Sam Bankman-Fried undertook a dealmaking spree in June that was unlike any other in the brief history of the industry. The co-founder and chief executive officer of digital-asset exchange FTX bought two companies and tried to save another one with a large loan.

Even for someone worth $10 billion, Bankman-Fried committed about $1 billion in the midst of a market that has wiped out $2 trillion. To his legions of hardcore fans, this is further proof that SBF is a benevolent, deep-pocketed investor and philanthropist who is defending the industry in its times of greatest need.

It might be possible. The wheeling and dealing of Bankman- Fried has revealed the full scope of his plans to dominate the industry. He is exploiting the bad fortune of his competitors to expand his empire on the cheap. The crisis will endanger his core businesses if there is an element of saving the industry.

Chris is a general partner at Race Capital, one of the first venture firms to invest in FTX, the company at the center of SBF. His ambition is clear at this time.

It could all go wrong. The whole thing feels like he is trying to catch a falling knife, just days after it received its rescue loan. Bankman-Fried will have a lot of control over the industry if it goes well. The thought that decentralization is what makes their market different, and better, than the traditional financial system run by a few big banks and trading companies is troubling.

"It's dangerous for the whole industry to have connections to FTX." That doesn't bode well for a free-market scenario, particularly the free markets that people like to use.

There are many players tied to SBF.

The greater risk to the industry would be if no one took action, according to Bankman- Fried. It was the last thing we wanted to happen. He says that the last thing they wanted was for customer assets to be uninsured. Is there a good investment that we could make in return for it. That was not really a main thing.

His public comments and behind-the-scenes maneuvers suggest more deals are on the way. It was reported that FTX was interested in taking over the company that used to be worth $60 billion. Bankman- Fried said there were no active negotiations. Last year he floated the idea of buying the company. He wasn't sure if he was joking.

He wants to win a lot of things.

Bankman- Fried had a late start in the field. He left Jane Street to start his own company, Alameda Research, after graduating from MIT. He quickly built a name for himself as he was able to focus on his hobby.

When he decided to start FTX in Hong Kong, he had a lot of clout. His fans were attracted to the exchange by its low fees and attractive product offerings, and it became one of the biggest platforms in the industry. He is estimated to own more than half of FTX, 70% of FTX US, and most of Alameda. FTX raised $400 million in January at a $32 billion valuation and FTX US was worth $8 billion.

While favoring profitability over the growth-at-all-costs approach, Bankman-Fried has deftly managed his company's capital. She says that they kept their employees tight and raised capital when they didn't need it. He was able to bargain hunt as the rest of the world did.

He bought Bitvo in June. In the wake of the collapse of the TerraUSD stable coin and the implosions of Celsius Network and Three Arrows Capital, Bankman- Fried made two of his biggest moves to date.

Just a few days after it was announced that it had a financial lifeline, the company went to Chapter 11 protection. We didn't have a lot of time to do due diligence. We didn't have a lot of time to spare. The goal was to protect customer assets, not bolster his business, according to Bankman- Fried.

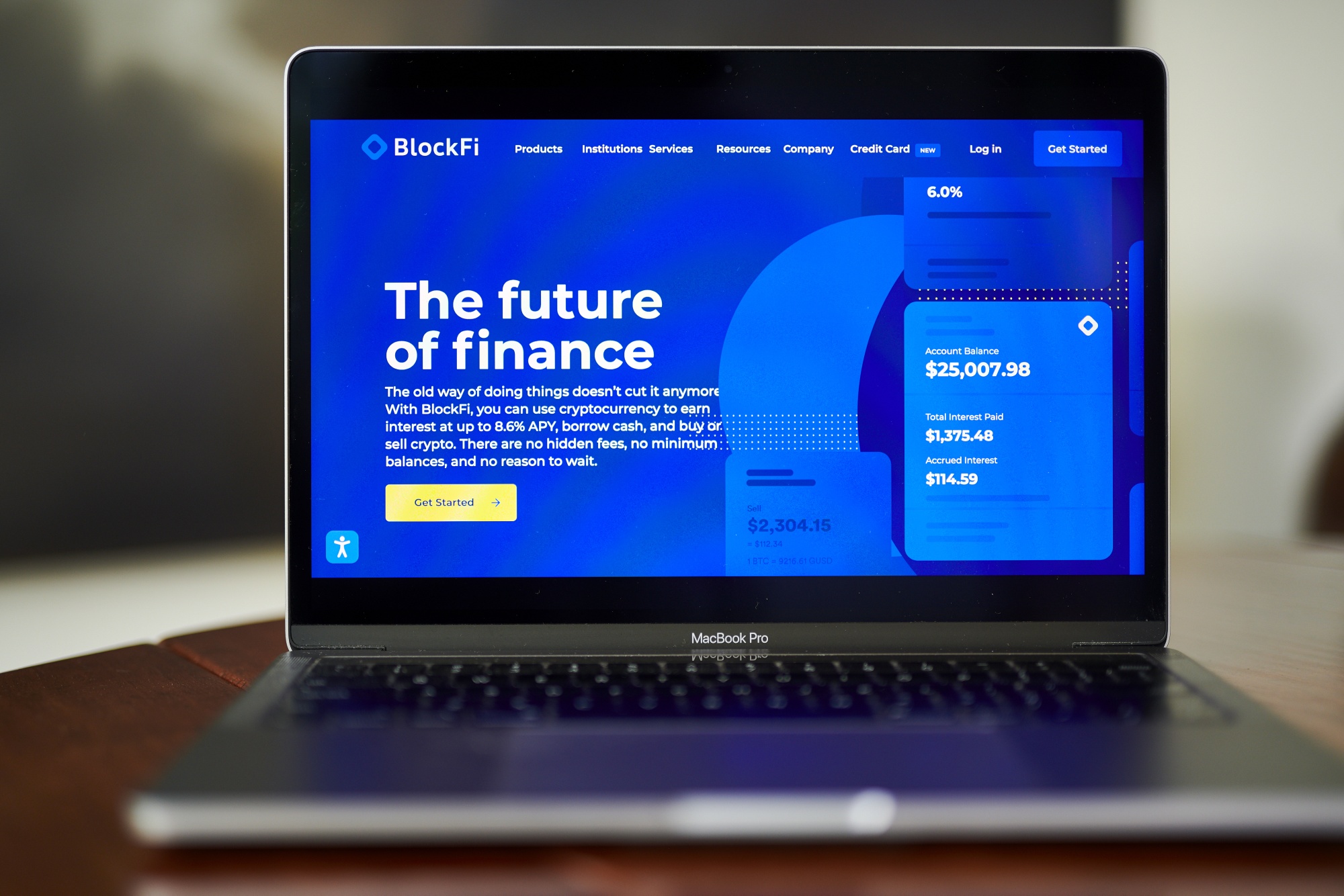

Even by Bankman-Fried's competitors, the BlockFi deal is being hailed as a triumph. Industry watchers say he probably bought the firm for pennies on the dollar. Ledn made an offer to inject fresh funding into the company but it was rejected in favor of F.

The decision to bail out BlockFi was made to help FTX US build out its brand and gain exposure to more potential customers, according to Dan Matuszewski, co- founder of the company. An acquisition would allow Bankman- Fried to expand into more areas. He says it's likely that FTX will be offering a wider range of retail products.

Bankman- Fried passed on Celsius and Terra, two deals his team had looked at. He has stopped a few companies where his involvement has not been made public. To figure out what it would take to save the business, his team reached out to companies rumored to be facing difficulties.

He is looking at raising fresh capital to fund more transactions, as the volume of distressed deals his team is looking at has waned recently. He doesn't know of any other companies that are about to go under. I can't say that there are no. We hope we went through the worst of it.

The billionaire is trying to find bargains.

The data comes from press releases.

When one takes into account Alameda Research, which has developed into an influential trading and venture firm, it's easy to see how much power Bankman- Fried is accumulating. According to Architect Partners, Alameda and FTX are expected to be the top providers of distressed financing in the second half of the century.

There are potential conflicts of interest down the road given the breadth of his business interests. Bankman- Fried had an influence on the industry. The tangled web of investing, lending, and borrowing between the company and Alameda was revealed by Voyagers. According to Toby Lewis, chief executive officer of Novum Insights, FTX and Alameda can make or break projects.

According to Architect Partners, Bankman- Fried has the potential to reduce market competition. If FTX continues at this level, who else is going to be around?

To many, Bankman-Fried, with his Einstein-like wild hair and promise to ultimately give away virtually all his wealth, is a cultural figure who can be supported by the community. He doesn't hesitate to raise questions about the industry and its future. "Decentralization still needs role models, still needs leaders, and still needs people who pave the way."

That doesn't mean Bankman- Fried can't be opportunist. He isn't a "kind, gentle savior" according to Race Capital. "I wouldn't be fooled for a minute."

A 30-year old billionaire wants to give away his fortune.