It's hard to get any sort of excitement about a lot of health startup that we cover on the site. An online pharmacy raised more money.

Alto Pharmacy raising a Series E is impressive and raising $200 million is even better. There isn't a lot of news about those companies because they are too large to be a startup and haven't had a liquidity event.

The company disrupted an existing industry with a new business model, has been doing well for a while, and is now raising more money to do more of the same. It was also the story back in 2017: The company raised $250 million in 2020.

I know that sounds a little lackluster for someone who writes about companies for a living, but, I mean, listen to the founder's quote from the company's press release.

“We’ve been laser-focused for the last seven years on building solutions to the foundational issues plaguing the broken pharmacy industry. We’re so proud of the progress the team has made, quietly solidifying our position as the market leader in the rapidly growing digital pharmacy market,” said Alto co-founder Jamie Karraker. “We’re thrilled this new funding will enable us to continue to define this evolving industry and to help even more patients get the care they deserve.”

The company disrupted an existing industry with a new business model, has been doing well for a while, and is now raising $200 million to do more of the same.

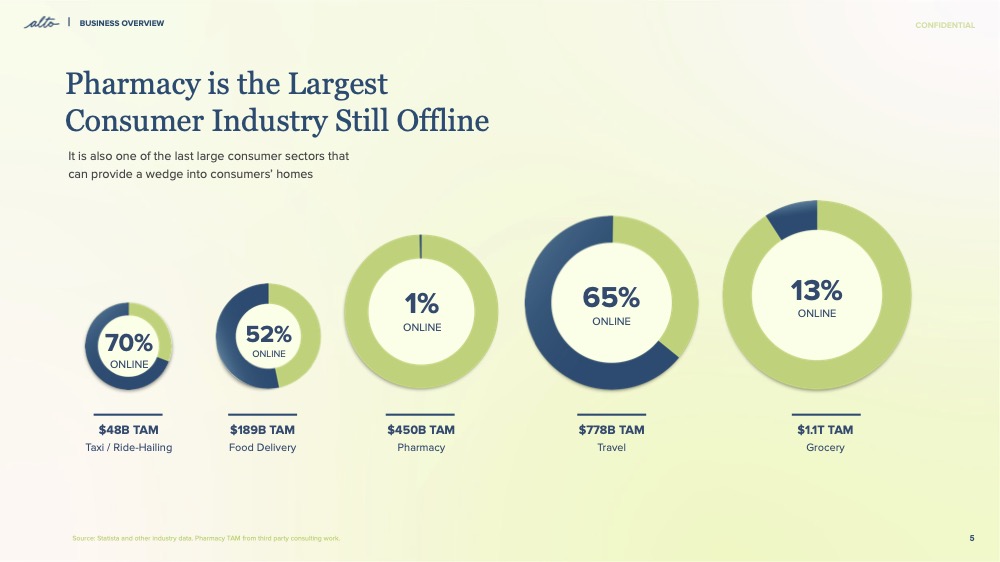

This is the slide-deck equivalent of a standup comedian standing on a stage, peering into the spotlights, muttering ‘pharmacies, amirite?’

It is hard to forget that there is a middle ground in the fast- moving world of early-stage startup. Companies exit quickly for a lot of money. A lot of crashes and burns in lawsuits. A lot of companies grind themselves to the bone on the way to success, customer by customer, metric by metric, market by market. There aren't many companies that raise five rounds of institutional growth funding with half a billion dollars raised along the way.

You have to have a plan for what to do next to get the company to where it needs to be when you make it that many times. Alto told the world about its $200 million raise in January. The company announced on June 30 that it has a new CEO in the form of an ex-Amazon executive.

I was curious to see how a company would tell the above story in a pitch deck. Some parts of the story are not shown on the pitch deck.

If you want to submit your own pitch deck, here is how to do it.

Some of the numbers in the deck were blacked out, and the company removed three slides from the deck. There were three slides removed, two of which were product demos.

There is a lot of data and presentation in this 21-slide deck. Three of my favorites are listed.

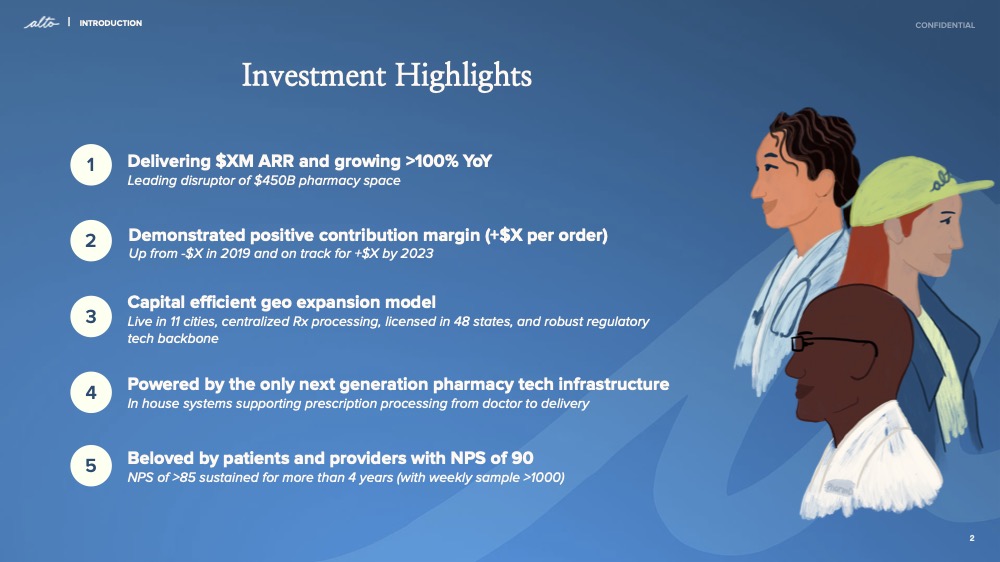

The second slide shows how to get to business. The Alto Pharmacy is open in a new window.

Traction is everything — that’s true for every startup, but it becomes more and more important the longer the company has been around. Hitting those milestones, growing that growth — it’s the name of the game. Alto doesn’t mess around, crashing straight into a five-point summary of why the investors should show them the money. Frankly, this slide is an award-worthy list of accomplishments.Every investor will ask how and can you do it again after doubling its ARR year on year. "If we sell more of this stuff, we'll make more money." is financespeak for "if we sell more of this stuff, we'll make more money." The figure was negative in the year. The company lost more money when it fulfilled more orders. It set a more beneficial goal for next year after three years of change.

If the company can convince me that it has a plan for conquering new markets, that could mark the company as a relatively safe bet for a startup.

The company is growing quickly and has great customers. Its operating and R&D expenses are high enough that it is losing money. It could become a profitable company if it is able to simplify marketing. Look! It's easy to roll out to new markets.

I would be excited about the next 55 minutes of my life if I had invested at the late growth stage.

Let's go! The image was taken at the Alto Pharmacy.

The window is open in a new way.