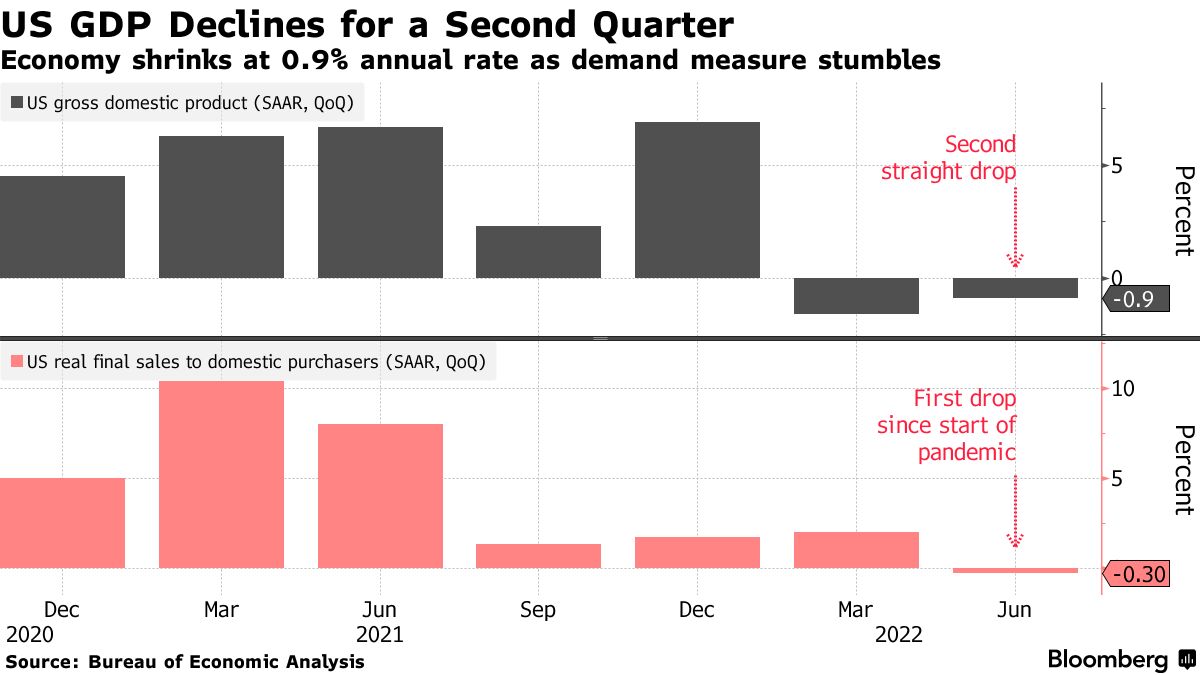

After the US economy contracted for a second straight quarter, the drumbeat of a recession grew louder.

The first three months of the year saw a 1.6% decline in gross domestic product. The biggest part of the economy, personal consumption, rose at a 1% pace.

The economy has lost steam in the face of high inflation, rising borrowing costs, and a general tightening in financial conditions. The economy is vulnerable to a downturn.

The report will make it more difficult for the Fed to raise rates.

Business investment, government outlays, and housing all declined in the report. The trade deficit added to the figure.

In the second quarter, a key gauge of underlying demand that excludes trade and inventories components fell at a slower rate than in the prior quarter.

The report shows how tighter Fed monetary policy has hurt interest rate sensitive sectors such as housing. The debate about when the US will enter a recession is likely to intensify.

A group of academics at the National Bureau of Economic Research make the official determination of the end and beginning of business cycles.

“The contraction in second-quarter GDP significantly raises the risk that the economy will fall into recession by year-end...lagging momentum leaves the economy vulnerable to further adverse shocks such as a potential energy crisis in Europe or intensified supply strains in the second half of the year.”

-- Yelena Shulyatyeva and Eliza Winger, economists

For the full note, click here.

In a survey of economists, the median projection was for GDP to rise by 0.4% and consumer spending to increase by 1.2%. The S&P 500 opened higher and the dollar fell after the report possibly reduced chances of further aggressive Fed rate increases.

A number of retailers and tech companies have slashed their profit forecasts in the last few weeks. Apple and Microsoft are slow in hiring.

The strong US dollar is pushing the global economy toward a recession.

Weakening the labor market would remove a key source of support for the economy and help shape the course of monetary policy later this year.

Powell said at the news conference that the Fed thinks it's necessary to have growth slow down.

We think we need a period of growth below potential so that the supply side can catch up. Powell thinks that there will be some weakness in the labor market.

Applications for unemployment benefits last week were higher than expected.

The tech giants are having a hard time hiring.

Services spending grew at a faster rate than goods in the GDP data. Spending data for June will be released on Friday.

Americans are facing higher prices for a wide range of goods and services. Wages have increased but not fast enough to keep up with inflation. Russia's war in Ukraine is one of the reasons why the Fed is trying to limit inflationary pressures.

The sizes of the moves will be dependent on the data. Inflation is too high and the labor market is tight.

Spending on structures and equipment fell in the last quarter. Outlays on intellectual property products went up quite a bit.

The biggest decline in residential investment since the start of the epidemic was due to high borrowing costs and the squeeze on the housing market. Builders are downbeat about future demand as sales fall.

“We seem to have entered an economic downturn that will have a broad impact on the digital advertising business. And it’s always hard to predict how deep or how long these cycles will be, but I’d say that the situation seems worse than it did a quarter ago.” -- Meta Platforms Inc. CEO Mark Zuckerberg, July 27 earnings call

“We’re seeing customers and specifically lower-income customers trade down to value offerings and fewer combo meals.” -- McDonald’s Corp. CFO Kevin Ozan, July 26 earnings call

“The increasing levels of food and fuel inflation are affecting how customers spend, and while we’ve made good progress clearing hardline categories, apparel in Walmart US is requiring more markdown dollars.” -- Walmart Inc. CEO Doug McMillon, July 25 updated guidance

“We do assume a recessionary environment around us... So accordingly, we’ve taken the actions which we have in our recession playbook, which are largely focused on being very aggressive on cost side.” -- Whirlpool Corp. CEO Marc Bitzer, July 26 earnings call

The report showed that the trade and inventory changes subtracted 2 percentage points from the GDP change.

The personal consumption expenditures price index grew for a second quarter in a row. The index rose after falling after rising. Friday will see the release of monthly PCE price data.

With the assistance of two other people.