It's getting harder and harder to execute a soft landing.

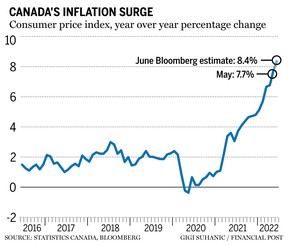

The year-over-year increase in Canada's inflation rate was the biggest in more than 25 years.

The photo was taken by the National Post.

The Bank of Canada uses Statistics Canada's consumer price index to guide its interest rate decisions. You need to know what to look for.

The year-over-year increase in gasoline prices was the main reason why the reading accelerated from May.

The July numbers are expected to be less severe because of the easing of oil prices. Inflation has spread to other areas. When Statistics Canada took gasoline out of the consumer price index, it still came up with a year-over-year increase.

The high end of the Bank of Canada's comfort zone for inflation was achieved by seven of eight major components. The decision to increase the benchmark lending rate by a full percentage point was supported by the latest figures.

Bay Street economists predicted that inflation would go up. The rapid cooling of the housing market may be offsetting inflationary pressures elsewhere. The 6.1 per cent increase in June was slower than the 7.4 per cent increase in May. Real-estate agents are collecting less money because prices have fallen.

Something has to give because the cost of living is increasing so fast. The economy is headed for slower growth as higher interest rates have triggered a correction in housing markets and surging food and fuel costs are draining consumer disposable income that could be used to bolster broader consumption. What is the amount of slower? The Bank of Canada predicted last week that the country's GDP will increase by less than this year. The economics team at the Bank of Nova Scotia said this week that they expect the economy to grow next year. We are headed for a recession according to economists at the Royal Bank of Canada. Soft landings are getting harder and harder to do. The central bank said last week that more interest-rate increases are coming, and the new inflation reading suggests it will be another big hike. It would be a challenge for consumers, executives and investors to borrow more than three per cent.

The email address is kcarmichael@postmedia.

In-depth discussions and insights into the latest in Canadian business can be found on Down to Business. The latest episode can be found below.

The Financial Post is part of Postmedia Network Inc. There was an issue with signing you up. Try again.