China's property bust is sending shock waves through the country's 400 million middle class, upending the belief that real estate is a way to build wealth.

As property developments stall across the country and house prices fall, many Chinese homeowners are cutting spending, postponing marriage, and withholding mortgage payments on unfinished homes.

Peter gave up on starting his own business and buying a BMW 5 series after the construction of his home in Zhengzhou was stopped by China Aoyuan Group. He is saddled with a mortgage that is eating up most of his disposable income on a home he might never see.

Peter asked not to have his full name or personal details used for fear of reprisal, as he knows that every investment comes with a risk. Homeowners shouldn't bear the consequences of their actions.

Peter is one of hundreds of thousands of homebuyers in more than 90 cities across China who are boycotting a combined 2 trillion yuan in mortgage loans after companies such as Aoyuan and China Evergrande Group stopped projects. A growing number of the nation's middle class, which has 70% of its wealth tied up in housing, are joining the wildcat actions to refuse payment, posing a threat to the economy and social stability

A grace period on loan payments and for local governments and banks to step in and rescue the situation are being proposed by Chinese authorities.

It is possible that construction halts will affect up to 14 trillion yuan of homes in China, or about 1.3% of the nation's GDP.

China's housing market is unique in the fact that new homes are being sold before they are built, with mortgage payments immediately after the initial deposit. Developers were able to begin new projects because of this cash.

The current turmoil in China is unprecedented and halted real estate projects are not uncommon in the country. As the economy slows after more than two years of rolling Covid lockdowns and a sweeping crackdown on the private sector, youth unemployment is at a record high.

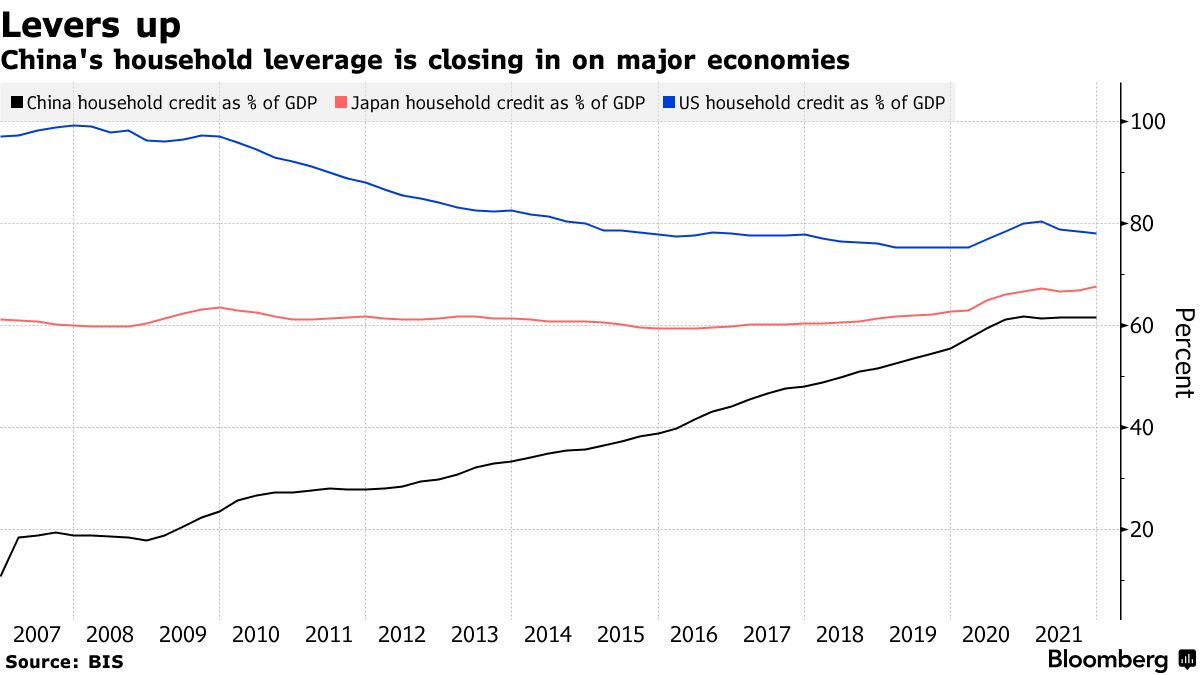

Home prices have fallen for 10 months in a row, while disposable income has fallen for five straight quarters. China's household leverage rose to 61.6% of its gross domestic product at the end of 2021, from 27.8% at the end of 2011. It is low compared to the US and Japan.

Hong Hao, a former China strategist at Bocom International, said the mortgage refusals will suppress house prices and sales and create a negative wealth effect.

Hong doesn't think it's a good bet. Home prices will never fall, that's what many people think. A paradigm shift is taking place.

The long property cycle had turned according to Andy Xie.

Xie said that the high and rising prices were justified on growth. It's no more.

In China, where disposable income per capita is less than in the US, it can take years of savings to afford an apartment. The so-called "six wallet" is used by young couples to finance purchases.

Li, a technology firm worker who has taken a 25% pay cut this year, is using a third of his salary to make a mortgage payment on an Evergrande development in Wuhan. He joined thousands of other people in boycotting the project in order to get the local government and developer to restart construction.

He is afraid to start a relationship because he doesn't know if he will own property for marriage.

Legal remedies against banks are being looked at by home buyers.

The buyer of an Evergrande project has sued his bank after the project was halted and his lender failed to transfer funds into an account.

He said that home buyers should not pay the price because the developers violated the laws.

Peter's bank failed to transfer money into an account that was supposed to backstop the project, which gave the developer free rein to use the funds, he and other home buyers claimed in their mortgage boycott letter.

Requests for comment were not immediately responded to.

Some people don't want to protest or pressure the government. Tom doesn't plan to stop mortgage payments or join protests because he doesn't want it to affect his credit rating. The project will be completed by the local government.

Many elderly people don't have the luxury of waiting. He couldn't get a bank loan and used his life savings to buy an apartment with an elevator. There was no sign of activity when he visited the site twice.

The best we can hope for is that the government fixes it. Even that seems to be a futile hope.

The assistance was given by Allen K Wan and others.