknowledged that there are a few factors that could shield Canada from the worst of the economic situation.

Guatieri said there are a couple things that might keep Canada on side. Commodity prices are still pretty elevated, despite pulling back from their highs, in particular energy prices, which is a weight on the U.S. economy.

Canadians have excess household savings that could be used to protect against more severe downturn scenarios. There is still a chance that central banks can pull off a soft landing despite the GDP contraction.

The countries can avoid an official downturn. It will be less severe if we slip into a recession because households have excess savings. As the economy weakens, we should expect inflation to fall over the next year or so.

The email address is shughes@postmedia.

The Financial Post is part of Postmedia Network Inc. There was an issue with signing you up. Try again.