It's a good day. Time is running out for Chinese firms on US exchanges, as well as Fed hikes and markets rejoicing.

The US economy is not in a recession despite the Federal Reserve raising interest rates for the second month in a row, according to the chair. The target for the federal funds rate was raised to a range of 2% to 2.5%. The June-July increase is the biggest since the price-fighting era of Paul Volcker. The Fed will slow the pace of increases at some point, according to him.

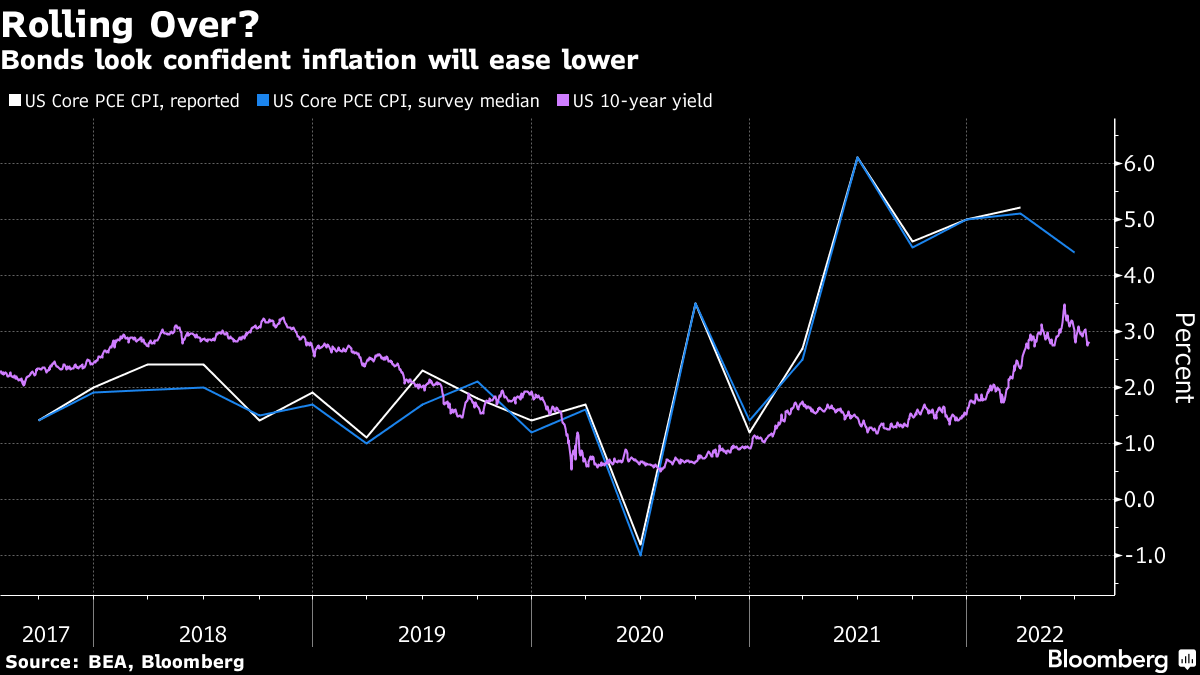

After a Wall Street rally, Asian stocks are expected to rise. There is hope that the pace of Fed monetary tightening will eventually slow. Bond yields could be capped by that possibility. Don't get too used to it. After the Fed hikes in May and June, big gains for riskier investments were followed by sharp selloffs as the still toxic backdrop of high inflation and recession risk sunk in again. Expectations for rate hikes could easily be adjusted by investors. The market may well continue to be volatile in the years to come.

China is facing more complex risks and challenges than before, according to the president. In a speech to local government leaders, the president said that China was entering a new phase that offered strategic opportunities. Major policies and development goals will be laid out at the upcoming 20th Party Congress. The presidents of China and the US are due to speak by phone on Thursday.

The chair of the Securities and Exchange Commission said that the US and China need to reach an agreement soon to avoid being kicked off American stock exchanges.

Gucci sales fell 4% on a comparable basis during the second quarter due to Covid-19 lock-ups in China. The group recorded an increase in interim sales and profit due to strong performances in other markets. Since the Pandemic struck, Gucci's popularity has suffered among consumers, as uncertainty remains when it comes to virus restrictions.

Over the last 24 hours, this has caught our attention.

The Fed hiked rates by 75 basis points, but also met expectations for a softer approach going forward. Once investors get more time to assess the outlook, the US market may be in for a rough ride. Rate increases in May and June were followed by the same thing. Data outcomes will be important and investors will be hoping GDP echoes the Fed by coming in as expected. A positive growth result to avoid a technical recession would be good, but the key figure is the inflation read that accompanies the report. The Fed has a chance to avoid setting off a recession if the Core PCE prices gauge slows substantially.

Garfield Reynolds is based in Australia.

Garfield Clinton Reynolds helped with the project.