The only question is whether the Bank of Canada raises its rates in September.

The person who said that wasStephanie Hughes.

There are 12 comments on Jul 20, 2022.

According to Statistics Canada, inflation in June was boosted by gasoline prices, which increased by 54.6% from the year before.

Veronica Henri is the photo editor for the Toronto Sun.

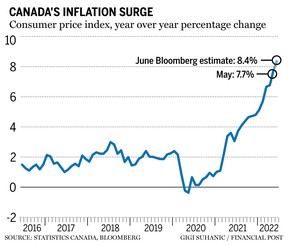

The Canadian economy saw an inflation rate of 8.1 per cent in June, the fastest since 1983. The consumer price index breaching eight per cent will add more pressure on the Bank of Canada to deliver another rate hike in September despite the latest reading coming up short.

Fuel to the inflation fire was added by the increase in gasoline prices. The price of oil peaked in the first week of June in Canada. The cost of a car went up as demand outpaced supply.

Canadian economists weighed in to give their opinion on what this means for the Bank of Canada. They said what they had to say.

There is a head of macro strategy at Desjardins.

The slightly weaker-than- anticipated inflation readings will be good news for central bankers. Canadian energy prices are falling in July due to the fall in global commodity prices. The economy is too hot and 45 per cent of the basket is rising faster than seven per cent a year. The only question left is if the Bank of Canada hikes rates in September. The odds seem to be even between the two. Between now and the next interest rate decision a lot will depend on the July employment reading.

Karl is the chief market strategist.

Two- and 10-year yield spreads between Canadian and U.S. bonds are narrowing, which is leading to a sharp decline in the Canadian dollar. The Bank of Canada is expected to raise benchmark interest rates by another quarter of a percentage point in early September, but there is a chance of a further easing of inflation pressures before then. Since early June, shipping rates, food costs, oil benchmarks and gasoline prices have all fallen, and the shelter index could fall further as tighter financial conditions remove air from the housing markets.

It's really saying something when an 8.1% inflation rate is greeted with a modicum of relief

Douglas Porter, chief economist at Bank of Montreal

The chief economist at the bank is Douglas Porter.

The sizzling read came in two to three ticks below consensus expectations but was still enough to drive the annual rate to a new multi-decade high. The monthly rise would have been at the upper end of anything seen in the decade before the epidemic, and still represents an increase of just over eight percent, so today's result is not good.

When an 8.1-per-cent inflation rate is greeted with a modicum of relief in financial markets, it isn't as awful as expected. According to the many core metrics, underlying inflation has settled into a five per cent clip. We expect the Bank to hike in September with a more moderate move.

The Conference Board of Canada has an economist on staff.

The Bank of Canada has an inflation target range. It's not just yet. In June, price growth was broad based. With price pressures still boiling over, we expect that year-over-year changes to theCPI will not start to fall until late this year.

The Bank of Canada boosted the overnight rate by 100 basis points. Most expected the announcement to hit harder than it actually did. The bank is trying to upset everyone's expectations. In the second quarter, short-term consumer inflation expectations reached a record high. Canadians will be impressed by the bank's commitment to bring inflation down when the rates are higher. A harder push against the housing market will be one of the effects of rates. Front-loading rates can increase the chances of a soft landing. Canadians are bracing for impact as the brakes stop.

The email address is shughes@postmedia.

The Financial Post is part of Postmedia Network Inc. There was an issue with signing you up. Try again.