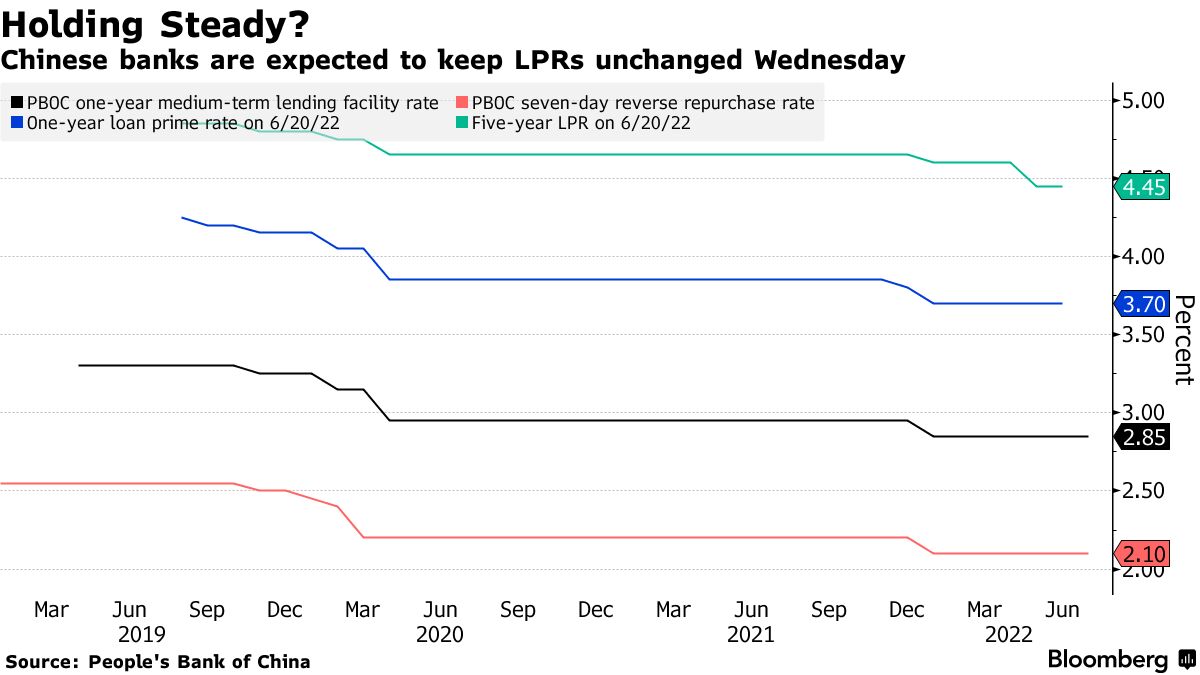

Chinese banks are expected to hold their main lending rates steady in the absence of more easing from the central bank, which is trying to strike a balance between keeping inflation under control and supporting the economy.

The one-year loan prime rate is expected to stay the same on Wednesday. In January, it was lowered. Twelve of the 14 economists surveyed think that the five-year rate will stay at 4.45%, while two think it will be cut by 5 or 10 basis points.

The LPRs are based on interest rates that 18 banks offer their best customers and are given in quotes as a spread over the rate of the People's Bank of China's one year policy loans. Since January, the rate has not changed.

The PBOC is expected to continue providing support for the economy in the second half of 2022. There was a window to cut rates.

The PBOC and Chinese leaders have recently highlighted their concern over the possibility of high inflation from overseas, and signaled a reluctance to lower interest rates. Rate hikes in major economies have limited China's room for monetary easing due to fears that cutting rates while other nations are raising them would lead to capital outflows.

A recent mortgage payment boycott by buyers of unfinished homes has led to calls for more policy help for the property sector. The last reduction in mortgage rates was in May, when banks cut the five-year rate by a record 15 basis points.

"As the concern on property has been rising recently, a cut in 5-year rate could lend supports to the sector and boost confidence in the market."

He predicts a reduction of 5-10 basis points.

In June, the weighted average interest rate on new deposits was 2.31%, 12 basis points lower than in April, when the central bank urged financial institutions to cut the rate.

John and Yujing helped with the project.