You can follow us on social media and sign up for The Readout newsletter.

The new resident of 10 Downing Street will inherit a lot of economic problems.

Inflation in the UK is running at a faster pace than it has in the past. The Bank of England tries to keep its rates in line with its peers. The labor and supply chain were wounded by the UK's decision to leave the European Union.

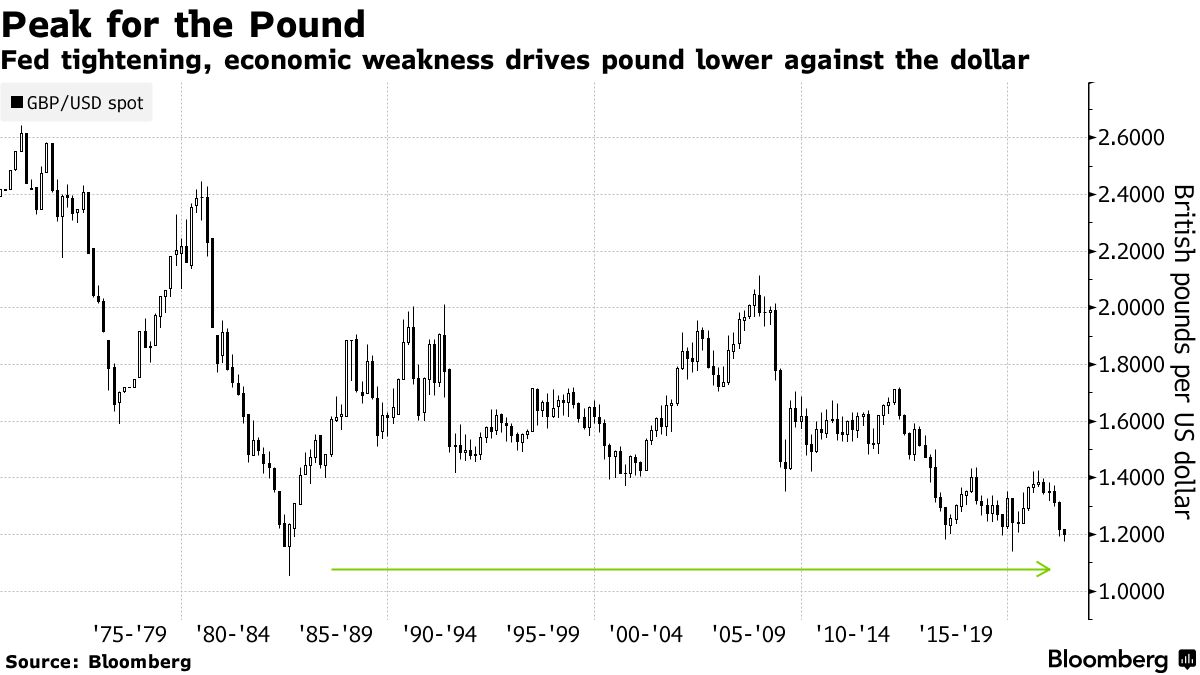

When the Covid-19 panic and lockdowns were at their peak, sterling was at its lowest level in a long time.

The new UK government is taking over in a difficult situation because of the UK's long-term bugbear of falling productivity. There is a chance of a nasty spiral of higher inflation and a weaker currency.

Regardless of who wins the leadership race, the forces behind the pound's slide may prove beyond the power of the government.

Volatile energy prices and a tight labor market have left the Bank of England with a dilemma of whether to hike interest rates or not. The UK is vulnerable to global trouble because of its open economy. Over the next two years, inflation will be the highest in Europe, according to economists.

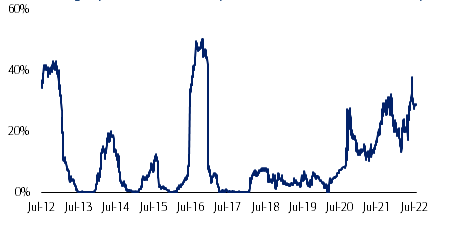

According to a Bank of America strategist, sterling has become a more important part of investors' currency holdings since the UK voted to leave the EU. It is particularly exposed to souring investor sentiment around the world because of Russia's invasion of Ukraine and China's Covid fight.

The pound has become more sensitive to global risk appetite.

As Britons feel the pinch of a weak pound when shopping for goods shipped from overseas, the nation's central bankers watch the impact on price growth. The pace of inflation has increased because of a slump in the Bank of England's preferred gauge of pound strength.

Steven Barrow wrote in a note to clients this week that the economy will feel very recessionary even if GDP growth improves. The kind of union militancy last seen in the 1970s and 1980s is what Barrow thinks will happen.

BofA expects the UK to experience a recession on higher inflation and rates.

The obvious solution to buoy struggling households is more expansive fiscal support from the government, but there is a risk that it could cause inflation and make the job of the BOE harder. Tax-cut pledges by candidates could cause prices to go up.

The pound is expected to fall further to $1.15 against the US dollar. Catherine Mann has said she backed a 50-basis-point hike to help support the currency, doubling the size of the BOE's most recent moves.

That could help narrow the central bank's rate gap with the Fed. The Fed has raised rates by 150 basis points in half the time that the BOE has raised rates. The dollar is at its highest level in 18 years.

The pound is not the only thing facing a surge in US currency. The factors that plague sterling to the UK aren't unique. The euro lost its value against the dollar for the first time in 20 years this month, while the European Central Bank hiked its rate for the first time in four years.

Philippe Jauer said that a large deficit, high inflation and political turbulence is the fate of many countries, particularly in Europe and the Eurozone.

The euro-sterling pair will move higher over the next six to nine months, according to Bank of Montreal.

He said that there wasn't much rally potential regardless of who won.