As if the environment weren't tough enough for one-time stock market high-flyers.

The decline in value is due to the plunge in the price of thecryptocurrencies. The loss was calculated by using the companies' previous disclosures.

The paper losses for MicroStrategy and Block are only for the time being, but the car maker has locked in some of the decline.

MicroStrategy, Block, and other firms own a lot of the digital currency.

The source is coinGecko.

The danger that companies run when they decide to hold some of their corporate treasury in cryptocurrencies is shown by the toll. There is no guarantee that it will ever get close to its November high of almost $68,000, despite the fact that it has rebounded a bit from its low last month.

According to Jerry Klein, managing director at Treasury Partners, a New York firm that manages cash for corporations, it is very risky for companies to purchase Bitcoins.

According to CoinGecko, there are at least 27 public companies with the digital currency. More than 85% of the Bitcoins held at public companies were with three companies: MicroStrategy, Block andTesla.

The holdings add to the risk for investors. Their shares have been hit by inflation, rising interest rates and the possibility of a recession. MicroStrategy and Block have lost a lot of their value this year.

The companies are led by people who support the cryptocurrencies. One of the boldest moves was made by MicroStrategy Chief Executive Officer Michael Saylor. The value of the token went down in the second quarter.

Saylor questioned the conventional strategy of investing in short-term US government securities when yields plummeted, adding that inflation would make cash worthless.

Early last year, Musk's company bought a large amount of the token and sold some of it at a profit.

Musk said on the earnings call that it sold 75% of its holdings because it was unsure how long Covid would last in China. There is a factory in China.

He said on the call that they are willing to increase their holdings in the future. This shouldn't be taken as a judgement on the digital currency. He said that the company hasn't sold any of its holdings of Doge coin.

As of 5:35 a.m., the price of the digital currency was $22,962.

According to a company statement, Block owned $366 million worth of that coin as of March 31.

The earnings of MicroStrategy and Block on August 2 and August 4 will be watched by investors.

The combined paper losses for the three companies are about $5 billion. MicroStrategy is the majority of that.

A representative for Block wouldn't comment on the company's holdings of the digital currency.

According to Matt Maley, chief market strategist at Miller Tabak + Co., the companies that hold the digital currency will try to hold onto it. They might have to sell it if it sees another leg down.

MicroStrategy CEO Saylor says there's no margin call on the loan.

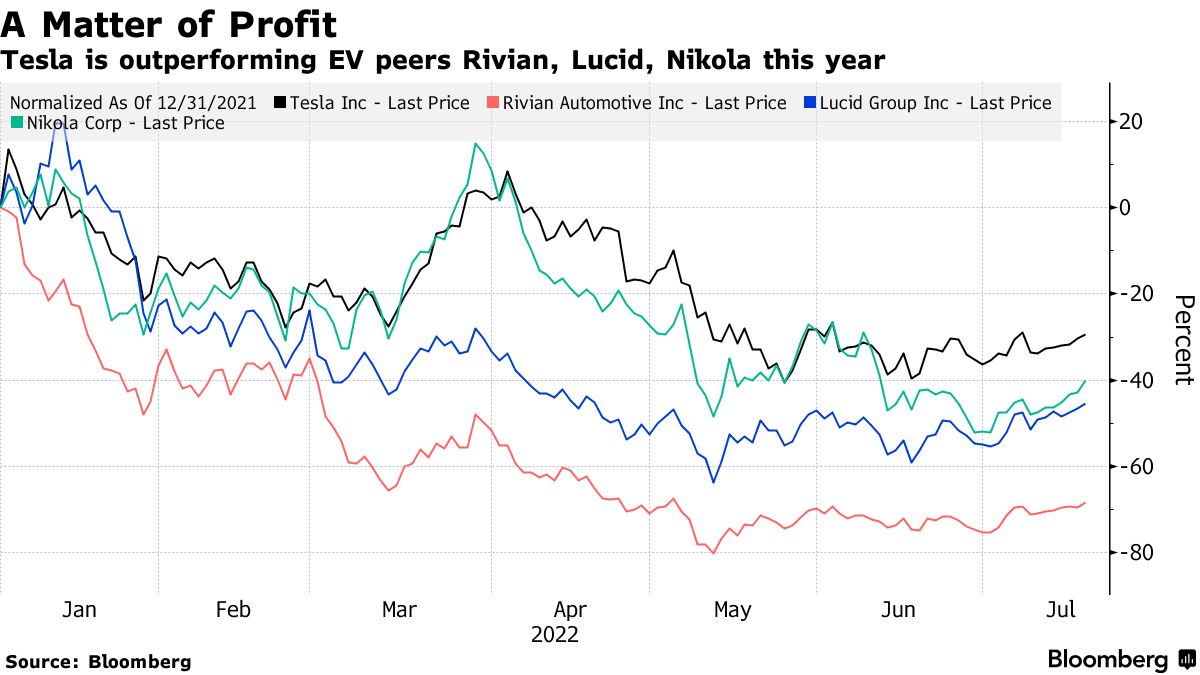

As investors move away from unprofitable growth companies, the world's most valuable automaker is doing well. The company reported second-quarter earnings that beat analysts' expectations. Rivian's stock has lost more than two-thirds of its value this year, while other companies have plummeted.

Tom Contiliano, Esha Dey, and Matt Turner helped with the project.