The 25th anniversary of Upfront was celebrated last year. Over the course of a decade, our industry has experienced unprecedented growth.

In many ways, it feels like a return to normal in our industry because of the changes that have taken place. Yves Sisteron, Stuart Lander, and I have been working together for more than two decades and that has taken us through many cycles of market enthusiasm and panic. Dana Kibler is our CFO for nearly two decades.

We believe this consistency in leadership and intuition for where the markets were going helped us to stay sane in a world that seemed to have lost its mind and we have new capital to deploy in the years ahead.

We believed that the headlines in 2020 and 2021 represented an opportunity for real financial gains for savvy investors, even if they didn't read the headlines.

Since 2021, Upfront returned more than $600 million to LPs and returned more than $1 billion since 2018.

The returns were more meaningful than if we had raised a billion dollars. In a strong market, it is important to ring the cash register and this doesn't come without a concentrated effort.

As early-stage investors, our daily jobs remain largely unchanged, even though the funding environment has changed a lot. Over the past few years we have been laser focused on cash returns, but we are planting seeds for our next 10–15 years of returns by actively investing in the market.

We are excited to share the news that we have raised $650 million across three vehicles to allow us to continue making investments for many years ahead.

We are happy to announce the close of our 7th early-stage fund with $280 million.

Our third growth-stage fund has $200 million in commitments and our Continuation Fund has more than $175 million.

I get asked how Upfront is changing given the current market. It's not much. We have invested in 12–15 companies per year at the earliest stages of their formation with a median first check size of $3 million over the past 10 years.

In the beginning of the current tech boom, we wrote a $3–5 million check and this was called an A round, and 12 years later in an over-capitalized market, this became known as a seed round.

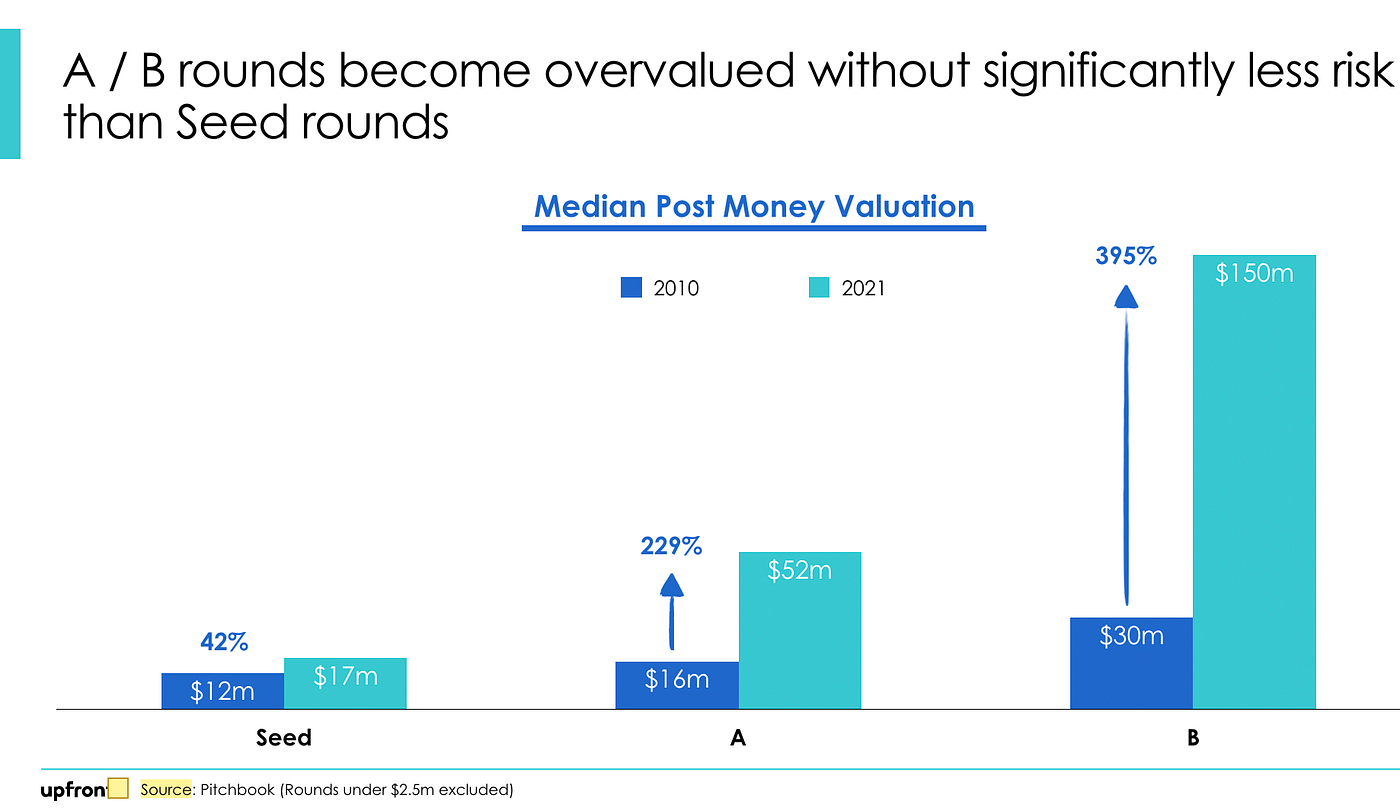

The above data shows that Upfront decided to stay focused on the Seed Market rather than raise larger funds and compete for A/B round deals. As money poured into our industry, it encouraged many VCs to write checks at higher valuations where it was unlikely that they had more proof of company success.

At Upfront, we decided to stay in our lane. We published our strategy some time ago and said we were moving to a barbell strategy of funding at the seed level, avoiding the A/B rounds and increasing our investments in the earliest phases of technology growth.

When we get involved in Seed investments, we usually represent 70% to 80% in one of the first institutional rounds of capital, and then we serve the founder over the course of a decade or more. We write follow-on checks to the tune of $10–15 million out of our early stage fund in our best-performing companies.

The best companies were staying private for longer so we started raising Growth Vehicles that could invest in our portfolio companies as they got bigger but also invest in other companies that we had missed at the beginning.

Why didn't we just lump it all into one fund and invest out of one vehicle? When we started our Early Growth program, I was asked that question.

It's in short form.

In Venture Capital, Size Matters

For a number of reasons, size is important.

It is easier to return multiples of capital when you don't deploy billions of dollars in a single fund as Fred Wilson has articulated in his posts on " small ball" and small partnerships. We like to invest in our Seed fund when teams are less than 10 employees and we have ideas that are out there. I invested in the boards in 2009.

If we combined $650 million or more into a single fund, it would feel too small to each investor to be important, and yet that's the amount of capital we believed many seed-stage investors to be important. At some of my peers firms, they were writing large checks out of large funds and not taking board seats. I believe the larger funds made some investors search for places to deploy $50 million or more.

Our most recent Early Growth fund is $200 million and we want to write $10–15 million into rounds that have $25–75 million in capital including other investment firms.

Extreme team focus and constrained size have been important for upfront.

Our sector focus has been what has changed in the past decade. We have focused on what we believe will be the most important trends of the next several decades rather than what has driven returns in the past. You have to get three things right in order to drive returns in venture capital.

It is difficult to be good at venture capital if you don't get all three correct.

There is a deeper concentration on those categories where we anticipate the most growth, the most value creation, and the biggest impact.

We are doubling down on our areas of enthusiasm and expertise with this fund.

Upfront is where venture capital begins. The Upfront VII and Growth teams are made up of 10 partners.

Most people know that Upfront is based out of Los Angeles but the majority of our capital is deployed outside of Los Angeles. San Francisco is the top destination outside of Los Angeles.

While some investors are moving to Austin or Miami, we have been increasing our investments in San Francisco and opening an office with 7 investment professionals. The Seed Investment Team is led by Aditi Malwal, who also leads our Fintech practice, and the Growth Team is led by the man who was most recently the head of Corp Development at Success Factors.

While the market is transitioning into a new and potentially more challenging reality, Upfront remains committed to what they have always focused on.

We are active partners with our portfolio in both good times and difficult times. We commit to being long-term partners to our portfolio when we invest.

We operate from a place of strong conviction when we invest. Every founder in our portfolio is there because an Upfront partner believed in them and did everything they could to make the deal happen.

We are grateful to the people who trust us with their time and money. We are blessed to work with people who are rising to the challenge of funding. We would like to thank everyone in the community for their support over the years. We're going to keep working to make you proud.

I would like to thank you.