Kim started Tomo Credit to help international students get credit more easily.

The mission has evolved over time. Tomo Credit aims to help young adults with no credit score who are in good financial health.

Tomo is broadening its focus to include a group of people in the US who want to build credit fast.

The target market we can address is much bigger than we anticipated. The credit invisible goes beyond immigrants according to CEO Kim.

Tomo is different from a lot of other credit offerings in that it doesn't rely on a single score. The Tomo Score is used to identify potential borrowers with no credit score. No credit check is required for the Tomo Credit card. Credit limits are based on cash flow. It doesn't make its money off of consumers directly.

It sounds risky. It's true.

Kim insists that the company's default rate is not indicative of the risk. A 2.5% default rate is reported by American Express.

She said that their customers spend a lot more than any other customers. By talking to other neobanks, we learned this.

Customers who are identified and given a card spend a lot and don't default. Our performance has given us confidence to scale.

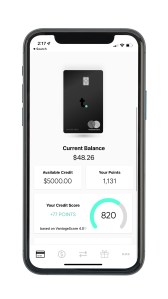

Tomo Credit is an image.

TomoCredit raised $22 million in a Series B funding round in order to give more credit to Gen Zers. 100 million dollars in debt financing has been secured by it. Tomo Credit has raised over 40 million dollars in equity.

The startup has seen 1,000% revenue growth in the last year. She said that Tomo is on track to do another 1000% revenue growth.

According to Kim, Tomo has received 2.5 million applications over the years.

Kim notes that the fundraise was a locked deal before the market turned.

The company plans to use its new capital to broaden its product offerings. Mortgages. Kim thinks that the mortgage market is an opportunity at the moment.

There was a huge surge in applications during the Pandemic. She said that during a market downturn they are seeing another peak of customers. Customers become more aware of their finances during uncertain times.

Tomo has been operating with a lean mentality. It has 50 people working for it. Kim said that part of its new capital will be used to hire more engineers.

The Next Level Fund and Mastercard participated in the oversubscribed equity portion of the financing. The debt was given by a bank.

Kim said that he wanted to help immigrant communities to reach their American Dream faster with Tomo Credit. It has been great to work with minority-focused funds.

The Next Level Fund invests in early-stage tech and tech-enabled companies with women or diverse mangers as part of their founding teams. She was drawn to TomoCredit by the fact that Kim was able to identify a problem as a young female immigrant and turn it into a new financial product.

Vilma wrote that she understood what customers wanted and needed from the financial service industry. Tomo Credit is working to build a more inclusive credit landscape by democratizing access to credit.

I launched my weekly newsletter on May 1st. It will be in your inbox if you sign up here.

Kapor Capital, Square co-founder Sam Wen back TomoCredit in its $10M Series A funding round