Bob Michele, a bond market veteran for more than four decades, predicts a 75% chance of a US recession over the next eighteen months.

The chief investment officer of JP Morgan Asset Management said on Friday that clients are returning to bonds. They have regained confidence in the central bank.

The world's central banks are trying to tame inflation while avoiding a recession. The European Central Bank raised rates for the first time in a decade. The Federal Reserve is expected to hike 75 basis points next week and 50 basis points in September according to a survey of 44 economists.

The market is pricing in where they think the Fed should go. The Fed is in agreement with that. At the end of the year, the Fed funds rate is likely to be around 3.5%.

The equity market isn't fully priced in a recession over the next year, according to a portfolio manager. She said that the market is pricing so that it doesn't grow. Negative growth is what I think will happen.

Despite closing the week stronger, paring this year's market plunge to about 17%, the stock market fell on Friday as disappointing results from social-media firms and weak economic data added to recession fears.

The bar was low going into earning season. Corporates are telling you that the consumer is getting weaker, but also that business confidence is getting weaker as well.

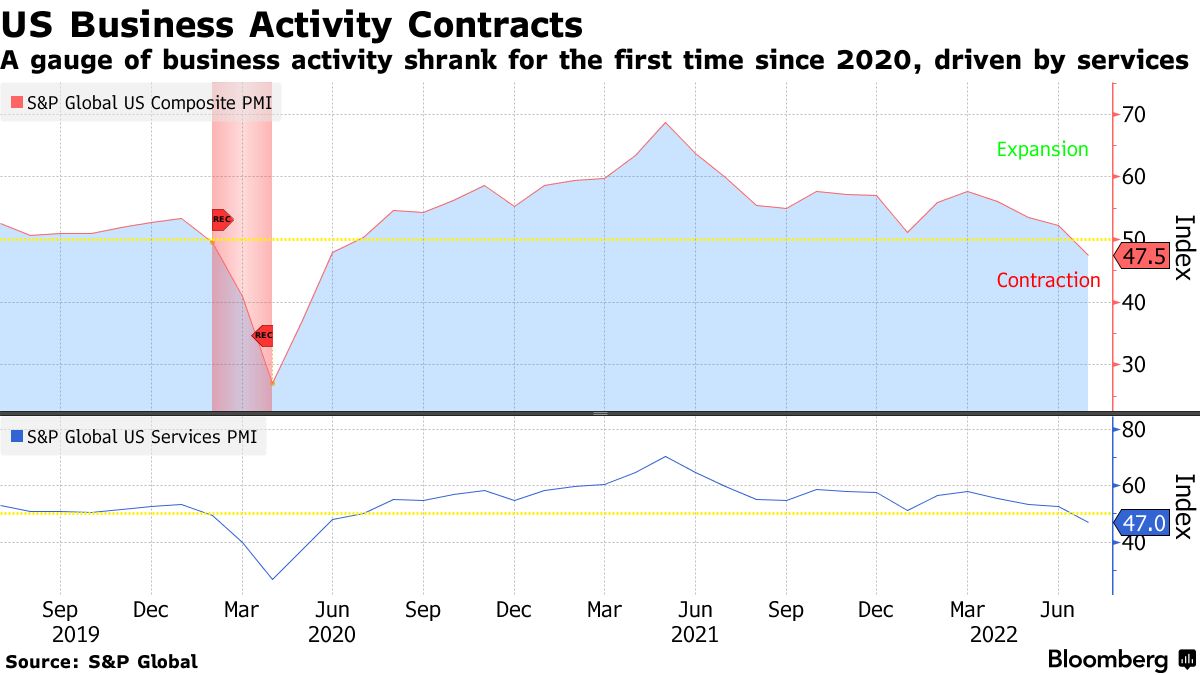

According to a survey from S&P Global, business activity deteriorated across the world in July, while treasuries extended an advance.

Browne said that inflation will continue to show up in second-quarter earnings but that financing costs will start to really bite.

Both agreed on the short-term outlook for Europe, saying inflation will likely remain high and the European Union will struggle with soaring energy costs because of Russia.

It can only raise rates so high that it is only able to slow consumption.

He said that they like debt in Germany but not in Austria. We don't necessarily agree with Italy.

The dollar fell this week after hitting a record high last week.

Browne thinks that the dollar will continue to strengthen, while Michele thinks that the dollar has gone as far as it can.