For three days each week during the month of April in 2014, a seasoned product manager named Lulu Young, an engineering manager named Paul Connolly, and a young jewelry salesman named NickMolnar gathered in a bare, windowless conference room to work out the features and functions of their product. The goal was to appeal to both online retailers who were always eager to convert more virtual browsers into actual shoppers and consumers who didn't have credit cards.

The product gave would-be users two options, both of which were outside of Australia's credit regulations. Pay After Delivery allowed people to wait 30 days before handing over any money. People can pay over time and split their bill into four installments. It didn't take long for Young and her colleagues to agree on the structural details: They'd need to let people stretch payments over more than 30 days but "we didn't think that a much longer period was necessary and looked at 60 days" It was too similar to the paradigm because of two payments. The mental gymnastics for four were easy to perform.

The service was called afterpay. The first people to try out the two new ways to pay were the jewelers parents. It didn't take long to see that the pay after delivery option wasn't very popular. The mood shifted when Princess Polly, a website that bills itself as the ultimate global fashion destination for trendsetters who want the latest Insta-Ready, TikTok-approved, celeb-worthy looks,experimented. Young received an email every time someone paid in four. She says that the order trickle became a steady stream. I quickly removed the alert.

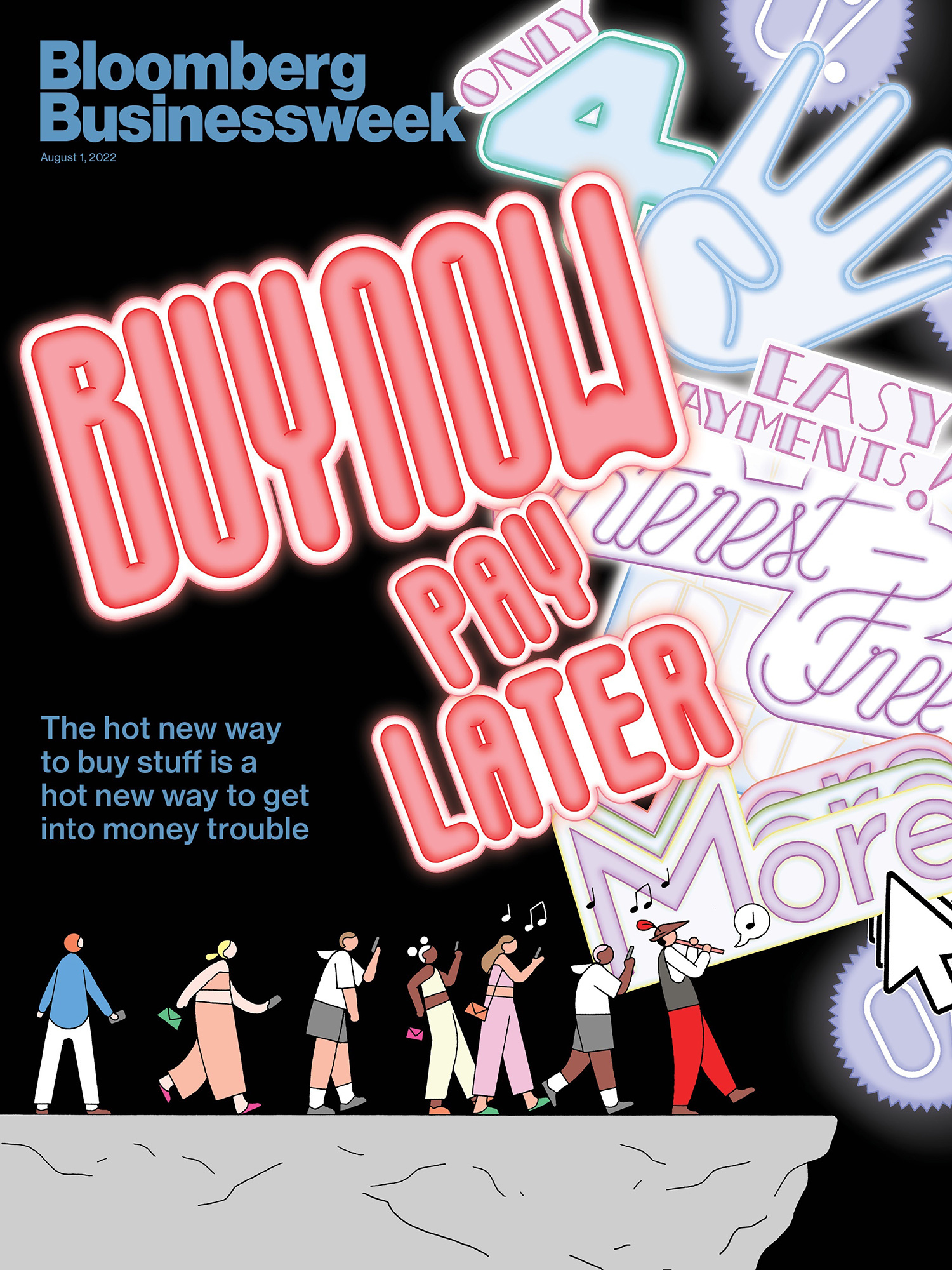

In Australia, pay-in-four is readily available at the checkout of hundreds of thousands of retailers online and off. Afterpay attracted investment from a Chinese tech giant and a US investment firm made its co-founders billionaires. The most valuable acquisition in Australian history was made by Block Inc. The model is the flagship product of the company. One of the biggest and fastest changes to consumer credit in decades is the emergence of BNPL as an alternative to credit cards and predatory lenders. It took root in the US as a way to buy clothing, cosmetics, and other discretionary items and exploded in popularity as a result of the Pandemic. You can buy now and pay later for things like designer furniture, socks and underwear, and groceries and gas. You can buy a gun from a small company.

The growth of companies such as Afterpay and Affirm is attributed to widespread distrust and dislike of credit cards among the under-40 set. The narrative has been repeated so many times that it has become almost biblical. The pay-in-four model may have less facile explanations.

There is a type of regulatory arbitrage in which pay-in-four products circumvent consumer protections designed to prevent people from getting screwed or screwed themselves. In the US, companies that extend credit have not been subject to much regulatory oversight. The Truth in Lending Act was enacted in 1968 and has been changed many times since. Pay-in-four isn't touched by that law.

Pay-in-four taps into human psychology and consumer behavior. Our present bias is what drives the desire for instant gratification. It exploits the fact that humans tend to discount the chance of bad things happening in the future and overestimate the chance of good things coming. Because we are less sensitive to the pain of a price tag if individual chunks feel affordable, we are more willing to part with our hard-earned dollars. Merchants love pay-in-four. There has been a 300% increase in the number of people who have tried the services in the U.S.

There is a correlation between boredom, browsing the internet on your phone while lying in bed, and shopping sprees.

You can split purchases up to $2,500 into four installments if you shop online. To pay 25% of the total price upfront, you must use a credit card, debit card, or bank account number. The companies use proprietary models to assess the risk of lending you money. The requests are approved quickly. You are invited to download the company's phone app. The remaining three biweekly payments can be charged to the card or account entered at checkout with the app. An online shopping mall is where you can browse the wares of brands that have formed partnerships to accept that BNPL provider as a form of payment. Money, eyeballs, and data flow as a result.

The arrangement is reversed. The pay-in-four model is great if you make your payments on time and don't owe anything. You could be hit with late fees from the provider if you fall behind on your payments. If you have a low account balance, the auto-deduction will cause your bank to charge you an over-the-counter fee. You will end up paying interest if you don't pay off your credit card balance in full. Credit cards are accepted as a way for users to pay on platforms, despite the fact that they are bad for the environment.

Merchants benefit from accepting credit cards because they increase sales. Merchants pay a higher fee but are rewarded with more completed transactions and higher sales. The fees from merchants make up the single biggest source of revenue for many companies, and they say it's proof that their interests are in line with those of their customers. Users who don't pay off balances in full and on time earn a lot of the revenue from card issuers.

There is a correlation between boredom, browsing the internet on your phone while lying in bed, and shopping sprees, so maybe it was no wonder that the BNPL industry took off as the pandemic dragged on. The consumer advocates were concerned about what exactly was BNPL. Different services were offered by the companies that operate under the name. Both Afterpay and Klarna charged late fees. Affirm and Klarna had interest-bearing long-term installments. There is a lack of consistency. It wasn't clear what laws were applied. The Credit Card Accountability Responsibility and Disclosure Act of 2009 was passed by Congress in order to make it harder for credit card companies to market to young people and risk saddling them with debt.

Is pay-in-four credit? Back in the 1990s, deferred-presentment providers did not take semantic liberties, but new services can be hard to define. Afterpay said it was a budgeting tool. The service was called a "global payments and shopping service." People bluffed as time went on. If I spend your money now and then pay you back with my money later, common sense would dictate that I am borrowing from you and that you are lending to me Regulators in California and Massachusetts have accused providers of offering illegal loans.

In December, the Consumer Financial Protection Bureau ordered companies to submit information about their industry practices and risks. Robert Lawless, a professor and expert on bankruptcy and consumer finance at the University of Illinois' College of Law, says that the creation of the Consumer Financial Protection Bureau was predicated on the need to regulate the popularity of innovative products. Lawless says that financial regulation is a game of whacka-mole. Congress can't keep up with all the new devices and transactions so we need a regulatory agency to keep an eye on them.

Why didn't it happen sooner? Donald Trump's administration was hostile to the agency and its mission. Mick Mulvaney was the first acting director of the Consumer Financial Protection Bureau and he sponsored legislation to abolish the agency. Kathy Kraninger, who had no previous financial regulation or consumer protection experience, tried to make it easier for people who couldn't afford to pay their loans. The lag may have been caused by data, as the number of complaints didn't explode until 2021. The number of complaints is on track to surpass last year's total. There are incorrect information on credit reports and attempts to collect debt that isn't owed.

There are consumer complaints to the bureau.

The bureau is called the Consumer Financial Protection Bureau.

In an interview, Joe Biden's choice to lead the Consumer Financial Protection Bureau is clear-eyed about the benefits and risks. He says that allowing people to overextend themselves has led many people to believe that what they thought was free was not.

The agency is expected to issue its initial report on the industry this fall after issuing a request for information on the companies. Companies could eventually be required to follow consumer protection laws that aren't currently applied. It could force the biggest players to take exams. Best practices and fines can be issued by the bureau. The industry complains that this is regulation by enforcement, but it is where the CFPB can move the fastest.

Increased regulation could affect the growth of the industry. Regulatory changes will place it on a more secure footing, according to the research company. If there is a recession, investors are worried about the viability of companies reliant on lending to mostly younger and less wealthy consumers. Affirm and Block have lost more than half of their value since the beginning of the year. The July funding round slashed its value to just under $7 billion from $46 billion.

The losses have grown. In the first three months of the year, Block's more than doubled compared to the same period a year earlier, driven primarily by afterpay loan delinquencies. The increase in credit losses was due to its expansion in the US and France. Charge-offs at Affirm increased by 362%. The lender will charge off the loan, refer it to a debt collector, and record it as a loss on the book.

According to the Federal Reserve Bank of Kansas City, there are some two dozen companies that are now operating in the United States. Apple Pay Later is a pay in four option. In August 2020, the new version of PayPal was launched. There is a race to the bottom as companies try to get a piece of the market. The Consumer Financial Protection Bureau said in December that banks would need to find other sources of revenue.

It has not been tested during an economic downturn because it is new. With inflation high, money doesn't go as far, which could lead to an increase in demand. The usage could go down if people stopped spending all together. There could be a rise in the number of people who can't repay their loans. The industry is in the beginning stages.

Afterpay exported its pay-in-four model to the US four years after it began. Neither Affirm nor Klarna offered pay-in-four services yet. With 400,000 merchant partners and 150 million active users in 20 countries, Klarna is the largest BNL provider.

Affirm started out 10 years ago with long-term loans. It makes a lot of money from interest on them and bills it as more transparent than a credit card. If you don't pay late fees, Affirm will cut you off from the platform The company was founded by Max Levchin and two other people. A new era of consumer finance is what Levchin sees as the potential for pay-in-four and other installments. He wants to use them to change the credit scoring system.

Without access to credit is hard to be a functioning member of the economy and society. Central repository for data about the income, assets, payment history, and outstanding debt of American consumers has been a function of credit reporting companies. When you apply for a credit card or a loan, the lender uses that data to determine your creditworthiness or how much risk you pose to lend.

The traditional system has not been well received. Almost 106 million Americans are considered "credit invisible," "unscorable," or "subprime and below" according to data. Poor people, people of color, immigrants, and young people are more likely to be cut off from traditional banking than other groups. People with lower credit scores are more likely to be black and Latino. The potential for innovation to mitigate racial, financial, health, and wealth gaps is there, according to a fellow at the Brookings Institute. She said that through technology and automation, they can reduce costs and prices.

The legacy credit system is broken and unfair, and what they're creating to replace it will make the world a better place. Levchin spoke from his home office. He was a penniless teenager when he came to the US. It took a long time for it to come back. He says this is a personal conviction. When I experienced my road bumps a long time ago, the system was ripe for fixing.

That's where the technology comes in. Credit card issuers use a one-time assessment on the creditworthiness of individual borrowers to decide whether to issue a card. Levchin said that making every transaction an explicit borrowing event protects companies from overextending themselves. It makes more people eligible for loans.

A traditional lender must factor in a borrowers income, expenses, and obligations when deciding on a line of credit. Credit scores are used to predict the likelihood that a person will pay late. There is a loan for headphones. The first of the four payments is a 25% down payment and the provider only needs to estimate the likelihood of default over the next six weeks. The smaller dollar nature and shorter repayment window make them less risky.

The exact components are not disclosed. Hundreds of internal and external data variables and features are included in Afterpay's models. Levchin has said that Affirm has been building upproprietary data for nearly as long. Our process involves looking at credit report data, but could also include some Affirm specific stuff, like what we know about the merchant and the thing they are about to sell you.

The loans are branded by the companies as tools of empowerment. Users skew young and female, many with low to moderate incomes. The companies say that the transformation of them into responsible customers is the result of BNPL.

Spending looks like a game because of the advertising on it.

The industry faces accusations that it emotionally manipulates users and glamorizes debt, using social media to drive adoption and marketing slogans. The store has afterpay. Andrew Kushner is a policy counsel at the Center for Responsible Lending in Oakland, Calif. It reinforces the need for stronger protections so that it won't cause more harm down the line.

According to the companies, their protections enforce responsibility. They cap late fees at 25% of the purchase price or start you with a low ceiling of $100 before increasing your limit after you show you can pay on time. A lot of people don't have the money to take on debt, but that doesn't mean they can't do it anyways. Consumers have sued the companies after they were hit with bank overdraft fees. A recent study by Amy Cutts showed that almost half of the borrowers used the service after maxing out their credit card. One-third of users said they had fallen behind on their payments.

Consumers have developed certain expectations when it comes to paying with credit. They will increase their credit score if they pay their bills on time. The credit reporting companies have not been consistently reporting the existence of a pay-in-four loan. A system to do this will be developed by the credit reporting companies. The lack of reporting has made it difficult for lenders to see how much a prospective borrowers owes. Loan stacking is when borrowers carry multiple loans with them at the same time. It's the result of a system that doesn't do enough to stop problems.

She moved to New York last summer to make it as an artist and is living with the consequences of her own loans. After graduating from the University of Texas at Austin, he got a job at a museum, rented an apartment in Brooklyn, and started working as a graphic designer and teacher. She lost multiple jobs, fell into a debt trap, had her checking account closed, and saw her credit score plummet because of the swine flu. She bought two plane tickets for $607 through Affirm in October and November of 2021. She missed one payment and that's when things went to shit.

The offer was found through Alternative Airlines. She took out loans from a number of different providers, including Uplift and Spotloan, both of which charge high interest rates. She owes money to four companies. Affirm and Uplift charge off as losses. The experience has shown how difficult it is to keep track of multiple loans coming due at different times, and how in the dark she was about the risks. Spending looks like a game due to the advertising on these things.

The companies don't force you to buy stuff, but they do lower the barriers. According to a survey conducted by the Federal Reserve Bank of Philadelphia, convenience, not lack of credit access, was the main reason people chose to pay with BNPL. According to Sifted, a publication of the Financial Times, Sebastian Siemiatkowski, co-founder and CEO of Klarna, questioned whether the loans made by the bank were too easy to borrow. When it comes to money, it isn't a bad thing. A bit of tension in a payment can be beneficial.

Customers and merchants sometimes have disagreements. Credit card users have the right to complain about overpayments and billing disputes under the Fair Credit Billing Act. There is no framework for this type of work. The companies depend so much on revenue from merchants that there may be a financial incentive to keep them happy.

A 58-year-old retired bartender learns that the hard way. He bought a ring for his wife on the internet. He found one he liked from a Los Angeles jeweler, and when he put it in his cart an offer appeared from Affirm: He could pay the bill in 12 installments, at an interest rate he could live with. He says that money doesn't grow on trees up here. The buy button was on the screen.

He says it wasn't the 1.27-carat cushion-cut diamond he chose when the package arrived at his door. He says it looked like a cracker jack ring. He complained to Affirm. A customer care representative wrote in an email thatAffirm only provides the funds for your purchase. We don't deal with merchant questions. The merchant will have to be contacted directly. He was told that the package never arrived. A picture of the FedEx receipt was sent to Affirm. The merchant was ruled in favor by the customer care representative because the return was not in line with the policy.

Affirm charged off his loan after he refused to pay. He blames the stress of the whole thing for causing a stroke that has left him unable to work, and he blames it for his credit score dropping 100 points. Matt Gross is a spokesman for Affirm. He wants all consumers to have a positive experience with Affirm.

Merchants have exploited irrational consumer behavior for a long time. The fiscal ramifications of humans being hardwired to avoid intense moments of displeasure were shown a few years ago. The hedonics of debt can cause people to make credit-related decisions that work against their interests. Prices can be increased if consumers are willing to make payments for a long time, according to a paper written by Lawless and his co-authors. According to the paper, a seminal study on colonoscopies found that the duration of pain was more important than the pain at its peak and how bad it gets. Cohen says that what holds for colonoscopies holds for credit.

We all need to get colonoscopies. Even if a short pay-in-four plan isn't relevant today, you will be a customer soon enough. Affirm and Klarna want to join themselves further into our finances. In addition to having a banking license in Sweden, Klarna also offers savings accounts to people in Europe. Pay Now is a recent innovation that does not involve credit at all. Pay now. Users of Affirm's savings accounts will soon be able to buy and sell virtual currency.

People buying things in person in actual real life could be the future of the BNPL industry. You can pay-in-four not just via merchants with whom it has partnerships, but for whatever you want, wherever you want. You can split payments into four interest-free installments with Affirm's card. Levchin thinks it's "top of wallet" for people to use it to buy groceries at Walmart.

Levchin doesn't think that an impending recession will cause the use of BNPL to go up. He says there will be a lot more buy now, pay later in the US than there is currently. He wants you to abandon credit cards in order to use Affirm. I am biased and trying to sell it at the same time here, but I see the demand for this credit-card-alternative payment method rising among young people who are fed up with the credit card industry. I don't think it's a given that everyone has to believe in it. It is my job as anentrepreneur to believe in my future.

It is hard to argue against the world that the companies say they are creating. There is something powerful about adding a certain aesthetic to lending, with vibe-y names, better-looking websites, smartphone apps, and a lot of marketing. The risks and responsibilities are the same for the spenders.